The term Electronification is thrown around a lot when talking about advances in the corporate bond market. It describes the nascent trend of using technology to trade in a marketplace where the vast majority of trades are still negotiated over the phone. Since electronic execution only accounts for roughly 20% of U.S. corporate trading volume, one might wrongly assume that efficiencies are slow to come by.

But just because a bond isnt executedelectronically, does not mean technology didnt play a crucial role in getting the trade done.

Five years ago, if you walked by my corporate bond trading desk at one of the largest asset managers you would have seen frantic phone calls, a trader scribbling a price into a notebook, and a portfolio manager skimming through inventory spreadsheets from dealers.To put it simply, corporate bond trading was antiquated.

Today, that desk looks completely different – dare I say, calm even? This is a direct result of the advancements being made throughout the entire trade lifecycle, which weve witnessed first-hand at Tradeweb. Regrettably, many of these technology advancements are not quantifiable by industry standard metrics and are often underappreciated in the Electronification story.

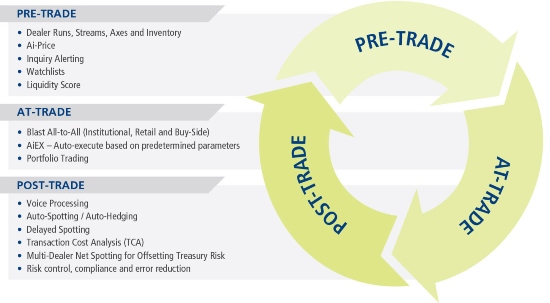

Previously, pre-trade pricing information was scattered in emails, on scraps of paper and over phone calls. Now, that data is electronically organized and parsed through the aggregation of streams, axes, inventory and dealer runs that are directly routed into a clients Order Management System (OMS).

At the execution level, All-to-All trading opened an entirely new channel of liquidity where the buy-side and dealers could trade directly with each other anonymously. Advancements arent stopping there – Portfolio Trading is becoming immensely popular with the proliferation of the Fixed Income ETF ecosystem, enabling designated portfolio traders at banks to access bonds via ETFs and more easily facilitate pricing client trades. A client may have a very large, market-moving trade and would prefer to utilize a designated portfolio trader at a bank to price that trade to avoid information leakage. As the Fixed Income ETF ecosystem continues to flourish, Portfolio Trading will only become more dominant.

At the post-trade level, the electronification continues withMultilateral Net Spotting, an innovation which truly changes the landscape for credit markets around the world. Tradewebs patent-pending Net Spotting technology allows clients to have one spot price for a given Treasury benchmark across multiple dealers. In 2018, $152 billion of volume was put through Netting, enabling clients to tap into $2.8 million of never before possible savings.

In fact, here are some examples:

Voice Processing: Eliminate the Need for Traditional Ticket Sending

With Voice Processing, the buy-side trader is able to electronically send an order from their Order Management System (OMS) directly to the dealer as soon as the trade is bilaterally agreed upon. Instead of waiting for the salesperson to the spot the trade, confirm the price, and manually enter the trade details, Tradeweb automatically spots / prices and/or hedges the trade for the buy-side and the dealer. All trade details are electronically returned to the OMS and the trade is booked. This reduces manual entry of transaction details and eliminates operational risk, maximizing scalability and trader productivity.

Automated Intelligent Execution (AiEX): RFQ is Getting Smarter

Intelligent technology like Tradewebs AiEX (Automated Intelligent Execution) allows traders to set pre-programmed execution rules to automatically execute trades that meet their parameters. These parameters can include tolerance price from composite, minimum number of counterparty responses, and negotiation time. With AiEX, you have an efficient route to market and less human trading biases, making it possible to quickly execute large volumes of trades tailored to your strategy.

Mulit-Dealer Net Spotting: Savings Never Before Captured

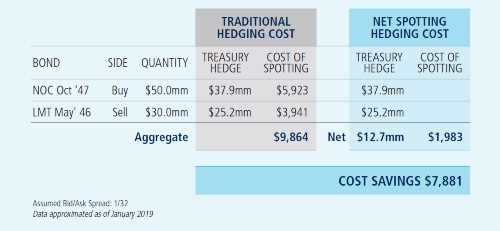

Net Spotting is saving clients and dealers real money, but appears nowhere in industry standard measures of corporate market structure electronification.Lets say Katie Smith, a Trader at XYZ Asset Management does 2 corporate trades during the day:

Buy of $50mm NOC 4.03% Oct 2047

Sell of $30mm LMT 4.70% May 2046

Since these are spread-traded bonds, in which a spread is quoted above a benchmark government bond yield, Katie must spot these trades against the corresponding old 30-year Treasury bond. The old 30-year Treasury bond bid/ask is quoted at 100-02+/100-03+. The Treasury Spot is imperative because it determines the price of the corporate bond.

Traditional spotting workflow would have Katie pricing these bonds separately and receiving two Treasury spot prices – one at the bid side and one at the offer side. By utilizing Tradewebs Net Spotting, both of Katies trades would both be spotted at one price instead of having to pay the bid/ask on the Treasury bond. That is savings of $7,881! This kind of cost savings was not possible without advancements in technology. Imagine the cost savings to the marketplace if all eligible volume was netted.

So as much as it may seem to market participants that the corporate market isnt modernizing fast enough, I think it is – you just have to look at the minutiae of market structure to see the full picture.

Once you do, youll see electronification ineverystage of the corporate bond trade.