US exchanges are expected to continue to innovate to allow institutions to interact with the increased volumes of retail trading, which mostly takes place off exchanges.

Jack Miller, head of trading, institutional equities at Robert W. Baird & Co, said the increase in retail volumes has brought topics such as payment for order flow and exchange rebates to the forefront.

In the US retail trades are not executed on exchanges but most are sold by retail brokers to market makers under “payment for order flow” agreements, allowing the brokers to offer no-commission trading to retail. The market makers internalize the flow and capture the majority of the spread, in return for offering retail investors a slight improvement on the exchange price.

“Increased retail volumes have recalibrated expectations of exchanges towards retail investors so they are more accessible,” Miller said. “Wholesale institutions want to participate in retail flow and there are active conversations.”

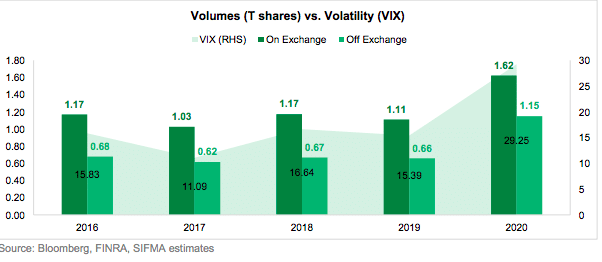

The pattern between off-exchange volumes and volatility shifted in 2020 according to an analysis of US equity market structure by regulatory body SIFMA. Trades previously moved onto exchanges during periods of high volatility. However, in 2020 volatility increased 90.1% year-on-year and off-exchange volumes increased 74.5%, more than the 46% increase for on-exchange volumes.

SIFMA said in its report: “Market participants also attribute the increase to: increased fragmentation after adding three new equity exchanges in September 2020; people became accustomed to the higher level of the VIX and therefore learned to execute efficiently off exchange under these conditions; and the growth in retail trading, which is often executed off exchange.”

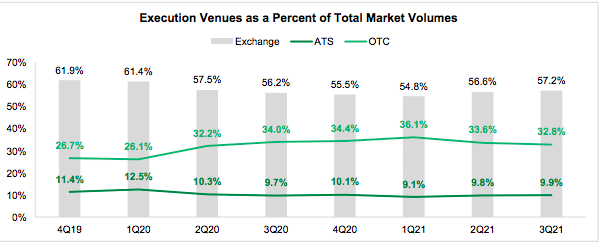

The study continued that between the fourth quarter of 2019 to the third quarter of this year, exchange trading as a share of total market volumes declined while over-the-counter venues grew.

“Off-exchange trading on OTC venues is now around one-third of total volumes, with over half of volumes still being executed on exchanges,” SIFMA added. “The big jump in OTC venues occurred in the second quarter of 2020.”

Cowen’s research department estimated in its Themes 2022 report that only 30% of the volume that hits the tape in U.S. equities is single-stock, accessible, non-high frequency trading liquidity.

Jenny Hadiaris, head of global market structure at Cowen and Company, said in a video: “We’ve been following retail trends in accessible liquidity for several years, but the sheer volumes in 2021 and the regulatory headlines around payment for order flow have made individual investors impossible to ignore in almost every single sector and stock this year.”

Cowan this year built stock specific, inaccessible liquidity metrics into its algorithm to account for retail activity.

“This was born out of clients’ frustrations that volumes no longer seem to have any correlation to liquidity,” she added. “We don’t expect an overhaul to retail order handling in the coming years and accessible liquidity will continue to be a large challenge for institutional investors.”

The firm is also closely monitoring retail options activity which has been rising over the past year and can drive directional moves in the underlying securities.

Retail data

Retail volumes are included in off-exchange trading but these volumes also include blocks and other institutional trades, including bank capital commitment as part of institutional trades. Miller highlighted the lack of transparency in retail volumes.

In November Nasdaq announced the launch of the Retail Trading Activity Tracker, that measures stocks and exchange-traded funds traded by individuals as well as buy/sell ratios per ticker on a daily basis. The data is developed from publicly available data and the Securities Information Processor (SIP).

Oliver Albers, head of data, investment intelligence at Nasdaq, said in a statement “The increased participation of individual investors is rapidly changing market dynamics, and the Retail Trading Activity Tracker is the first of its kind to offer general accessibility to consistent and standardized information on retail trading activity.”

Innovation

Shane Swanson. equities and financial technology expert in Coalition Greenwich’s market structure and technology practice, agreed that the increase in retail trading volumes has been significant in the last 12 months. He told Markets Media: “This is mostly beneficial as long as investors have right level of knowledge and risk awareness.”

He highlighted that exchanges have been innovating around retail flows including the introduction of Nasdaq’s Retail Trading Activity Tracker and IEX Exchange’s enhancements to its retail program, and he expects this invitation to continue.

In September IEX Exchange announced that nearly a dozen retail brokers have joined IEX Exchange’s Retail Trading Advisory Committee (RTAC) to evaluate how market infrastructure, and rules governing market operations, can and should evolve as retail participation in the equities market continues to grow. The committee will consult on areas including proposed new order types; consideration of the impact of new regulatory requirements and proposals for regulatory changes on the retail investor and their brokers

Ronan Ryan, president of IEX Exchange and co-founder of parent company IEX Group, said in a statement: “As an exchange with a mission to do right by all investors we felt bringing the retail broker community together was essential and timely given the unprecedented growth participation in our markets.”

Fergus Keenan, chief strategy officer at Adaptive Financial Consulting, the specialist global electronic trading consultancy, told Markets Media that the influx of sophisticated retail users has increased performance expectations for venues and accelerated the need to provide customized solutions.

“Equity brokers currently providing services for the retail market have vendor products that they put together, or maybe white label, and they are understanding that’s not cutting it,” said Keenan. “We have been helping firms to build resiliency, for uptime to be 100% and to architecture solutions that can scale.”

Keenan expects market structure to revolve to provide multi-asset access points including equities and digital assets.

Impact of retail on liquidity

Retail investors decrease crash risk of stocks by providing liquidity to stock markets after a market-wide liquidity shock according to research from the Karlsruhe Institute of Technology, The Impact of Retail Investors on Stock Liquidity and Crash Risk.

The researches treated the COVID-19 pandemic as an exogenous shock to a treatment group of stocks likely held by retail investors in March 2020 and caused steep crashes in stock markets and analysed data from the Robinhood trading app.

“We find that stocks that are likely held by retail investors have significantly higher liquidity and lower price-crash risk during the COVID-19 pandemic,” said the paper. “We conclude that retail investors stabilize stock prices, in particular in times of financial markets turmoil”

In addition, retail investors’ impact on crash risk is more pronounced for stocks with low volatility, low turnover, or low short interest. “We conclude that retail investors are not just uninformed contrarian traders but rather act on some information,” added the researchers.

They concluded that the study suggests that corporate financial managers should focus on attracting retail investors in times of financial markets turmoil to maintain higher stock prices that might help in raising capital.

“Institutional managers should attract more funding from retail investors to avoid capital constraints when arbitrage opportunities are apparently most profitable,” sad the report.

In addition governments should provide more incentives for retail investors to invest in financial markets as this might reduce the need for government and central bank interventions, which can lead to higher taxes, more debt, and moral hazard.