Trend analytics increasingly are being used to predict the periodicity of alpha over the day to give traders an edge when making trade-timing decisions. Advances in modern statistical modeling methods and access to big data are helping traders earn excess trading performance by improving their timing contribution.

Optimizing the Curve

Traditional pre-trade reports aim to estimate trade costs through the use of well-known explanatory variables such as average daily volume (ADV), bid-ask spread, etc. If an order’s percent of ADV and spread are small, the estimated trade cost will likely be small. If an order’s percent of ADV and spread are high, the estimated trade cost also will likely be high.

In practice, traders often ignore pre-trade reports except in the case of difficult-to-trade names. In the case of trend analytics, however, traders can make use of the predictive signals across all names – small, medium, and large cap – as the potential for a performance pickup through optimized trade timing is always present.

If the trend analysis estimates that a stock will trend in your favor over the trading session, then it makes sense to tilt the algorithm’s trade scheduling curve slightly to the back end of the trade horizon. If the trend analysis indicates that a stock will move away from you over time, then it makes sense to front load the algorithm’s trade scheduling curve slightly. Care must be taken to optimize the curve only slightly, however, as significant risk taking is usually not the goal with broker algorithms.

Actionable Analytics

Gone are the days of producing pre-trade reports for the purpose of “checking the box.” The value of trade analysis report quickly falls to zero unless they are actively being used to earn excess attributable alpha.

Post-MiFID II, “all sufficient steps” must be taken in the search for best execution. “Algo wheels” are increasingly being used to optimize broker selection and, similarly, trend analytics tools are increasingly being used to optimize the timing contribution to trading performance.

Automating Next-Generation Analytics

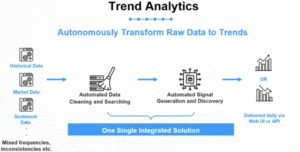

Automation in the analytics process is key to staying ahead of the trends. Big data sets need to be scanned for quality and cleaned autonomously if they are to consistently produce statistically significant alpha generating signals (see Exhibit 1, below).

Automation is expanding into the traders’ analytics review process. Gone are the days when a trader prints out his pre-trade report to read the numbers and think about courses of action. Increasingly, analytics vendor data is being streamed into the traders’ execution management systems (EMS) via FIX or through a proprietary interface via API for fast and efficient signal processing.

Exhibit 1: Trend Analytics Process

Source: causaLens

“Traditional approaches are not fit for purpose in today’s markets,” said Dr. Darko Matovski, CEO of causaLens. “Using technology that autonomously adapts to dynamic changes and embeds causality is the only way to discover alpha in execution.”

Best execution is an evolution and competitive industry pressures are intensifying. Traditional analytics tools increasingly need to be replaced by modern statistical and automated trade signal processing technology.

This article originally was published on TabbFORUM,

https://tabbforum.com/opinions/trend-analytics-the-new-pre-trade/

Michael Mollemans is a TABB Group senior analyst