Nasdaq set records in US option and European equity trading last year, in addition to exchange-traded product assets under management tracking its indexes.

Adena Friedman, president and chief executive of Nasdaq, said on the results call: “Our record fourth quarter and full year results attest to Nasdaq’s continuing ability to address the needs of our clients in a capital markets environment characterized by elevated trading, strong IPO activity and rising index valuations, made possible by both our resilient, scalable technology and the flexibility our team exhibited in effectively delivering for clients against a pandemic-impacted backdrop.”

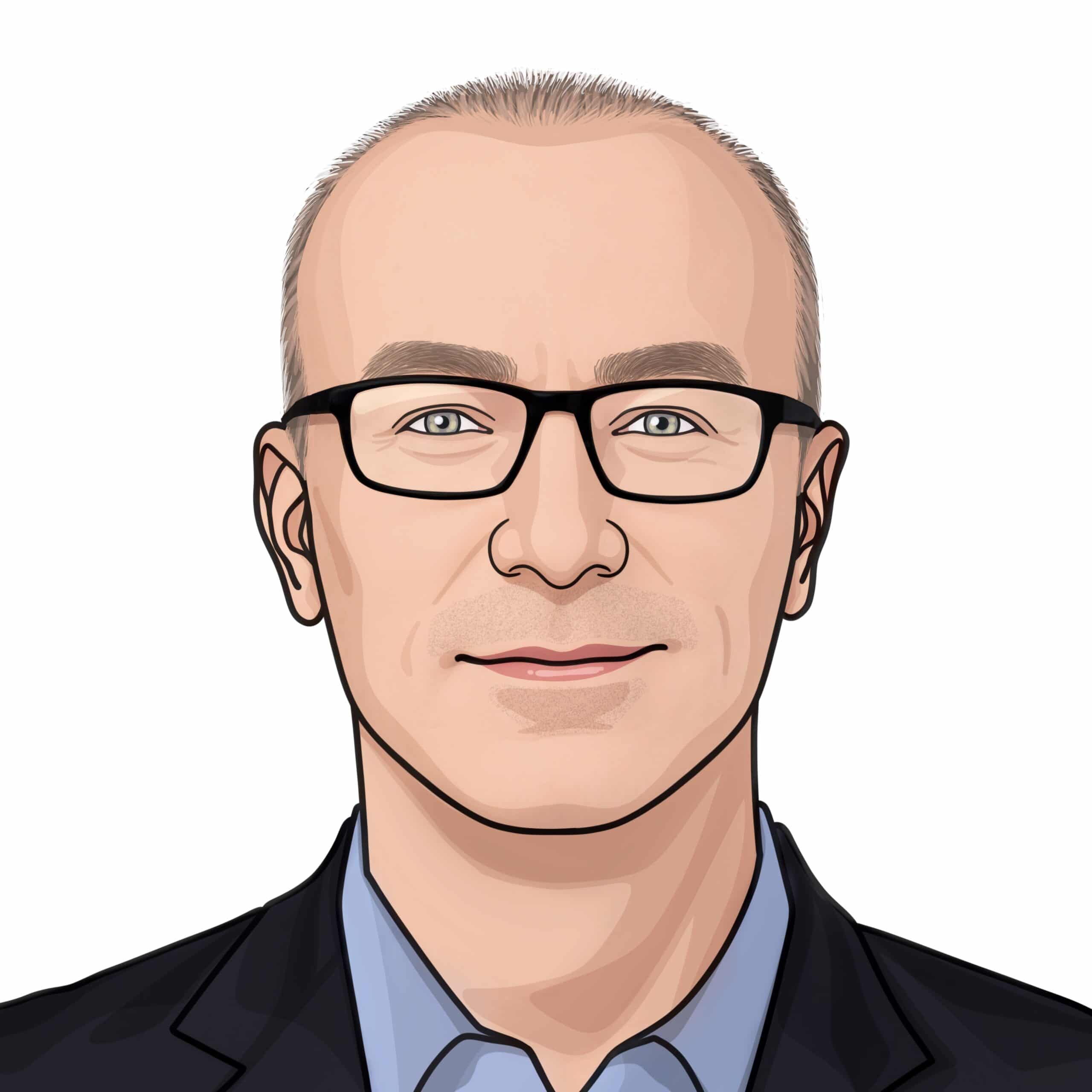

The firm said Market Services set new highs in US option and European equity trading in 2020 which helped increase net revenues 21% year-on-year.

Nasdaq’s U.S. options market set a quarterly record of 741 million contracts traded, an increase of 71% year over year, in the last three months of 2020.

“2020 was also the first year Nasdaq led all exchanges in total volume traded for options (inclusive of both multiply-listed equity options and index option products), building upon what is now an 11th consecutive year leading in multiply-listed equity options market share,” said the results statement.

Nasdaq also reached a new decade-high annual market share of 78% in Nordic equity trading during 2020, including 79% in the fourth quarter.

Investment Intelligence

Assets under management in exchange-traded products benchmarked to Nasdaq’s proprietary indexes reached $359bn (€297bn) at the end of last year, an increase of 54% over 12 months. Net inflows into new products that launched in the fourth quarter of 2020 exceeded $1bn, driven primarily by strong initial interest in the Invesco QQQ Innovation suite.

Friedman said: “We believe our index franchise leans into the future. We have also seen solid growth in analytics and market data.”

