Cboe is bringing US-style market structure for equity futures and options to Europe by launching an exchange with a central order book to provide on-screen liquidity and a single point of access for trading and clearing across the region.

Last week Cboe Global Markets completed its acquisition of EuroCCP, the pan-European equities clearing house. This paves the way for the US group to launch Cboe Europe Derivatives, an Amsterdam-based futures and options market, in the first half of next year subject to regulatory approvals.

David Howson, president of Cboe Europe told Markets Media: “We are discussing competitive pricing and liquidity incentives in the working groups we are running for the derivatives initiative. The sweet spot for the platform is not just about being cost-efficient but offering a single point of access to products, the market model and contract design.”

Cboe's acquisition of EuroCCP marks the beginning of the next chapter for Cboe Europe and, together with EuroCCP, we couldn’t be more excited to further deliver on our pan-European mission by planning the launch of Cboe Europe Derivatives. #DefiningMarkets pic.twitter.com/aWrFAS2r7h

— Cboe (@CBOE) July 1, 2020

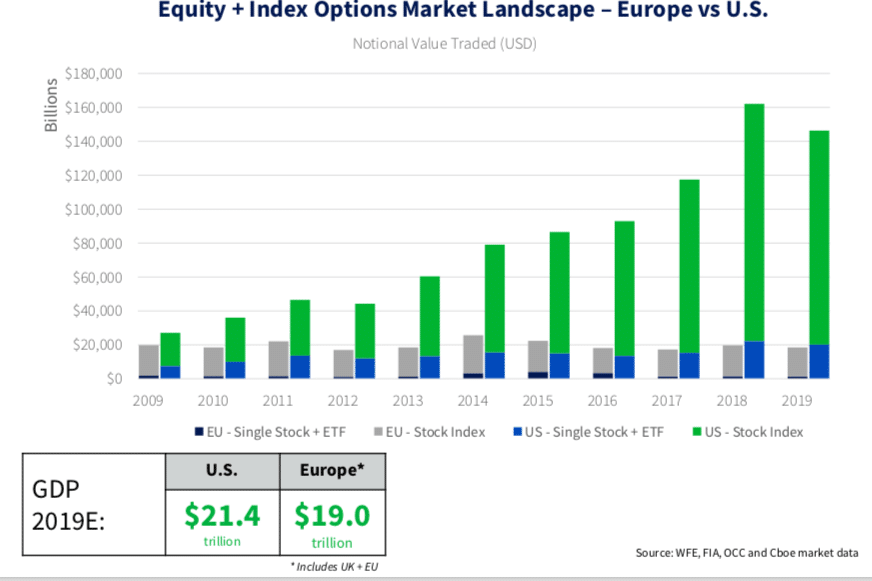

Howson said: “There is a significant difference in size between the US and European equity derivatives markets and significant growth is possible in Europe as there is latent demand from systematic and index funds.”

He said in an investor presentation last week that Cboe Europe is creating a single market for equity futures and options in the region with a market structure that simplifies cross-border trading.

Howson continued that the US and Europe had similar-sized equity futures and options markets in 2009. However since then the US market has grown, while Europe has stagnated due to a lack of competition, transparency and an opaque market structure the favours fragmented over-the-counter trading.

Howson said in the presentation: “There is demand for on-exchange trading such as in the US, which is transparent and quote-driven.”

Kyle Voigt, analyst at financial services broker Keefe, Bruyette & Woods, said in a report that KBW does not believe that Cboe is simply trying to take market share from incumbents.

“Management shared that it had been approached by its customers, including customers in the US, that are looking for more efficient ways to gain country-specific exposure,” Voigt wrote. “So, revenue that Cboe generates from this initiative could possibly be somewhat additive to the overall derivatives pool in Europe, instead of taking market share away from the incumbents.”

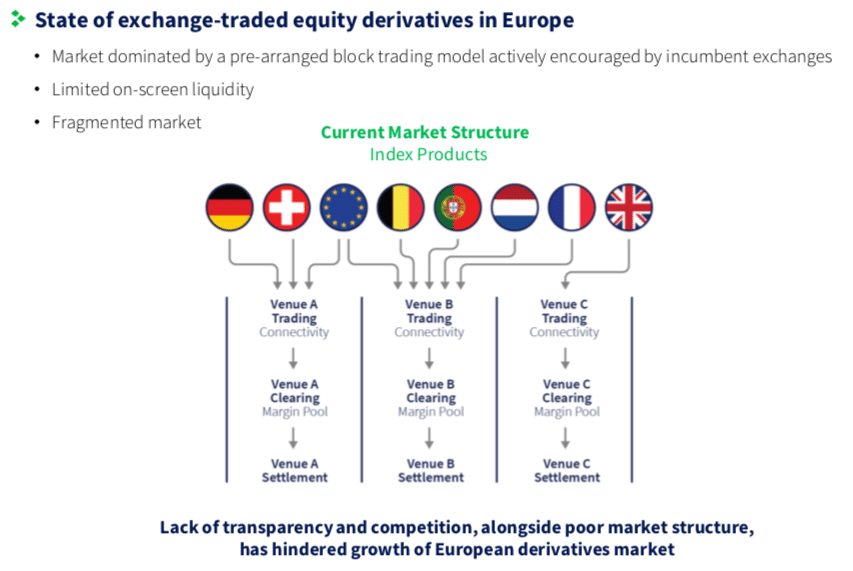

Howson continued there are currently three venues for trading equity futures and options in Europe, three clearing houses and three market models with inconsistent contract designs and low liquidity.

