I field several calls daily from former trading associates inquiring about investing in cannabis. Its easy to skip the basics, but that can lead to confusion and missed opportunities. Ive enlisted the help of cannabis business intelligence leader New Frontier Data to provide an editorial series for Traders Magazine outlining the fundamentals of this rapidly evolving industry. -SB

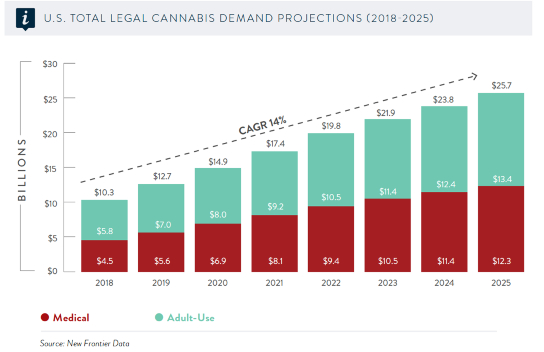

With an increasing majority of Americans supporting cannabis legalization, and the industry generating $10.3 billion in sales throughout 2018, it is a seminal time for investors and operators seeking entrance and opportunities in this fast-growing sector.

Through results from state ballot initiatives in the November 2018 elections, medical cannabis is now legal in 33 states (nearly 2/3 of the U.S.) and the District of Columbia (D.C.), while cannabis has been legalized for adult (i.e., recreational) use in 10 states and D.C.

Based on the election results, New Frontier Datas revised U.S. forecast for the combined medical and adult-use state markets is on track to grow to $17 billion in 2020, and $25.7 billion by 2025. Meanwhile, with large states like California and Michigan now fully legal, the adult-use markets share of those sales will double, from 22% in 2018, to 44% in 2025.

As of the first week of November, the total market cap of the top 15 cannabis companies was about $24.3 billion.

New Frontier Data analysis shows that were cannabis fully legal in all 50 states, it would at minimum create $105 billion in combined federal tax revenue by 2025. Based on an estimated 15% retail sales tax, between 2017 and 2025 the federal government would collect $46 billion in sales tax, $20 billion from business tax, and $39 billion from payroll deductions from a legalized market – entirely new revenue from an industry which on the federal level remains illegal.

In October, Canada became the first G7 member nation to legalize cannabis nationally, though now the supreme courts of both Mexico and South Africa have declared that prohibition violates their citizens civil rights. The Canadian markets opening means that the entire northern contiguous U.S. border with Canada includes legal markets on both sides for all but a 45-mile stretch in Idaho.

The popularity of cannabis has been borne out among U.S. state markets. As confirmed through a nationwide survey released in October by the Pew Research Center, more than six-in-10 Americans (62%) favor legalization, maintaining a steady increase over the past decade. Though the share of U.S. adults supporting legalization changed little from 2017 (with 61% favoring it), it has doubled since 2000 (31%).

In 2014, Colorado became the first U.S. state to legalize cannabis for adult use. Many of the early states to do so (including Colorado, Oregon, and California) placed no limits on the total amount of available licenses. Notably, some can control the number of licenses issued to meet the demand (which would potentially limit licenses), but to date have chosen to let the market regulate the supply-and-demand balance. They offer separate licenses for each market segment, usually meaning that cultivators, retailers, manufacturers, distributors, and testing laboratories are only permitted to operate in specific vertical spaces. In those states, a business need only pass the qualifying conditions for licensing (e.g., inspections, local licensing, application fees, etc.) in order to receive one. Such markets are defined by many small facilities operating in a highly competitive market where wholesale prices have been plummeting. Regardless, the practice has the advantage of quickly converting consumers from illicit to legal markets.

