In our prior analysis, we focused on the period around the open and closing auctions. Today we take a deeper look at intraday trading – commonly called “continuous trading” – where prices and liquidity are constantly in motion across all trading centers. Importantly, all stock tickers can (and do) also trade on any venue.

That enables us to directly compare live market quality across the different exchange models. What the data shows, is revealing, especially now that the New York Stock Exchange (NYSE) trading floor has reopened.

Nasdaq has more liquidity, even in NYSE-listed names

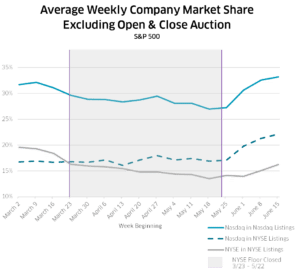

For a long time, Nasdaq has traded much more liquidity in our own listings than NYSE does in theirs. Since the NYSE floor closed due to COVID-19, Nasdaq has actually provided more liquidity in NYSE listings, too.

After the NYSE floor reopened, the amount of intraday liquidity on Nasdaq for both Nasdaq and NYSE listings has grown far more significantly than the liquidity on NYSE for its own listings.

Chart 1: Nasdaq has more intraday liquidity than NYSE, even for NYSE listings.

Source: Nasdaq Economic Research. Calculated using daily simple average per symbol

In today’s fragmented markets, a deeper liquidity pool is important for investors looking to work large orders. More liquidity aggregated in one place makes it easier to route trades and reduces the time to complete an order. That in turn reduces opportunity costs as well as reducing the market impact that an order creates.

Nasdaq’s electronic markets use incentives available to all participants to contribute to good market quality and liquidity. That makes our markets fairer and more equal, which in turn brings more competition and liquidity to the quote. More liquidity at the quote naturally leads to tighter spreads.

Nasdaq has tighter spreads

Another place that competition for liquidity can be seen is in the bid-offer spreads on each market.

Spreads are important for investors because they represent the cost of an immediate fill. Wide spreads not only add to costs, but also tend to add to the fragmentation and complexity of sourcing liquidity.

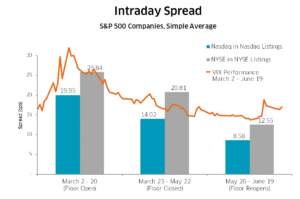

Data shows that spreads in Nasdaq stocks are better than spreads in NYSE stocks.

In Chart 2 below, we have equally weighted the results so the top Nasdaq stocks, like AAPL, MSFT, GOOG and AMZN don’t disproportionately benefit our results. We also show the changes to the VIX since March (in orange). That highlights how the general reduction in spreads over the period in view is mostly due to a reduction in market-wide volatility, something we studied in more detail here. However, regardless of the level of volatility at each period, Nasdaq stocks had tighter spreads than NYSE stocks.

That would seem to confirm a few things—

- Nasdaq has more competitive spreads,

- Regardless of whether the NYSE trading floor is open or closed,

- Or whether the overall market has high or low volatility

Chart 2: Comparing spreads by listing market during the COVID-19 period.

Source: Nasdaq Economic Research. Calculated using simple average of duration weighted spreads per symbol. VIX daily performance overlaid in chart is a rough representation for illustrative purposes.

Nasdaq has lower intraday volatility

It’s not really fair to look at volatility across the spectrum of all stocks. Larger stocks tend to have more diversified businesses, more liquidity and tighter spreads. That in turn tends to give them lower volatility.

That’s why we try to compare volatility across similar-sized stocks. But even then, stocks in some sectors, like technology, tend to be more volatile than other sectors, like utilities.

We see again that market-wide stress (volatility) affects single stock’s volatility regardless of listing market, explaining the general improvement over the three timeframes in the chart 3.

Despite that, and despite the higher proportion of tech stocks listed on Nasdaq, data shows that the volatility during the Covid-19 period has been consistently lower for Nasdaq stocks than NYSE stocks.

Now that the NYSE floor is reopening, we can more confidently say that Nasdaq-listed large cap stocks have lower volatility regardless of whether the floor is open or closed as well as whether market stress is high or low.

Chart 3: Comparing spreads by listing market during the COVID-19 period.

Source: Nasdaq Economic Research. Calculated using simple average of 5 minute (High – Low)/ midpoint intraday prices.

Traders would rather trade on Nasdaq

The data shows the Nasdaq market is better for investors. It has more liquidity, tighter spreads and lower volatility. That reduces trading costs for investors, increasing the shares an investor can buy for the same return. That in turn reduces the costs of capital for companies. And this is true whether or not the NYSE floor is open or closed.

Simply put, Nasdaq’s electronic markets are the best for investors and issuers.