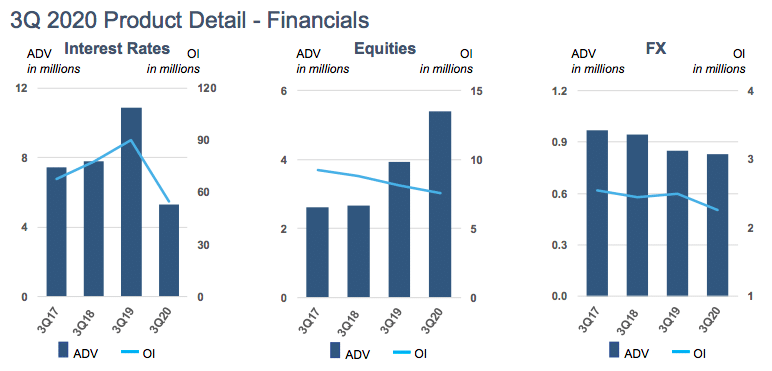

Total average daily volume at CME Group fell in the third quarter due to low levels of interest rate volatility, although volumes rose in metals, equities, agriculture contracts and outside the US.

The exchange reported today that average daily volume for the third quarter of this year was 15.6 million contracts, down from 17.6 million in the second quarter.

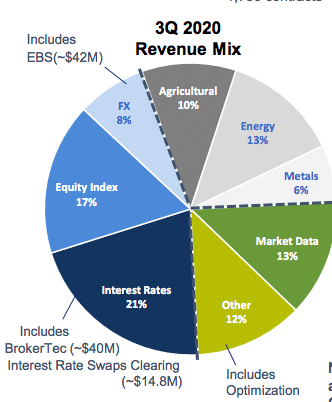

Terry Duffy, chairman and chief executive of CME Group, said on the results call: “Interest rate volatility has been at historically low levels so average daily volume has fallen but we have shown strength in metals, equities, agriculture and foreign exchange volumes have recovered. Market data had an exceptional quarter with its highest revenues in history.”

CME said there were bright spots in the third quarter despite headwinds in the rates business. Ultra 10-year note futures reached all-time high open interest of 1.1 million contracts in August. Duffy said market conditions can change quickly and increased activity in the longer end of the yield curve should soon be reflected in the shorter end.

Sonia futures also reached a record volume of 58,485 contracts on August 5,.

The UK has chosen Sonia, the sterling overnight index average, as its risk-free rate while the US has adopted SOFR to replace US dollar Libor. After the financial crisis there were a series of scandals regarding banks manipulating their submissions for setting Libor which led to a lack of confidence and threatened participation in the related markets. As a result, regulators have increased their supervision of benchmarks and want to move to risk-free reference rates based on transactions, so they are harder to manipulate and more representative of the market.

CME said that in the third quarter the average daily volume of 3-month secured SOFR futures grew by a third. A record 39 participants also cleared $58bn in SOFR swaps in the quarter.

In equity index products the average daily volume of micro E-mini Nasdaq 100 contracts reached a record 787,000 contracts, up 243%, in the third quarter.

Europe, Middle East and Africa had the highest quarterly micro E-mini S&P 500 and Nasdaq 100 futures average daily volume, and the highest quarterly micro E-mini Nasdaq 100 futures ADV was in Asia.

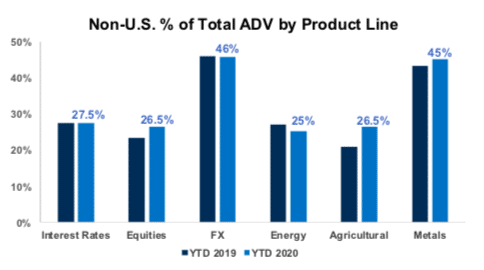

Total year-to date non-U.S. ADV increased 8% to 5.5 million contracts in the quarter, with growth across equities, foreign exchange, agricultural, commodities and metals contracts.

BrokerTec migration

A focus for the exchange is the migration of BrokerTec onto the CME Globex electronic trading platform in the fourth quarter of this year. CME acquired BrokerTec, which runs fixed income trading platforms, as part of its purchase of NEX Group in 2018.

Integration will take place in two phases with European government bond cash markets and repo migrating in November and U.S. Treasuries and repo in December.

Sean Tully, global head of financial and OTC products at CME Group, said on the call that the migration will improve functionality, reduce risk and cut costs for clients as they will be able to trade futures and the cash products on the same platform.

“After the migration BrokerTec will launch RV Curve, a way to easily trade pre-defined spreads on cash U.S. Treasury benchmarks,” Tully added. “RV Curve eliminates slippage and legging risk, providing a more efficient way to execute cash Treasury spreads.”

Chris Turner, analyst at German financial services group Berenberg, said in a report that CME’s dominant position in US Treasury futures and options will be strengthened when the trading of cash Treasury bonds and derivatives are on the same platform, as this simplifies risk management.

“While steps like this help the strategic development of the business, they cannot offset the huge volume headwind created by the current zero interest rate environment in the US,” added Turner. “Volumes across the group’s interest rate complex declined 51% year-on-year in the third quarter, and have continued to be 42% lower year-on-year in the past five days.”

EBS migration

The migration of EBS to CME Globex technology is planned to finish in the the fourth quarter of next year. EBS is the foreign exchange trading platform that was also part of the NEX acquisition.

Tully said that next week the exchange is launching FX Market Profile to the EBS Quantitative Analytics platform.

“For the first time, participants can compare future and cash FX products side-by-side and trade in both to reduce costs,” he said.

Data services

Market data revenue in the third quarter was a record $139m, up 7% from a year ago.

Julie Winkler, chief commercial officer of CME , said on the call that the increase was driven by more subscriptions as there was an increase in demand for real-time data.

“The rise in working from home has led to high demand for additional access and increased use of the data in automated trading solutions,” she added.

She continued that the demand for CME Smart Stream, the distribution of market data through the Google Cloud platform, had exceeded expectations. “It allows scalability and easier access,” said Winkler.

ESG contracts

In the third quarter CME launched futures based on the Nasdaq Veles California Water Index, which the exchange believes will attract new customers.

Winkler said the new contracts reflect increased demand for environmental, social and governance strategies.

“ESG contracts are a new innovation and will help firms meet their aggressive carbon reduction goals,” she added. “It is a major topic of conversation with clients, especially in Europe.”

Berenberg’s Turner said: “It is important to recognise that the attractions of CME are structural, while the headwinds facing the group are largely cyclical, and therefore – at some point – will reverse. Nonetheless, with lacklustre qtd volumes and tough yoy comparisons in Q1 2021, we continue to favour stocks with a lower proportion of volume-driven revenues (London Stock Exchange and Intercontinental Exchange, in particular).”