Boom. Zoom. To the Moon.

Thats how one could describe growth in the options market during the first quarter, according to the latest report and data from Tabb. The market consultancy reported US listed options volume reached new highs in Q1 2018, spurred by the surge in market volatility.

All three months of the quarter posted new monthly records. Trading in the period totaled 1.37 billion contracts, a whopping 25.1% quarter-over-quarter increase and a massive 33.1% increase from the Q1 2017 total, said Tabbs Tom Lehrkinder.

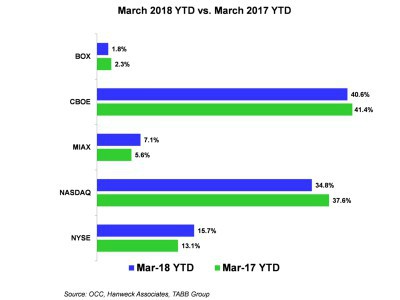

In a deeper look at the data, after combining the individual venue totals by exchange owner, CBOE Group captured 40.6% of the US equity options market in Q1 2018, which represented an 0.8% decrease from Q1 2017. Nasdaqs market share also fell in Q1 2018, to 34.8%, a drop of 2.8%, while ICE/NYSEs market share rose 2.6%, to 15.7%. MIAX, buoyed by MIAX PEARL, saw its market share rise 1.5%, while BOX slipped 0.5% compared to the same period last year.

Trading in options with short-term expirations (non-standard expirations with expirations of 5 weeks or less) totaled a record 410 million contracts in Q1 2018, a 21.6% quarter-over-quarter increase and a 32.4% increase compared to Q1 2017. Volume for each month of 2018 surpassed 125 million contracts.

2018 started off slowly in terms of volatility, but those quiet times were short lived, Lehrkinder continued. The January 2018 VIX average was in line with FY 2017; it took until February 2018 for the fun to start.

The CBOE VIX Index (VIX) averaged 17.35 for Q1 2018, with only 7 trading days settling below 10 and none since Jan. 11, 2018. The CBOE VVIX index spent all of Q1 2018 above the FY 2017 average of 89.5, with 45 days settling above the 100 level.

TABB Groups quarterly US Options Market Review examines market trends in US-listed options markets, including detailed insight into volume trends across the index, ETF and single-stock sectors. The report also examines trading in weekly options, provides market quality metrics and examines trends in volatility.