‘New oil’ or ‘new gold’ are just some of the phrases used to describe the value of data in financial markets. And rightly so. Data fuels every aspect of the trading process.

From the very beginning, trading has always been about information. Whoever has the best and the fastest information gains the edge.

Today, traders are also challenged with managing the sheer amount of data in financial markets. The edge that traders gain now is all about who can consume and make sense of the data the fastest by leveraging technologies such as artificial intelligence.

In the second of three reports on the trading desk of the future, Refinitiv partners with Greenwich Associates to explore data’s impact on financial markets over the next three to five years, including which types of data will be most valuable, who will provide that data, and how traders expect to use it.

The value of data in financial markets

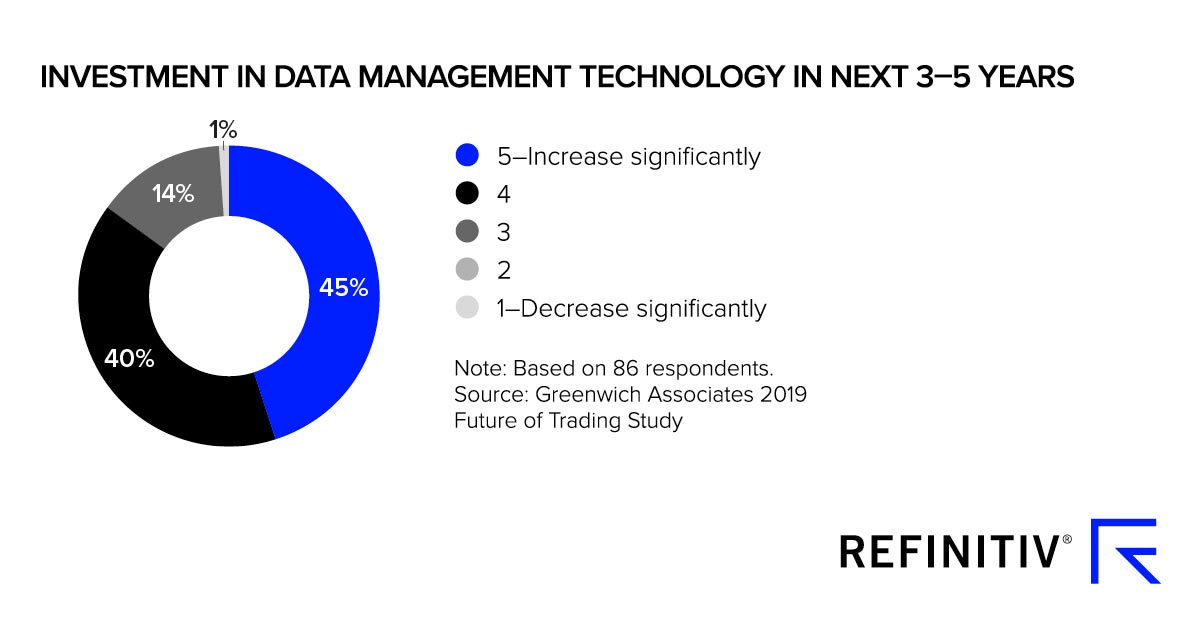

With an overwhelming 85 percent of banks, investors and capital markets service providers planning to increase spending on data management, the value of data in financial markets is clearly increasing.

The quantity and velocity of market data will continue to grow alongside trading volumes and the number of tradable instruments.

At the same time, tolerance for errors and acceptable latency for delivering that data will drop. Large investments in market data infrastructure by those up and down the value chain must continue for the foreseeable future.

Where will this data come from?

