Its a tale of two exchanges.

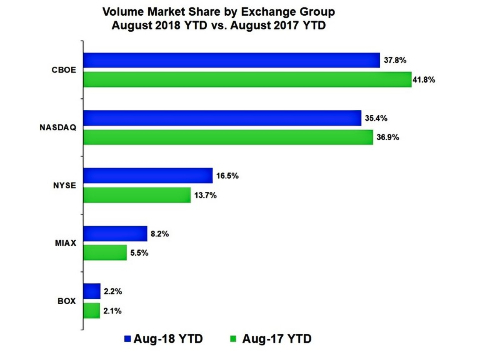

The two largest exchange groups, Cboe and NASDAQ, have captured 73.2% of options volume in 2018, but the three smaller exchange operators have gained market share.NYSEs share is up 2.8%, to 16.5%;MIAX has gained 2.7%, to 8.2%; and BOXs share is up 0.01%, to 2.2%.

This is according to the latest Options Liquidity Matrix published by Tabb Group.

Hanweck/TABB Group

Meanwhile, August option market quality was the best in almost five years, Tabb also noted. The average bid-ask spread in July was 0.223, the lowest in almost 5 years.The average moved up slightly, to 0.230, from July to August; but0.23 is still at the low end of the historical range.The liquidity of the options market in the US has gradually improved over time, despite setbacks such as February, when this figure widened to 0.36.

The Options LiquidityMatrix includes data and analysis separately for penny options classes and all options trades. Charts and data tables in the report include:

- Options volume by exchange on year-to-date and monthly basis.

- Options market share by exchange for all 15 exchanges operated by Cboe Global Markets, Nasdaq, NYSE, MIAX, and BOX.

- Options market quality for penny options classes and all options trades, including

- Average bid/ask spread

- Average bid/offer size

- Number of series traded

- Average trade size (contracts)

- Average trade value

- Percentage executed at bid/ask

- Percentage of time at best bid/offer

- Percentage of time at best bid/offer and greatest size