FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura Company.

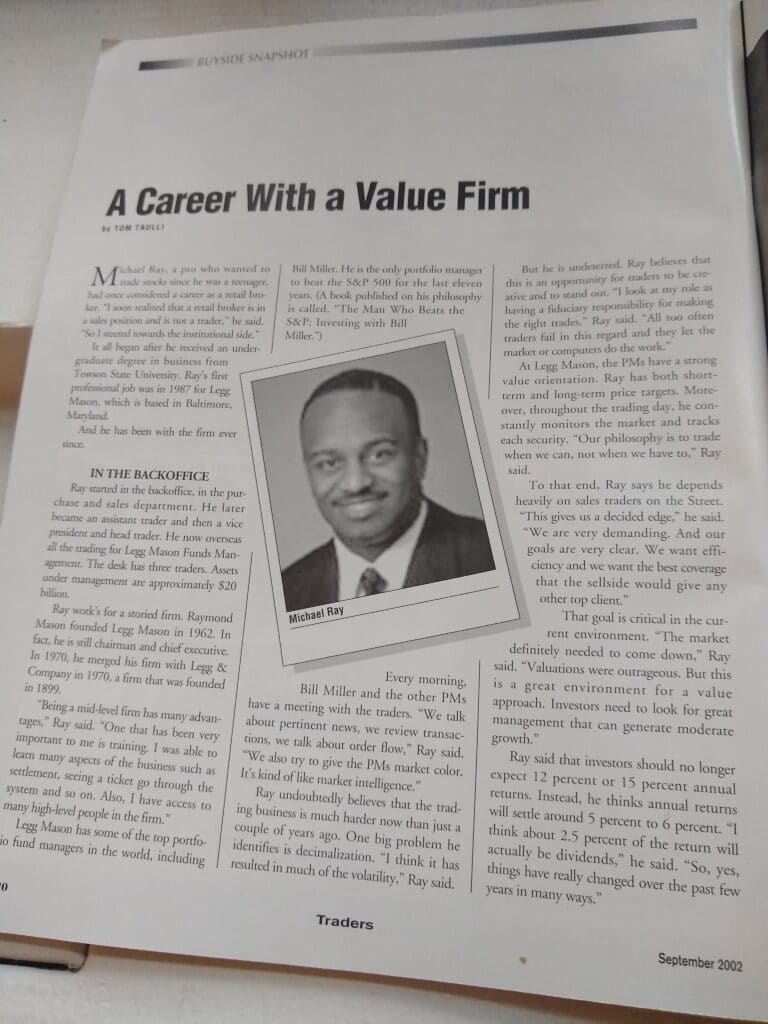

Michael Ray was featured in the September 2002 Traders Magazine. In “A Career With a Value Firm,” Ray, then a trader for Legg Mason, discussed trading and markets, as well as his own career in the industry.

Fast forward 18 years, Traders caught up with Ray, now a Senior Trader at Baltimore-based Adams Funds.

How has your career evolved since you were featured in Traders Magazine in 2002?

Five years ago, I found a new home working with the great folks at the Adams Funds. We manage two of the country’s oldest closed-end funds — the Adams Diversified Fund Inc (ADX) and the Adams Natural Resources Fund (PEO). As closed-end funds, shares of each Fund’s common stock are listed and trade on the New York Stock Exchange. Closed-end funds are great investment vehicles.

What have you learned since 2002?

The markets have really evolved since 2002 with fragmentation of liquidity causing big changes in how stocks trade. It has been very beneficial to learn how to overcome liquidity challenges by working through algorithms, dark pools, alternative trading venues, and great sales traders. All of us have had to become more technologically savvy. The entire process has come to require more automation and advances in technology.

How has trading / the trading business changed since 2002? How has it stayed the same?

I believe traders have become much more adept at knowing how and when to employ different technological options to help achieve their execution goals. I am also still a firm believer that cultivating good relationships with the sales traders who cover you will ultimately lead to better executions and service from the Street. That part has been a constant.

In the 2002 article you said “I look at my role as having a fiduciary responsibility for making the right trades. All too often traders fail in this regard and let the market or computers do the work.” Is this still true?

I believe that the first part of the statement is still true. The caveat being that technology and artificial intelligence are a much larger part of the landscape in our business. It’s incumbent upon all traders to learn to adapt to the changing landscape as time goes on or we will become extinct. We all must continue to embrace the use of technology to become better at what we do.

If your 2002 self were time-travelled to 2020, what about today’s trading and markets do you think you would be most surprised about?

To be completely honest, I am most surprised by the significant reduction in of the number of traders across Capital Markets Groups and Asset Management firms around the Street. During each successive round of consolidation and downsizing over the years, I have been amazed at how efficient the sales traders have become at covering 30,40, 50 and even 75 accounts. The number of trading professionals in the business is much smaller, but I wholeheartedly believe that everyone in a seat today is much more efficient at doing more with less.

What do you like about this business that has kept you in it for so long?

I enjoy working with such great people and the challenge of successfully managing transactions to achieve a positive outcome. Our industry continues to attract some of the best and brightest from around the world. I find that being around highly intelligent people in a competitive environment really floats my boat. Especially when those people are great human beings like those whom I have had the pleasure of working with throughout my career. I also enjoy being able quantify my contribution to the success of our group in a tangible way. It’s easy to quantify whether your transactions are good or bad in today’s world. I like that.

What market evolution do you think we’ll see in the next 18 years?

That’s a tough question. Eighteen years is an eternity in this business. Most of the changes in our industry are primarily driven by two things … regulatory changes and/or changes in profit margins. It’s safe to say that Artificial Intelligence (AI) will play a role in how margins rise or fall within different segments of our business. The regulatory rulings are more of a wild card. I recall how decimalization in 2001 changed the equity markets forever. Most people don’t realize that the rules which made decimalization possible were actually put on the books in 1970’s. I can’t think of an existing regulatory rule that might have that kind of impact in the future and my crystal ball seems to be out of commission.

What’s in store for your future?

As long as the shareholders, CEO and Portfolio Managers of the Adams Funds will have me, I will keep trying to make a tangible difference for them in the markets on a daily basis. I’m taking it one day at a time because that’s exactly the way I’ve done it for the last 33 years in this business.