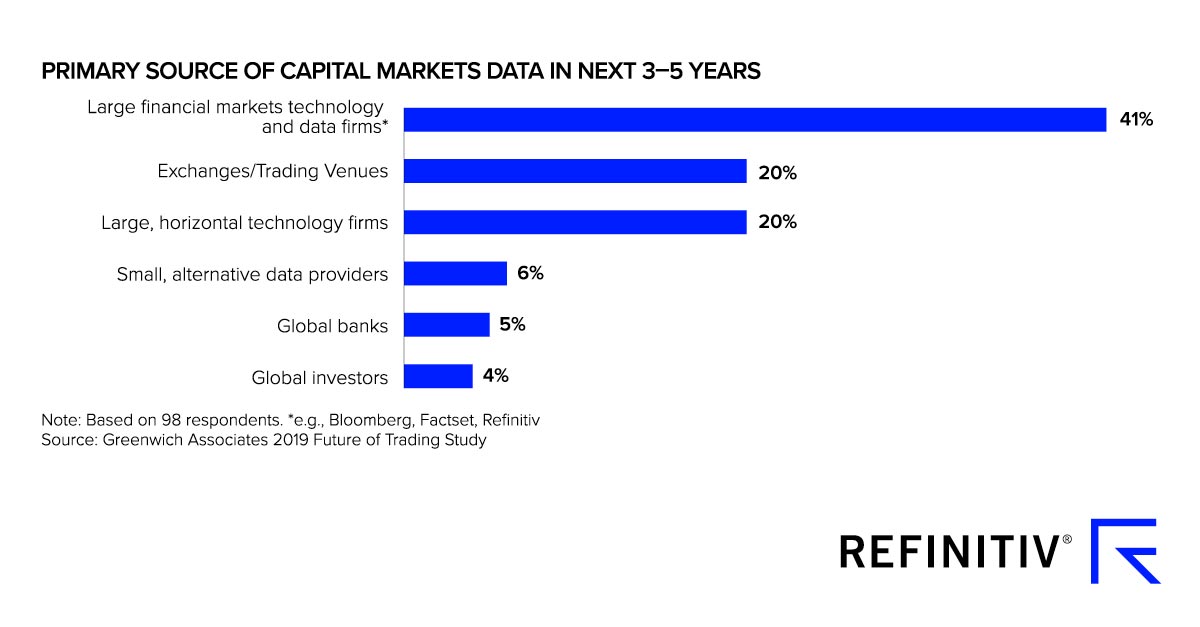

In the search for external data, 41 percent of market participants believe that large market data aggregators, like Refinitiv, will continue to act as the primary source of data for trading desks — beating out all other potential providers.

Why? Because they have the power to find, ingest, normalize, aggregate and then redistribute data around the world with high degrees of accuracy, and latency sometimes counted in microseconds.

With so much data to absorb, large financial institutions prefer to get most, if not all, of their information from a single place.

With so much data to absorb, large financial institutions prefer to get most, if not all, of their information from a single place.

Even as the importance and diversity of alternative data grows, the largest data providers will still act as the market’s de facto aggregators. In this case, cloud computing and easier access to data will be critical capabilities.

Data and analytics go hand in hand

For investing and measuring execution quality, the evolution of analytics is just as critical as acquiring the data itself. In other words, finding data is not enough.

You have to put it to work — to interpret, analyze and utilize existing, new and unstructured data across trading workflows.

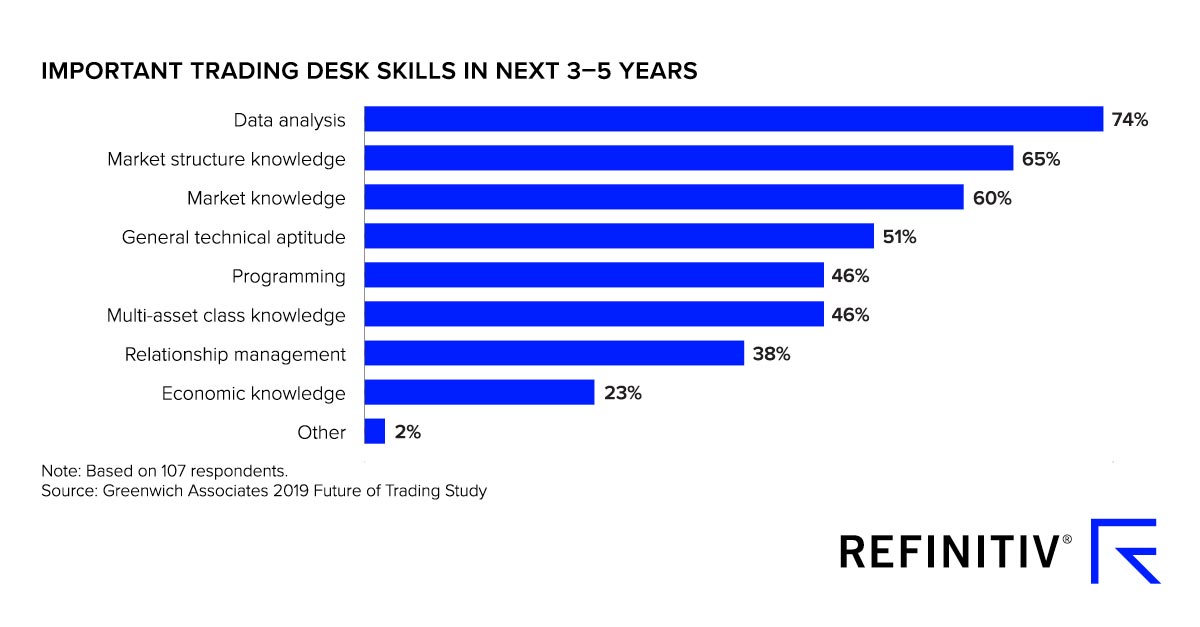

As a result, 57 percent of capital markets professionals expect to spend more time analyzing data, and 74 percent believe data analysis to be the most important skill that will be required to work on the future trading desk.

