With every crisis comes opportunity.

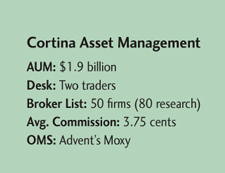

In the case of Drew Harbeck, a trader at the small-cap shop Cortina Asset Management, his opportunity came when he joined the Milwaukee-based firm’s desk right before the market meltdown began, roughly three years ago.

"I didn’t expect to be getting my feet wet" in the midst of a major correction, he said, but noted that the benefit "was being thrown into an incredibly hostile market and learning that there are times when you can’t be afraid to take risks trading."

Harbeck was new to trading, but he did have the benefit of doing a two-year apprenticeship at the firm out of college. He started in the back office. But before long, he found himself on the desk as a trading assistant, gaining valuable insights.

His boss and mentor Kurt Kujawa said Harbeck couldn’t have asked for a better time to begin his career. Kujawa estimates that one year of trading during the recent upheaval is at least the equivalent of two years of experience in normal times. Kujawa should know. He found himself in a similar situation when he started as a Nasdaq market maker in February of 1987-only months before that year’s history-making crash.

"If you can’t stomach those types of markets, then you’re in the wrong business," Kujawa said. "I tell Drew all the time, ‘If you couldn’t have handled it, you wouldn’t be here today.’"

Harbeck calls his boss a good mentor. There is a lot of "back and forth" on the market and strategies, he said. "He’s a good guy to learn from, since he’s been on both sides of the Street," Harbeck said of Kujawa. "We’ve got a good, solid relationship."

The need to develop relationships among small-cap brokers is something Kujawa stressed early on. So Harbeck got involved in the Security Traders Association of Wisconsin when he was an assistant trader. His stature in the organization has grown-Harbeck is currently president of the 91-member STA affiliate. In October, he spoke on a panel at the STA’s national meeting-a stint typically reserved for more experienced traders.

"The small-cap side of the business is still very dependent and reliant upon relationships," Harbeck said. "There is still a lot of value provided by sellside brokers and they’ve helped us source liquidity that we normally wouldn’t have been able to access."

That typically means finding blocks, though the firm uses crossing networks like Liquidnet, BIDS and BlockCross. "If I send someone an order, and it’s one of my better relationships, they’re going to know exactly how I want that order worked."

Harbeck admits he needs to keep learning and growing as a trader. And he only has to look across the desk to learn the lessons from his mentor, who is passing the baton from one trading generation to another.

"Drew listens; he pays attention; he asks questions and doesn’t dwell on negatives; and he isn’t afraid to take a shot," Kujawa said. "If someone is afraid to pull the trigger, they’re never going to be any good. You can’t trade scared."