The buy- and sell-side said that regulators looking to improve equity market structure should focus on defining and clarifying best execution obligations and not maker-taker pricing schemes and rebates.

That’s according to a recent Tabb Group survey, where upwards of 55 percent of respondents said regulating rebates and pricing schema isn’t necessarily the answer.

In January and February, Tabb conducted a survey titled “Let’s Not Throw the Baby out with the Bath Water,” and canvassed 140 broker-dealers, asset manager/hedge funds, execution venues, academics and vendors regarding the so-called “Grand Bargain” proposal along with the most impactful ways to reduce market fragmentation and complexity.

The results – 55 percent of those surveyed said that in contrast to the proposed maker-taker pricing legislation they’d rather see an updating of best-execution obligations, citing this as “most important.” Only 12 percent of those surveyed said changes to the maker-taker pricing model were “most important.”

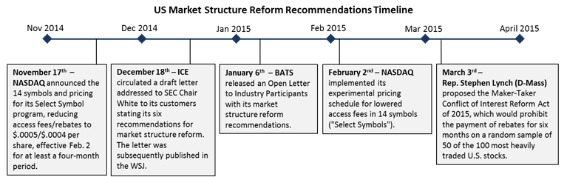

This view flies in the face of what regulators and some market participants have been examining as a problem with the current equity market structure. Recently, a number of proposals to fix the equity markets from BATS Global Markets, ICE , Nasdaq and even If passed, Rep Lynch’s “Maker-Taker Conflict of Interest Reform Act of 2015” would mark the first time Congress and not the regulators have stepped into the equity market structure fray.

The law if enacted would require the Securities and Exchange Commission to prohibit exchange rebates for six months on “a random sample of 50 of the 100 most heavily traded U.S. stocks.” The proposal resurfaces the debate on how best to improve US equity market structure, via targeted regulation or market forces.

Survey overseer Sayena Mostowfi noted that short of fixing fees, pricing differentiations will “continue to exist between market centers as those surveyed believe that order-routing conflicts of interest are best mitigated with best execution obligations for brokers, aided by uniform order/execution/order-type transparency measures.”

Also, the survey reported the current level of disclosures for ATSs, retail wholesalers, exchanges and algorithms as being “less than adequate.”

In addition, the 140 respondents support a focus on the cause, not the symptoms, of market structure issues.

It should be noted, Mostowfi pointed out, that a broker’s best execution obligations are not altered via market structure changes, although a series of pilots can detract resources and funding.