A quick Google search will bring up dozens of articles proclaiming the passing of value investing. Mainstream articles are even touting that Warren Buffett himself has abandoned value principles!

The past 10 years hasn’t been great for value investing strategies if you look at some of the top value funds.

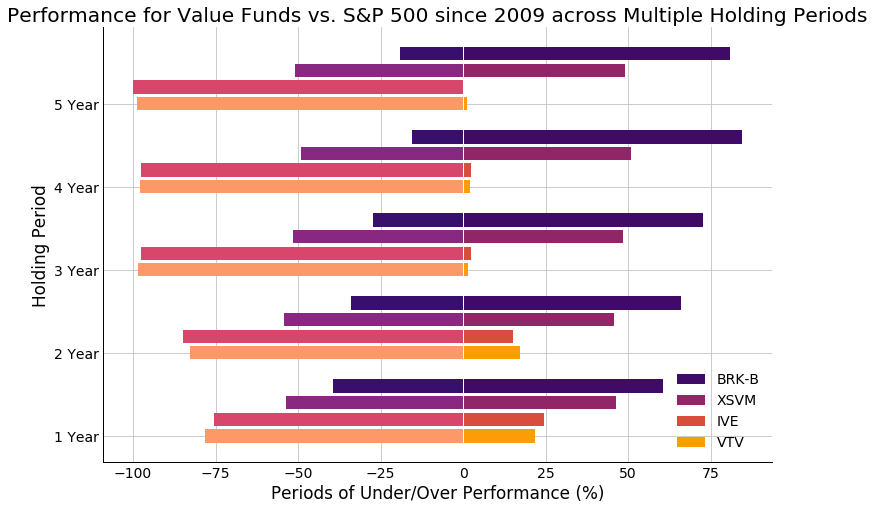

Value funds like IVE, VTV, and XSVM have all significantly under performed the S&P 500 since January 2009 by 60, 55, and 42% respectively. Even Warren Buffett’s company, BRKB, has trailed the S&P 500 by 5% over this time frame.

Just so you don’t think I’m cherry-picking data here, the following shows the returns of the above securities for all 1 year, 2 year, 3 year, 4 year, and 5 year periods since 2009 and compares those to the S&P 500. It doesn’t look good.

The returns for the three value funds all are quite dismal. Take IVE for example, there is no 5 year period since 2009 where it has outperformed (or even equaled) the S&P 500, and scarcely a 3 or 4-year period to be found either. This may be the worst of the bunch, but it doesn’t look that much better for the other value funds. BRKB picked up considerable steam in the second half of the decade leading to more periods of over performance, but this is the clear exception to the rule.

This is a strong reversal from the decade prior (1999–2009) where BRKB and our collection of value funds regularly outperformed the S&P 500.

XSVM, IVE, and VTV all began in the 2000’s. XSVM and VTV were too young to log any 5 year periods, while XSVM was old enough to log only a few dozen 3-year periods, making it’s poor performance in that range potentially a result of a small sample size.

For the decade ending Dec 31st, 2008, we have outstanding performance by BRKB against the S&P 500, and still have it beat with most of our value funds.

What Changed?

Interest rates.

The cost of financing plummeted as the Federal Reserve and central banks around the world cut rates to 0, and kept them there for nearly a decade.

The Federal Funds is the amount that banks can charge for overnight lending on excess reserves. This rate is targeted by the Federal Open Market Committee (FOMC) and acts as a floor on interest rates (this is breaking down a bit in recent months). As shown below, when this rate rises, key bond rates rise, and when this rate falls, bond rates fall.

This is incredibly important for value investing strategies for a number of reasons, but I’ll focus on four: valuation models, cost of capital, yield starvation, foreign central bank intervention.

Interest Rates and Valuation Models

Warren Buffett famously uses a discounted future cash flow (DFCF) model for valuation. This has become the preferred method for many modern value investors. Future cash flows are always uncertain, but the analyst makes their best judgment then discounts those cash flows back to the present.

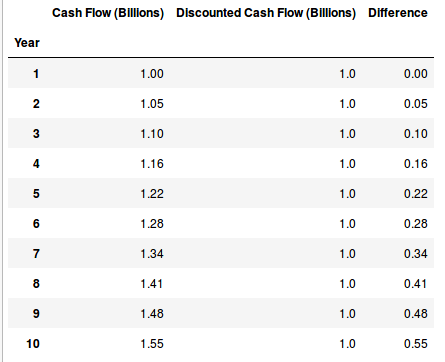

Let’s use a simplified example of a company where we look out 10 years and forecast $1 billion dollars next year, and with future cash flows growing at 5% per year every year for the next 10 years. We want to determine how much that is today, so we calculate it as such:

The key is the interest rate we use. If we assume a 5% interest rate, then our nominal cash flow will be $12.59 billion, but the discounted value (or net present value) of the future income streams will only be $10 billion.