Howson added that Cboe Europe can use significant parts of the US trading platform and overlay MiFID II regulatory requirements and specific European functionality.

The new market will initially offer trading in equity futures and options based on six Cboe Europe indices, which will all be calculated using Cboe equities market data.

“The extension of contracts will be customer-led,” Howson said. “We may look to launch single stock futures and options and volatility products are in Cboe’s DNA.”

Ade Cordell, president of Cboe NL, said in the investor presentation that European exchanges had been built as national champions so Cboe is uniquely positioned to launch a pan-European market.

“New market participants want a central order book,” Cordell added. “We are having great conversations with market makers, the sell side and the buy side who have latent demand but cannot deploy capital due to the current market structure.”

Cordell joined Cboe Europe this year to oversee the expansion into European derivatives and leads Cboe’s Netherlands-based exchange which will be the home of the new platform.

Closing the acquisition

Howson continued that it was a fantastic effort from both companies to complete the deal on time as they transitioned to working from home during unprecedented volatility and volumes due to the Covid-19 pandemic.

Cécile Nagel, chief executive of EuroCCP, told Markets Media: “There was no magic to getting the deal completed.”

She said it was down to working even harder, ruthless prioritisation and planning to make sure sufficient resources were dedicated to the deal, as well as good stakeholder management with banks, regulators and former EuroCCP shareholders.

Today, Cboe Global Markets has completed its acquisition of EuroCCP. The acquisition brings together two pan-European organizations that have long championed competition, open access and clearing interoperability in Europe.https://t.co/ucxdvOW8bm pic.twitter.com/zkKZSelLW8

— EuroCCP (@EuroCCP) July 1, 2020

Clearing

EuroCCP will continue to operate as an independent subsidiary and retain its name and chief executive.

Nagel added that EuroCCP has started building the required derivatives and risk functionality to extend its business from clearing cash equities.

“Our clients are very positive on the benefits of clearing cash equities and equity derivatives on the same platform which could bring efficiencies from a post-trade perspective,” she said. “EuroCCP remains dedicated to clearing equities, which is an attractive business to build on for cash and derivatives.”

The equity central counterparty clears trades from 37 venues, which represent approximately 95% of Europe’s equity landscape according to Cboe. Within this universe, EuroCCP has approximately 40% market share.

The clearing business would have been boosted by the MiFID II regulations mandating open access in the region this year, allowing users to choose where their trades are cleared regardless of the execution venue. However the requirement has been delayed due to impact of Covid-19.

This meeting also allowed 1 year delay of MiFIR Open Access to Clearing requirements. Lets hope this is the last delay colegislators give as otherwise we have #MiFID2 and the #CMU without competition. This misses the set #MIFID2 goals. @EU_Competition https://t.co/VZZummftlK

— FIA EPTA (@FIAEPTA) June 25, 2020

“The one-year delay to open access is disappointing as both EuroCCP and Cboe are in favour of open and competitive market infrastructures, but there is no short-term impact to our equities business, or plans in derivatives,” Nagel added. “Even when the open access comes into force in July 2021, it will take time and hard work to gain access to venues.”

Revenues

Voigt estimated that the initial new six equity index derivatives could generate revenue of around €424m ($480m), with the majority coming from STOXX 50 trading.

“We think CBOE would need to get to 5% of current equity index average daily volume to break even in this venture, assuming the ongoing expenses related to the trading and clearing platform are near $10m to $15m per year,” he added.

The analyst highlighted OMX Stockholm 30, FTSE MIB in Italy and IBEX 35 in Spain as the next largest equity index derivatives that the exchange could launch.

“We also think Cboe would be interested in launching volatility derivatives on these indices over time if it builds sufficient liquidity in the derivatives market,” he said. “We think this is a long-term strategic play by Cboe, and it will take time to generate revenue.”

Cboe said that as part of the transaction, EuroCCP put in place a committed credit facility of up to €1.5bn. This facility is an important part of a number of new tools and procedures designed to strengthen the firm’s liquidity risk management framework and help ensure EuroCCP continues to meet relevant liquidity requirements under the European Market Infrastructure Regulation (Emir).

Ed Tilly, chairman, president and chief executive of Cboe Global Markets, said in the presentation: “This acquisition is a significant milestone for our European business. Full ownership of a leading equities clearing house not only enhances our current European equities business, but also provides opportunities to diversify our business into trading and clearing derivatives in the region.”