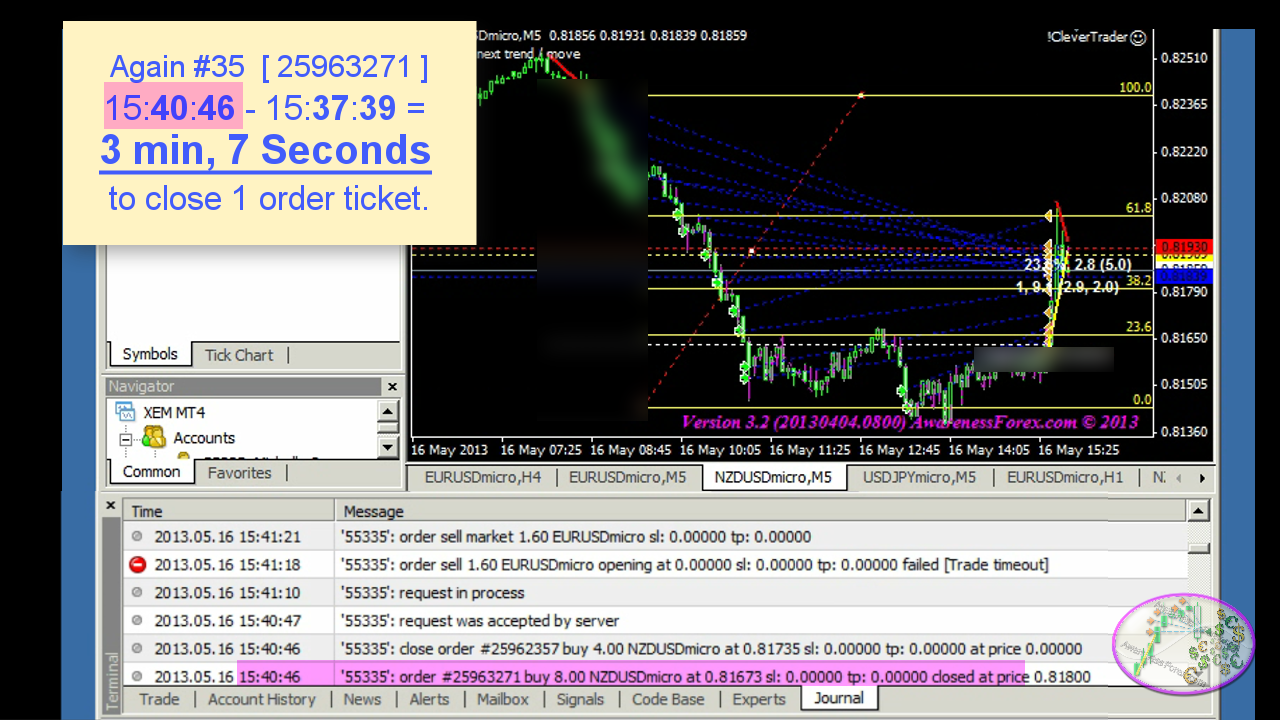

Video demonstrates a broker unfairly inserting execution delay of over 3 minutes on several order requests, creating massive slippage.

Clients [mainly traders and asset managers derivatives brokerage] invest significant time to develop and deploy strategies that will hopefully generate alpha [profit]. A derivatives broker is expected to execute client trades in the best interest of their clients, which includes not trading against their clients. Not only is this professional behavior, but it is also a legal requirement of MiFID 1/2 and equivalent laws that outline how brokers should handle their fiduciary responsibility to their clients.

A client expects that their chosen forex Straight Through Processing broker will act in the best interest of their clients first when handling their orders. This would include executing a clients order as fast as possible without trading against their client. This includes:

-

frontrunning their order,

-

giving asymmetric slippage,

-

providing false or misleading prices

-

Not safeguarding client funds (mainly via segregation)

-

Causing Asymmetric or artificial order delays between different clients or different accounts without a specific reason. (technically bait and switch, but also related to asymmetric slippage).

Lets watch and see what happens when an offending broker intentionally delays orders.

https://youtu.be/cRGwSFivSS0, appx 8 minutes.

When a broker trades against their clients instructions, it does more than cause a client to potentially generate [greater than usual] losses. The losses can then have a domino effect in causing either clients and the money people they represent (hedge fund, private equity, pension funds, allocators, etc) to lose confidence in the trader/asset manager. The trader could be blamed or the track record that took months or years to build is irrevocably tarnished.

Perhaps for some brokers, STP has another meaning: Straight To Pocket. AwarenessForex keeps a private list of whos who for brokers, taking into account the likelihood that a broker will abuse their position. And it goes well beyond a simple regulation check.

In future articles, we will address some of these related topics:

Part 2: Insider exposes the Ugly truth about bucket shop broker mentality.

Part 3: How to spot a cheating broker.

Part 4: [broker name], I apologize for winning

How Brexit helped to expose the bucket shops

What are best execution practices that favor the buy side?

How fast should orders be executed? Do you think 3 minute delay to execute an order is too long? Have you experienced broker order delays or other forms of negative manipulation? Let me know in the comments below.

Jon Grah, a Trading Signals Automation Specialist at AwarenessForex.com. Mr. Grah develops and trades intraday automated trading systems for hedge funds, prop firms, select private clients that boldly demand high alpha. He has over 16 years of combined trading experience in the financial markets, including designing one of the first zero-lag price measurement tools: APAMI.