The key here is that discount rate. You can see in the table above, that even through the discounted value remains constant (because it’s being discounted at the same rate we’re assuming it will grow at, so the values cancel) the difference between the nominal cash flow and the discounted model increases with time. The lower the interest rate goes, the closer these values come to one another which makes the discounted value of the company look much more attractive.

What Interest Rate to Use?

It’s not obvious what the correct interest rate ought to be. Buffett recommends using the rate on the 10-year US treasury bond for valuation purposes. The idea here being that 10-years is a reasonable horizon for a value investor and the 10-year treasury is a relatively low-risk and highly liquid asset to own. This makes it a reasonable proxy for opportunity costs with your investment.

Notice, however, what this does to the valuation as the rates drop as shown in the graph above. This makes companies with large cash flows in the future (and hence, very uncertain cash flows) look much more attractive than they really ought to be to value investors.

Cost of Capital

Because the interest rates closely mirror the rates on loans, companies that borrow money at low rate face a reduced cost of capital. This has the effect of enabling companies to roll over their debt for cheap when in fact they ought to go out of business. These companies are referred to as zombie companies and have become an increasingly worrying phenomenon in this low-interest rate environment.

Value investors likely won’t be caught purchasing these companies, but they do divert valuable resources away from the rest of the economy and bid up prices. This has the effect of making it harder for good companies to invest and grow because the zombies — which ought to be liquidated — continue to receive funding.

Yield Starvation

Many institutional investors such as university endowments, pension funds, trusts, insurance companies, and the like rely on safe and steady interest payments to continue to grow their holdings so they can meet future obligations. Low interest rates force these institutions to look elsewhere for the yield they desperately need.

For the past few years, we have seen more and more of these companies move into riskier assets such as stocks and even engage in venture capital investments! This has pushed hundreds of billions of dollars out of bonds into stocks which has pushed up the price of just about everything. Combined with the factors above, the riskier and sexier “growth” companies wind up reaping far more in than they would in times of normal interest rates, which inflates their prices and thus their performance relative to value investments.

Foreign Central Bank Intervention

If you think that it has just been the Federal Reserve that has been manipulating interest rates and pushing investors out on the risk curve, think again. Foreign central banks have been just as bad as the Fed, if not worse in many respects. Moreover, many banks have explicitly begun using their funds to purchase shares in the US stock market!

Many reports list the Swiss National Bank (SNB) and the Bank of Japan (BOJ) as the biggest participants in this scheme. In order to keep the value of their local currencies down in a misguided attempt at neo-mercantialism, the SNB, for example, has taken to printing Swiss Francs en masse and purchasing US dollars, Euros and other foreign currencies. Once it has the US dollars, it needs somewhere to put them, and has been purchasing US tech stocks. In essence, the bank is printing Swiss Francs and using that newly printed money to buy US companies. The price inflation implications of the bank’s actions should be obvious.

The Return of Value Investing

Everything I’ve stated so far shows that value investing strategies have drastically under performed a simple market benchmark. All strategies go through periods where they cease to work as effectively as they have in the past, but time shows that they soon rebound.

This low interest rate environment, has created the divergence between value and price over the past decade. It is critical to understand that the continuation of current debt, money creation, and low rates is simply unsustainable.

Debt can’t be rolled over forever. Pension funds and endowments won’t hit on every startup and have to liquidate other positions to meet their obligations. Recessions in Asia, Europe, North America, and elsewhere will come to pass forcing central banks to pull out of the US market. Markets for bonds from highly indebted countries will begin to dry forcing rates higher. All of these contributing factors will suck the air out of the sky-high prices in the US market.

Further, we know from Austrian Business Cycle Theory that artificially low interest rates set in motion an unsustainable boom that will be followed by an eventual bust. If allowed to clear the market of zombie companies and other financial aberrations, the ensuing recession will be painful but set the economy on a firmer path for renewed and strengthened growth. When this occurs, investing based on sound fundamental principles will resume its importance and its performance for the careful investor.

Already we’re seeing signs of weakness and financial difficulties on the horizon; it’s only a matter of time before it hits.