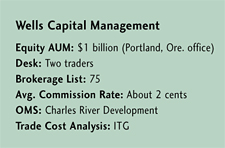

Be careful not to drive up prices and wait for natural situations. That is the philosophy of two Wells Capital Management traders in Portland, Ore. Their portfolio managers’ investment discipline is value-based for the office that has $1 billion under management.

Desk chief Mike McDougall and trader Matt Steadman have gone through the roller-coaster ride of small caps. The payoff as of late, the traders explain, is that their value funds are easily beating the Russell 2000 Value index. That index was recently up some 29 percent in the latest quarter but slightly down for the year.

The two traders previously worked for Benson Associates, which Wells Fargo acquired in a deal inked in 2003.

McDougall and Steadman still trade out-of-favor stocks. The desk’s style is contrarian. It seeks bargains, as one might expect from a value investor. But above all, it seeks liquidity by avoiding what it sees as common mistakes in the trading of small caps. How?

The McDougall/Steadman safety-first philosophy holds that traders often err by being overly aggressive. They buy or sell more stock than the Street can handle, adding to volatility. These traders make the mistake of not waiting for "natural situations," Steadman said.

The desk’s philosophy once included a wariness of algorithms. "The early algos were really written for the large-cap stocks," McDougall said. Steadman added: "In the past, we never used algorithms. They didn’t work for us."

A "sloppy algo overreacting to a major print," Steadman noted, would often run up prices. But algos in the small-cap universe have improved, he admitted.

Now that the traders are working at Wells Capital, they have the benefit of getting algos customized to fit trading preferences. The desk uses them in the right situation, he added.

"We exclude certain destinations and utilize nonposting algos," McDougall said.

Usually the desk uses no more than four or five dark pools. McDougall estimates that 20 percent of its flow executes in dark pools and 60 percent through broker-dealers-with the rest through secondary offerings/IPOs and internal crosses.

Another part of the current success has come from working for a bigger firm, the two traders say. Since Wells bought Benson, they now have more time to source liquidity and glean market intelligence. They are no longer stuck with back-office chores.

"Since Wells has a bigger structure, we’re now fully focused on the trading aspects and aren’t wearing several different hats," Steadman said.

"We used to have to handle the trade from beginning to end and that included any kind of settlement errors," McDougall added. He doesn’t miss the days of wearing many hats. Back then, small wasn’t beautiful.

(c) 2009 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/