Illegal insider trading tends to be something we dont hear about until its hit the big news networks and newspapers as the SEC goes for the throat of the accused. By then, unfortunately, those committing it have made their gains, usually in the multi-millions of dollars, and the damage has been done to the stock, its company and investors.

And quite frankly, the jail time assessed doesnt correct the damage done, and the fines rarely aid the investors in getting their money back. Many of those hurt are Average Joes and Jills who were just trying to pad their retirement nest eggs.

The act involves someone using information, which was not available to the public, buying and selling a companys stock. Because the dealings involved are pretty much done on the sly, its been difficult for the governing body of the SEC to prove illegal insider trading, unless one of the cohorts tattles on the others or their actions become glaringly obvious. In some cases, a sharp mind around the action may take notice and become whats called a whistleblower.

Writes Andrew Beattie of Investopedia: … insider trading is often difficult for the SEC to spot. Detecting it involves a lot of conjecture and consideration of probabilities.

However, detecting illegal insider trading may actually be less complicated than it sounds, at least to the eyes of a keen observer who is familiar with the culture of financial entities and is hip to some of the tools available via artificial intelligence. Its a matter of using temporal matching of the trade to its information source.

Key Components

Some terminology must be clarified:

Analyst estimates – these come from what an analyst estimates that a companys quarterly or annual earnings will be. They are important because they help approximate the fair value of an entity, which basically establishes it price on the stock exchange.

Share volume – this reflects the quantity of shares that can be traded over a certain period of time. There are buyers and there are sellers, and the transactions that take place between them contribute to total volume.

How To Detect an Unusual Insider Trade

It must be pointed out that there are insider trades that are considered legal. Those go down when the trading party – the CEO of a firm – reports to the SEC that he/she bought shares in the company. This can also be true if a board member, or an executive buys shares through a stock option, as long as the SEC is made aware.

However, signs of illegal insider trading occur when trades occur that break out of the historical pattern of share volume traded. Another hint to perhaps illegal insider trading is when a lot of trading goes on right before earnings announcements. That tends to be a sign that someone already knows what the announcement is going to indicate, and its an obvious violation.

Bells should also go off when trades are linked closer to the actual earnings instead of what the predicted earnings were. In this case, its clear the trades – especially made by someone close to the company – stemmed from information that was not readily available to the general public.

In other words, at the time an insider makes a trade, the trade should have a stronger relationship to earnings guidance rather than to earnings results achieved.

Insider Trading Detection Using Dynamic Time Warping

In econometrics, which is a concept frequently used by quantitative analysts to evaluate stock market prices, dynamic time warping (DTW) is an algorithm that can be used for measuring similarity between two data sequences by calculating an optimal match between the two. This sequence matching method is often used in time series classification to properly line things up.

The method, coupled with machine learning ensemble methods, can provide a clear path between the trades made by insiders and public data used to make the trades.

This is a product of artificial intelligence that has been expanded by Indexer, a Houston-based firm fast becoming an expert in products that can be used to advance the art of predicting trends in business and markets by using social media, financial data and news stories.

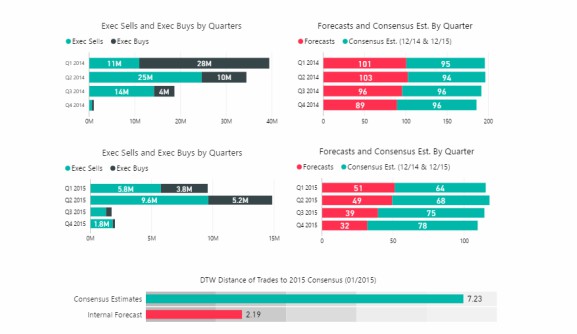

The graph below shows a hypothetical example, where a group of executives most likely failed to trade by industry standards by leveraging material non-public information. Although consensus estimates called for higher commodity prices at the end of 2015, it appears key executives traded for their personal accounts as a result of the forecast provided by a specialist system within the firm that was adept at predicting prices.

In the hypothetical scenario below, we aggregate executive trades in 2014 and 2015 and find a strong link between buys and sells of executive stock options, which line up with material non-public estimates of commodity prices that were provided by the specialist system.

For example, in the Exec Sell and Exec Buys graph, the green line represents sells, while the black line represents buys. In the corresponding period, we find the red line represents unrevised prices provided by the specialist system, and green line represents consensus estimates.

During Q1-2014, there was $28M in purchases of executive stock options, while in Q2-2014, there was $25M in sales of executive stock options. As illustrated in the graph below, the specialist system called for Q3-2014 commodity prices to make a precipitous decline going into the end of 2014. Remember, under this scenario, no revisions were made to the specialist systems price forecast. In this example, executives were afforded a significant advantage using price predictions from the specialist system.

In the final bullet chart, there was a dynamic time warping distance between trades and consensus estimates of 7.23, but this distance is only 2.19 when comparing specialist system estimates and executive trades. Please note, the closer the distance score is to zero, the more similar the trades are to the estimates they are measured against.

What It All Means

Its obvious that the executives involved did not follow industry standards in their actions and make public the insider information they had access to prior to the trades they made. These are the kind of violations the SEC and other governing bodies can look to in attempting to protect the trading public and the integrity of financial marketplaces. Artificial intelligence tools are a major factor in assisting the tracking of insider trading.

Every facet of our everyday lives has been impacted, infiltrated and greatly influenced by artificial intelligence technologies, says Vernon A. McKinley, a multi-jurisdictional attorney, based in Atlanta. In fact, the U.S. government and its multiple agencies have developed specialized intelligence units to detect, track, analyze and prosecute those unscrupulous individuals seeking to profit from the use of such tools, specifically in the financial industry, and to protect the integrity and strength of the U.S. economy and its investors.

Indexer is one of the leading start-up companies that can now detect trading anomalies in financial situations using artificial intelligence.

But only time will tell if these tools of the future will have an impact on how insiders trade on Wall Street and in financial markets around the world.

The views represented in this commentary are those of its author and do not reflect the opinion of Traders Magazine or its staff. Traders Magazine welcomes reader feedback on thiscolumn and on all issues relevant to the institutional trading community. Please send your comments to jdantona@marketsmedia.com