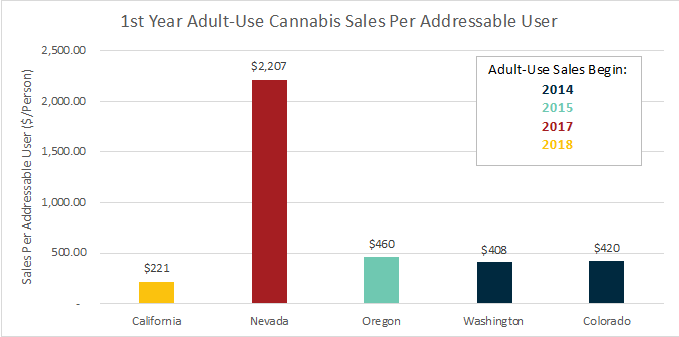

Such conversion has obvious upsides: In August, Nevada state officials reported that dispensaries there sold nearly $425 million worth of adult-use cannabis while collecting nearly $70 million in tax revenue through the states first full year of sales. Including both adult-use and medical cannabis, along with goods and accessories, the Nevada Department of Taxation reports that Nevada stores surpassed a half-billion dollars in sales, nearly $530 million. That dwarfed first-year sales by other states, and significantly outpaced Nevadas own projections: Its $69.8 million collected from combined cannabis taxes was about $20 million more than officials had predicted.

The strong demand is less about local consumers using more cannabis than those in other markets, but rather because Nevada has one of the highest visitor-to-resident ratios of any U.S. market, meaning that out-of-state sales have a larger impact on overall sales than they would in other, larger markets.

By comparison, Colorado sold $303 million in adult-use marijuana in 2014; conversely, in their first full years of sales Washington sold $259 million worth, and Oregon sold $241 million worth.

With a GDP which would rank as the worlds sixth-largest-producing nation, Californias market will close 2018 worth an estimated $1.92 billion, and is projected to grow at a compound annual growth rate (CAGR) of 13.7%, to reach almost $4.72 billion by 2025. The medical market is projected to decline at -5.4% CAGR through 2025, shrinking from $1.12 billion in 2018 to an estimated $760 million in 2025. During the same period, adult-use sales are projected to grow at a 25.5% CAGR, from $805 million to $3.96 billion.

Yet regardless of being an industry with sales beyond $10 billion – more than that of the entire snacks market – only about 26% of plant-touching cannabis businesses (those who have cannabis onsite) and 12% of ancillary businesses (i.e., related products and services) have bank accounts.

Naturally, once that the federal government loosens restrictions on banks, U.S. exchanges will immediately be more receptive to cannabis stocks. Work to solve the banking concern is underway in many arenas, including credit unions and regional banking.

Canada may have a head start in the global cannabis industry now that pot is legal, yet companies targeting the U.S. market say the advantage wont last long once the American branding machine gets rolling. Canadians first-mover advantages in large-scale production, large-scale farming, and large-scale commodity input has let Canadian licensed producers such as Tilray Inc. establish much bigger market value than their U.S. competitors, but the U.S. enjoys vital edges in brands, promotion, and the consumer experience. Canada has very strict rules around branding, including mandates that packages must be a single color, logos cant be bigger than the mandatory health warning, and marketing cant associate a product with fun or glamor. It is expected that once American companies can compete on equal footing, Canada will not long maintain its early lead.

Part 2 of this series will explore the Cannabis Product Story.

In 2016, Sachin Barot left his 20-year career on Wall Street to pursue the cannabis gold rush in California. He co-founded CERESLabs, a Cannabis Analytical Research and Lab Testing Company, with a mission is to ensure safe cannabis for all end-users.

–New Frontier Data is an independent, technology-driven analytics company specializing in the cannabis industry. It offers vetted data, actionable business intelligence, and risk-management solutions for investors, operators, and policymakers. New Frontier Datas data and reports have been cited in more than 80 countries worldwide to inform industry leaders. Founded in 2014, New Frontier Data is headquartered in Washington, D.C., with additional offices in Denver. For more information or media inquiries, please visit www.newfrontierdata.com or send email to info@newfrontierdata.com.