This article was first published in medium.com

February 19th, 2020, Trump was on top of the world. The stock market hit all-time highs, and his ratings were finally improving. Trump’s second term looked to be done and dusted. So to mark his historic gains, he posted a celebratory tweet.

A day later, that tweet came back to haunt him, as the economy lost its battle against gravity: Pandemic fears had sent the world into lockdown.

The first victim was U.S stocks. Over the next three weeks, they went on a volatile journey with intraday prices moving 10% or more either way. On the surface, markets looked untradable, but behind the noise, something bizarre was happening: While the Trump family went on a mission to save the stock market — with disastrous results — they unwittingly provided investors with buy and sell signals along the way.

The first sell indicator was during the early stages of the crash, where stocks initially fell 3.1%. The President said in a press conference that the U.S government had the virus under control. After, he opened Twitter to try and calm U.S investor nerves, but his attempt failed and stocks kept falling fast.

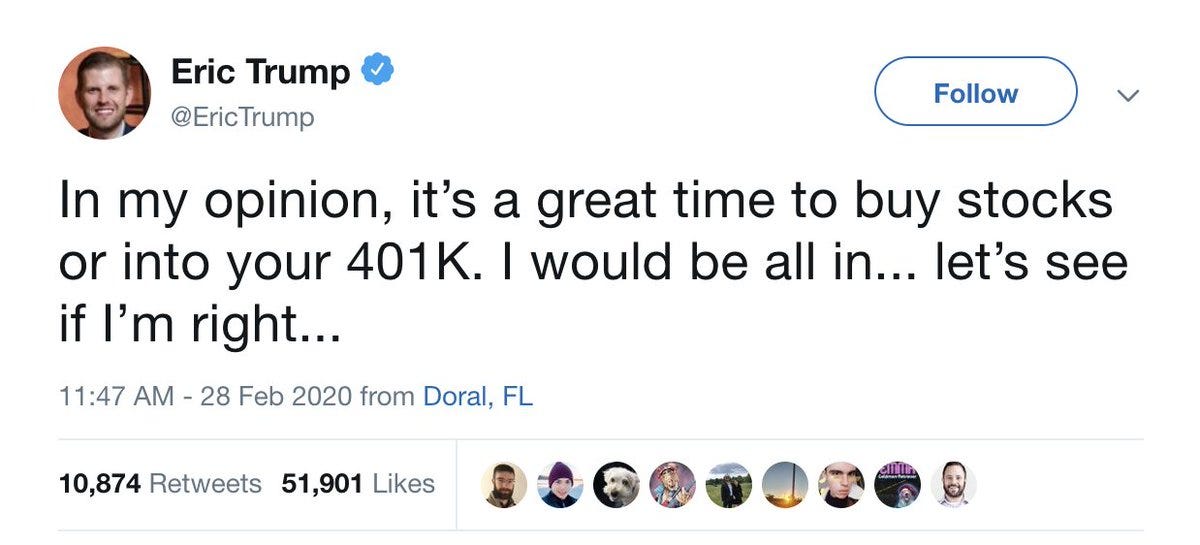

The Trump family was in full panic mode. So much so that Eric Trump — who was possibly egged on — decided to follow his father’s lead by attempting to pump stocks via his Twitter feed.

Unfortunately, he had to watch the stock market plunge an additional 25% before markets stabilized — and anyone who took his advice reconsidered putting their faith in tweets instead of economic reality.

Eric, out of embarrassment, later deleted the tweet, but Twitter’s finance community had already taken snapshots, knowing it would probably backfire on him.

Vox’s Aaron Ruper’s tweet went viral as a result, but it got worse for Eric Trump as the bear market rally had just begun. The timing of the tweet’s deletion coincided with the stock market bottoming, providing investors with a perfect signal to cover shorts and buy the dip.

By now, if you had taken the opposite side of every Trump-family tweet via shorting the market or just cashing out your investments, you’d be a very happy camper. As market analyst Sven Henrich demonstrates, the timeline of tweets has almost perfectly matched the rise and fall of stocks during the crash. If you kept your nerve, looking past the false optimism then noticing the extreme bearish sentiment mid-March, you would have matched S&P500 returns for the past two years in only three weeks.

Right now, we’re witnessing what appears to be a bear market rally, but what should worry bulls more is that Trump issued another sell signal. “The stock market was up very substantially today,” he said. “People are seeing a lot of good things, a lot of very smart people investing in the stock market right now.” He’s trying everything to sustain optimism as America plans to come out of lockdown with 22.2 million newly unemployed private-sector workers and an economic decline worse than the Great Depression.

Retail investors are buying into Trump’s optimism, being bullish as can be in a bear market: A survey by Statista finds that 66% of investors are leaving their investments alone while 13% are increasing holdings. What’s interesting is that millennials are adding more to their stock portfolios than the baby boomers who, in the past, have bought the dip consistently. Today, however, they’ve become more fearful: only 5% are putting their money to work.

Whether that’s a bullish or bearish signal is up for interpretation. If retail investors have now bought the dip, it’s up to the Fed to keep stock prices climbing to all-time highs as economic fundamentals are screaming uncertainty.

But one thing is for sure: while taking the opposite side of Trump tweets has been highly profitable, it’s an untested, unproven strategy — no disclaimer required. It’s difficult to know whether Trump’s latest pump will prove to be a reliable indicator. Could his latest comments signal the peak of the bear market rally or the journey back to all-time highs? Only time will tell.

The views represented in this commentary are those of its author and do not reflect the opinion of Traders Magazine, Markets Media Group or its staff. Traders Magazine welcomes reader feedback on this column and on all issues relevant to the institutional trading community.