However, spending time with data will mean different things to different people and firms.

Sell-side trading desks will examine customer trading patterns more systematically to help manage relationships, execute algorithms using artificial intelligence to source liquidity, and digitally communicate with clients more and more.

Those on the buy-side, like asset managers and hedge funds, will continue to use data to find investment opportunities, more accurately price illiquid assets, and manage risk.

The power of alternative data

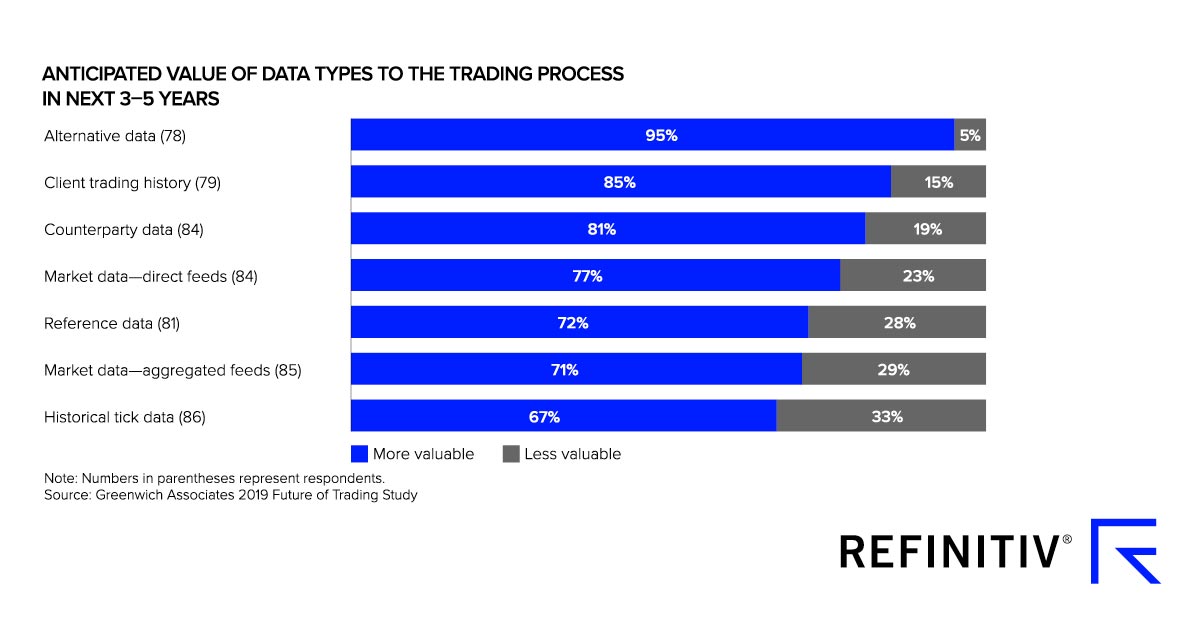

Even as we highlight the value of data, it’s important to recognize that not all data is created equal.

The term encompasses many different types, from market data to reference data. But today, alternative data tops the list of importance.

An overwhelming 95 percent of trading professionals believe alternative data will become more valuable to the trading process in the coming years.

This previously non-existent or largely under-utilized data source provides trading or investing signals that were once analyzed alongside market movements but were not considered relevant to trading or investing.

This previously non-existent or largely under-utilized data source provides trading or investing signals that were once analyzed alongside market movements but were not considered relevant to trading or investing.

However, alternative data will only be useful if traders trust the source, driving home the importance of investment, accuracy and speed.

The path ahead for trading workflows

Data is not simply a buzzword. If gathered correctly and interpreted accurately, it’s the path forward for trading.

At Refinitiv, we remain focused on creating value for clients through data that spans the trading workflow, making it easier for traders to see, analyze and act on insight and opportunity.

The changes in data and technology identified in these first two reports are driving an evolution in trading roles and relationships. Our final report will examine these shifts to define critical skills for the trading desk of the future.

Read our full report ‘The Future of Trading: Redefining Data’.