Does the illiquidity of stocks impact prices and returns of options written on these stocks? Research in the past has been cloudy on this point. But in a new paper, Stock Illiquidity, Option Prices, and Option Returns, presented at the OptionMetrics Research Conference, Professors conclude there is in fact a very strong effect of stock illiquidity on options prices.

In theory, the way market makers hedge option positions with underlying stocks creates the crucial connection between how the market works and options are priced, says Korn. But past research had difficulties to find a direct correlation between these factors, likely due to the effect that market makers are sometimes net long and sometimes net short in options.

The new research shows that the average absolute difference between historical and implied volatility, or options expensiveness, increases with the illiquidity of the underlying stocks, indicating that this measure (HV-IV) is a useful proxy for the sign of the end-users net demand. The increase in absolute expensiveness suggests strong evidence that the underlying stocks illiquidity is tied to option prices if one conditions on end-users net demand and the corresponding positions of market makers.

The research also shows that the relationship between option expensiveness and stock illiquidity translates into significant excess returns of appropriate option trading strategies. Higher absolute deviations between historical and implied volatility translate into higher abnormal returns of the strategies, which the researchers say cannot be explained by risk factors suggested in past research. Instead, Kanne, Korn and Uhrig-Homburg indicate that these returns are the result of intermediaries considering hedging costs of their options positions.

Researchers looked at all U.S. exchange-listed individual equity options from January 1996 to December 2011 using data from the OptionMetrics Ivy DB database. They arrived at three specific cases that point to how options are priced:

- If the market maker is net long in the option, then the prices should be cheaper because market makers want to buy options cheap and get compensation for the hedging costs they face, say the researchers.

- If the market maker is net short, then the prices should be expensive, because market makers want to sell at a high price and need a compensation for their hedging costs.

- Additionally, they found that the more illiquid the underlying stock the stronger the above two effects and the more extreme the cheapness or expensiveness of the option because hedging costs are higher.

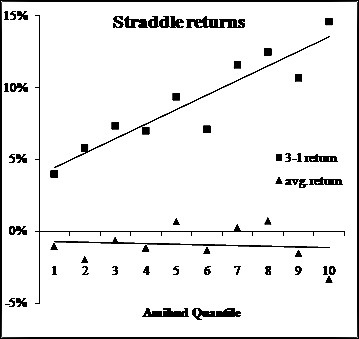

The impact of looking at market makers positions of being long versus short, versus not conditioning on this information, as was done in the past, can be illustrated in the following.

Following Goyal/Saretto 2009, straddle returns are calculated as

with t, the trading initiation date, and ,the following months expiration date.ource: OptionMetrics data

The lower line in the chart above shows the average of the long and short positions, as computed in past research. When this information is averaged, it appears the effects of stock illiquidity on option returns (represented by the horizontal line) are minimal. The upper line, conversely, shows the strategy from Kanne, Korn and Uhrig-Homburg that takes into account whether market makers are long or short. This line shows significant increases with illiquidity.

Researchers say these findings can help advisors in assessing the future returns of particular options. Generally, abnormal returns of options are more predictable when stock illiquidity is high. When the underlying stock is illiquid, deviations between historical and implied volatility might be more often not due to market makers superior volatility forecasting abilities but the result of market imperfections.

The most recent version of this paper from Kanne, Korn and Uhrig-Homburg includes additional analysis on the relative mis-pricing of calls and puts and the impact of more efficient pricing that resulted in the markets since 2003.

As their research shows, the prices of options are influenced by the illiquidity of the stocks they are written on and by the effect that market makers are sometimes net long or short in options. You have to condition on net demand, says Korn. If you dont take into consideration the distinction between long and short positions, you miss out on important aspects to assess opportunities in the option market.