There are two distinct narratives in the market when it comes to economic recovery from the current pandemic. Proponents of the V-shaped recovery are elated at the bounce of the markets from the lockdown-driven crash, earlier in March. While analysts on the other side of the spectrum believe the market has risen too far too fast, with the underlying economic fundamentals not advocating such a move.

The bullish sentiment suddenly came to grinding halt on Thursday, after the Federal Reserve announced its projections, saying U.S. economy is expected to shrink by 6.5% this year, the most in recorded history, before bouncing back to 5% in 2021 and 3.5% in 2022. News of escalation of new coronavirus cases in various U.S states coupled with these grim projections was enough to rattle the markets. The volatility also spiked.

Although the markets have somewhat stabilized since a massive drop of almost 6% in the benchmark S&P 500 index with gains in the following two trading days, the recovery still seems fragile. The numbers out of China today didn’t inspire much confidence either — The National Bureau of Statistics released data for May that showed China’s economy is bouncing back, but more on the supply side rather than demand and investment, and not as quickly as analysts expected.

Asian bourses started the week on the wrong foot with Korean and Japanese markets faring the worst, posting losses of 5% and 3.5% respectively. A fresh outbreak of COVID-19 in Beijing further soured the investors’ sentiment. Presenting the case for the second narrative presented earlier are four charts that highlight the disconnect and divergence of the stocks market performance with the underlying economy.

GDP to S&P 500 Index Divergence

While the real gross domestic product decreased by over 50% (Figure 1), the S&P 500 index posted a historic rebound from the lows. Earlier recessions have been marked by such divergence as the markets base their decisions on where the general economy is headed rather than where it has been. This is probably why the market has been so exuberant lately expecting the worst is over.

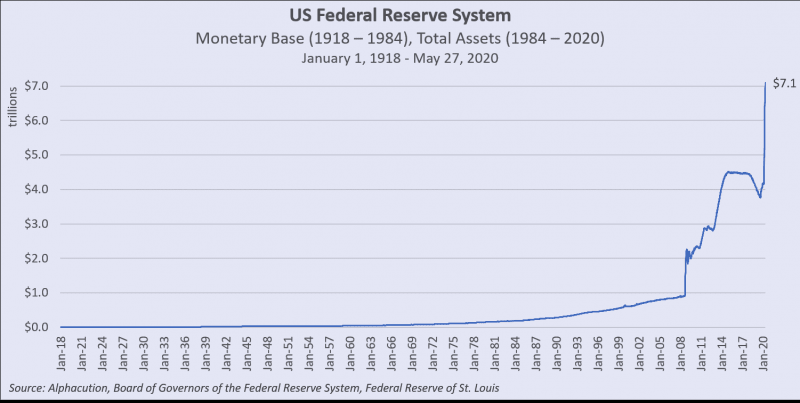

Exponential Rise in Federal Reserve Balance Sheet

The monetary base of the Federal Reserve has ballooned to historic proportions with total assets amounting to over $7 trillion (Figure 2). This is owing to the massive easing cycle that the U.S central bank has embarked upon support for the financial system and the economy. The pandemic-driven economic collapse resulted in unprecedented support from the FOMC and it has already reiterated that it would continue to support the economy with an additional stimulus in whatever form it is necessary.

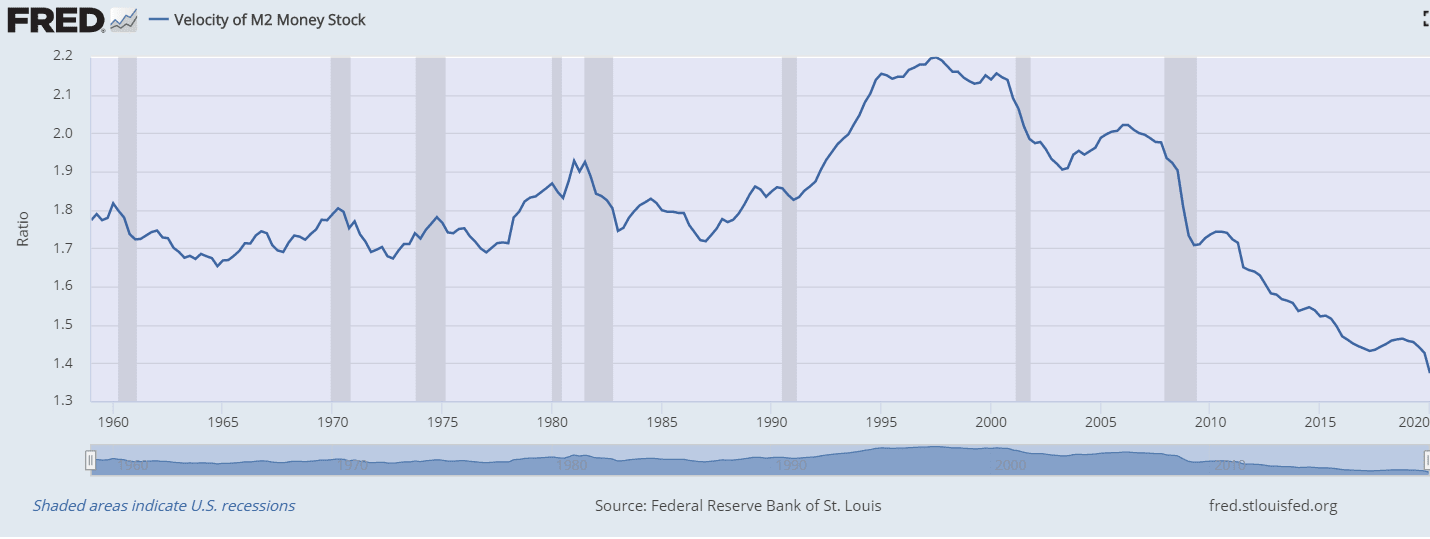

Decreasing Velocity of Money Supply

The velocity of money is a measurement of the rate at which money is exchanged in an economy. As evident from the chart above (Figure 3), the money supply in the American economy is at its lowest level in decades. Despite ultra-easy monetary conditions and money handed to people directly still hasn’t inspired much confidence for them to go out and spend it.

High Shiller P/E Ratio

The Shiller P/E ratio is one of the best and most accurate stock market valuation indicators and is commonly used by long-term investors. The indicator is still too high. The historical average of the past 130 years of the Shiller P/E ratio is 16.8 points and earlier recessions have resulted, following peaks in this metric. The current value is way above this average (Figure 4) advocating that the market is overvalued — the only other time it was higher than the current value was just before the dot-com crash.

Although the divergence and disconnect between the U.S stocks and economic fundamentals are pretty evident, one has to keep in mind that the Stock market is a leading economic indicator — investors base their decisions on future prospects of the economy, not past performance. The only problem this time around though is that the pandemic can throw a curveball anytime.

The views represented in this commentary are those of its author and do not reflect the opinion of Traders Magazine, Markets Media Group or its staff. Traders Magazine welcomes reader feedback on this column and on all issues relevant to the institutional trading community.