Where o where can brokers find more U.S. equity trading business?

Is it even out there?

Is it a case of the brokers chasing the wrong targets? Or are they too quick to accept excuses for not finding it?

Matt Samelson, chief executive officer & director of equities at Woodbine Associates said that conventional wisdom has it that discretionary order flow has become largely non-existent because the buyside has to pay for research obligations. In some instances, this is true. Yet, Samelson added that the degree to which lack of discretionary order flow has been blamed for failed business development is the stuff of myth.

“Order flow is out there. Unlike the unicorn, it can be captured,” Samelson said.

In a recent article shared with Traders titled “Where O Where Can Brokers Find More U.S. Equity Trading Business?,” Samelson noted that discretionary order flow is out there and can be had.

He prefaced his thesis by noting the following:

– up to 75 percent of market-wide commission wallet is portable.

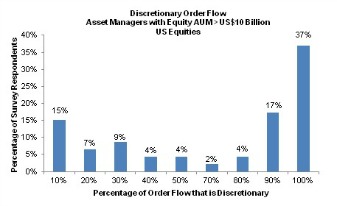

– 58 percent of surveyed traders at firms with more than US$ 10 billion equity AUM with say 80 percent or more of order flow is completely discretionary.

– Discretionary order flow is based on trading philosophy, order handling expectations, wallet size, and consideration for research payment – not “what is left over” after paying for research.

For the basis of his article, Samelson surveyed head or senior traders at 49 leading asset managers that actively trade in the U.S. equity market. These firms were mostly long-only and employed both fundamental and quantitatively based investment strategies. Firms ranged in size from US$1 billion equity AUM to more than US$ 100 billion equity AUM. The sample represented approximately 20 percent of the annual asset manager U.S. equity commission spend and was representative in terms of size and segmentation. trading managers about their percentage of discretionary order flow.

Furthermore, he defined “discretionary” as the ability for traders to direct order flow without any consideration given to payment for research services.

The article revealed that the majority, 58 percent, consider 80 percent or more of their order flow discretionary.

“A whopping 37 percent indicated that all order flow was directed with no consideration for research obligations,” Samelson said. “The figures suggest that, contrary to widely-accepted industry assumptions, a significant proportion of order flow is available to brokers seeking additional business. They also contradict the purported need of most investment managers to use most – if not all – order flow to meet research commitments.”

How can this be?

Samelson said it is possible that buyside traders are telling the sellside flow is not available because it is being directed to competitors and they simply do not watch to switch. (Fatigue from being over-marketed may top the list of their reasons.) He believed some sellside personnel, tasked with growing revenues and market share but unable to do so, resort to using this argument to maintain to protect themselves in the comfort of the status-quo.

According to the research Samelson conducted, large and small institutional investors have the most discretionary order flow; middle-tier the least. The proportion of firms that have high levels of discretionary order flow surprised us, but the breakdown across market segments makes intuitive sense.

“Bigger is better. “Eighty five percent of large institutional investors indicated that 2/3 or more of their order flow is discretionary,” Samelson reported. “Contrast this with 63 percent of small firms and 48 percent of the mid-tier.”

Translated into projected commission budget, he added that this means as much as 75 percent of the 2015 U.S. equity trading commission spend is up for grabs.

Looking into the details, the percentage of discretionary order flow, and the means by which the buyside elects to route order flow, is based on a combination of factors, he said, “trading philosophies, activity, size of wallet, and use of research. Research does not rule.”

Most large firms are extremely active traders – moving, accumulating and liquidating large positions on a regular basis. They are entirely aware of the effects trading costs – implicit and explicit – have on portfolio returns. They also have well-defined policies, procedures, controls, and compliance in place. Their reliance on external research differs considerably from their second and third tier counterparts. These factors afford large-firm traders a high degree of discretion when working orders.

Small firms have both a high degree of discretionary flow, when compared with the middle segment, and the least discretion, with 38 percent indicating 1/3 or less discretionary order flow. Their dependence on third party research varies just as widely. Those that do not rely heavily on external research tend to have more discretionary order flow, while those with a higher dependence are apt to be tied to a single provider.

“The middle tier firms have characteristics of both the largest and smallest firms,” Samelson said. “They are the most varied as a group and thus complicated to interpret. Firms that value the impact of trading slippage and rely less heavily on research tend to give their traders more discretion. Those heavily tied to broker proprietary and third party research services are apt to have less discretion. The weight of particular factors varies considerably across the segment.”

Furthermore, commissions associated with even a portion of three out of every four orders represent big money.

So how can the sell side seize upon these opportunities?

Samelson said that a broker’s ability to capture additional market share depends on its approach to buyside leadership; the effective conveyance of value in the execution process; and in some instances, like it or not, the value of research offerings.

“A well-developed business strategy predicated on solid information – rather than anecdotal industry chatter -is essential,” he said. “Optimal use of internal human resources and proper infrastructure and service development is similarly critical.”

Managers at many brokerages, Samelson said, neglect this crucial investment of time and resources. Rather, brokers follow the same old practices, hoping a few more calls or a little extra client entertainment will “bear fruit.”

“Challenging markets have made buyside clients and prospects more sophisticated. They are more exacting and far less tolerant of poor coverage, extraneous offerings, and empty sales pitches,” he said. “Brokers and service providers that invest in the right strategies can readily fulfill client needs will benefit handsomely.”