Index revenues were $97m, up 70% year-on-year. Nasdaq said this was due to higher licensing revenues from higher average assets under management in ETPs linked to Nasdaq indexes and higher licensing revenues from futures trading linked to the Nasdaq 100 Index.

Friedman said: “We have repositioned the segment for growth by deepening relationships with the buy side and building essential partnerships with the investment community.”

Market Technology

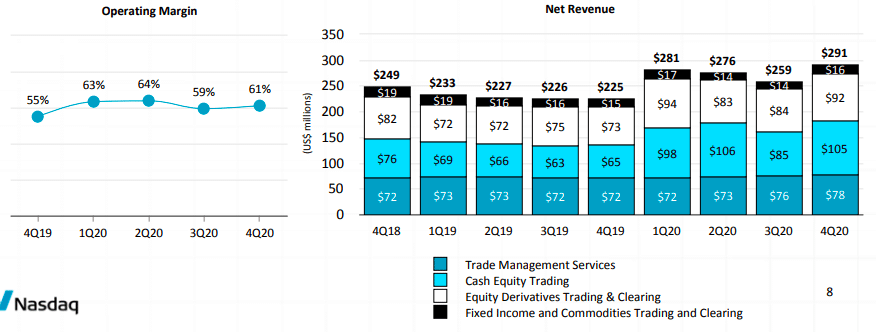

Friedman said the Market Technology business signed 29 new customers last year, with 25 choosing the cloud-based software as a service (SaaS) delivery model, but the segment was affected by the ongoing Covid-19 pandemic.

“Financial market infrastructures have been focusing on their immediate need to manage capacity and resiliency in elevated trading volumes and so have temporarily put significant projects and change requests on hold,” she said.

She continued that engagement had increased towards the end of last year but sales have not yet recovered to pre-Covid levels.

This month the firm launched an enhanced Nasdaq Risk Platform, a real-time single point of access risk platform for sell-side and clearing broker communities.

Valerie Bannert-Thurner, head of buy-side and sell-side business solutions, Market Technology at Nasdaq, told Markets Media that risk management technology solutions have been a big part of the business for a long time, through providing real-time risk and exposure calculations and alerting in equities and equity derivatives, particularly for prime brokers globally.

She added: “The acquisition of Cinnober gave us a risk platform for commodity derivatives and foreign exchange, which was primarily used by brokers. We brought together the teams and expertise to create a next generation cloud-native multi-asset risk platform.”

Nasdaq completed the acquisition of Cinnober, the Swedish financial technology provider to brokers, exchanges and clearinghouses worldwide, in January 2019.

Carl Slesser, head of execution and risk management solutions, Market Technology at Nasdaq, continued that the firm provided a system for pre- and at-trade risk management. The addition of the Cinnober system allows the new platform to extend into the post-trade risk space such as showing P&L, complex risk metrics and intraday margin in real time.

Slesser told Markets Media: “The new platform has a SaaS-based technology, a modular design and modern architecture. The speed and agility of the enhanced platform will empower clients to launch new businesses and focus on their core activities.”

In future the new platform will extend into other asset classes such as cleared fixed income products and interest rate derivatives. Nasdaq technology supports real-time margin replication for 35 CCPs and the firm is also continuing to expand to new venues and clearing houses.

Sucden Financial, the global multi-asset execution, clearing and liquidity provider, has gone live on the Nasdaq Risk Platform.

Slesser added: “Sucden Financial has adopted the platform to power its new multi-asset risk management system. In addition, existing risk management customers are starting to migrate onto our new platform with go lives scheduled for Q1 and Q2 this year.”

Nasdaq is continuing to invest in this area, by providing more risk methodologies, deeper risk metrics and expanding into fixed income and foreign exchange coverage as more volume moves onto exchanges.

Friedman concluded: “We are entering 2021 with strong momentum as we execute on the fourth year of our new vision for Nasdaq.”

Nasdaq clearing fine

Finansinspektionen (FI), the Swedish financial regulator said in a statement today that it is issuing Nasdaq Clearing AB a warning for serious deficiencies in its operations related to a member of the firm’s commodities market being declared in default in 2018. Nasdaq Clearing must also pay an administrative fine of SEK 300m ($36m).

The member did not have enough collateral to pay for trading losses and Nasdaq Clearing withdrew money from the default fund, which consists of contributions from all clearing members.

FI said an investigation showed that Nasdaq Clearing had serious deficiencies in its operations.

“The requirements the firm placed on the clearing members’ financial and operational capacity have been insufficient, and an incorrect calculation has resulted in the firm issuing insufficient margin calls,” said the regulator. “The firm has also been in violation of the investment prohibition in the European Union regulation on over-the-counter derivatives, central counterparties, and trade repositories (EMIR) by investing its own funds in derivatives much too long after the default event, which resulted in prohibited exposures to credit and market risks.”

The regulator said Nasdaq has taken measures to rectify these deficiencies, and therefore FI issued a warning and fine.

Michael Ptasznik, chief financial officer of Nasdaq, said on the call that Nasdaq had launched an independent investigation immediately after the default and rectified its operations, which was recognised by the regulator.

Ptasznik said: “We are reviewing the decision and our legal options.”

He is stepping down from his role and will be replaced next month by Ann Dennison, controller and chief accounting officer.