This report is the second of a two-part series. The first part can be read here.

By Rumman Iqbal, Consulting Partner, Wipro

In part 1, we discussed the current challenges of US Market Data Infrastructure as it exists today. In part 2, we take a look at the proposed rule by the Securities and Exchange Commission (SEC) on Market Data Infrastructure and its potential impact to market participants.

The Proposed changes

In February 2020, the SEC proposed the Market Data Infrastructure rule1 which aimed to enhance the availability and usefulness of National Market System (NMS) information, for a wide variety of participants; as well as help reduce information asymmetries between market participants who rely upon current Security Information Processor (SIP) data, and those who use the proprietary data feeds from the national securities exchanges.

The proposed rule from the SEC covers,

(a) redefining the content of the consolidated feed;

(b) decentralization of the consolidation model, and

(c) governance improvements

- • Redefining the Content

By amending the Regulation NMS Rule2 600, consolidated market data would be defined as data that is consolidated across all national securities exchanges and associations, which includes: (1) core data; (2) regulatory data; (3) administrative data; (4) exchange specific program data; and (5) Additional regulatory, administrative, or exchange specific program data elements.

The Core data set would be extended to include the following:

- Quotation data: To improve price transparency for high-priced stocks, quotation information would be published based on a new tiered definition of ‘‘round lot’’ that assigns different lot sizes to individual NMS securities according to their stock price.

| Stock price range | Proposed Round Lot |

| $0.00 – $50 | 100 shares |

| $50.01 – $100 | 20 shares |

| $100.01 – $500 | 10 shares |

| $500.01 – $1000 | 2 shares |

| Above $1000.01 | 1 share |

- Depth of Book: The consolidated feed would include aggregated quotes at each price between the best bid (and best offer) and the protected bid (and protected offer) (if different), as well as the five price levels above the protected offer and below the protected bid

- The best bid and best offer, national best bid and national best offer, and depth of book data would include odd-lots, that when aggregated are equal to or greater than a round lot, aggregated across multiple prices, but disseminated at the least aggressive price.

- Protected quotations, would only include odd-lots at a single price that when aggregated are equal to or greater than 100 shares.

- Auction Information: Information about orders participating in auctions, leading up to and during an auction, including opening, reopening, and closing auctions, and disseminated during the time periods and at the time intervals provided.

- Proposed Decentralized Model

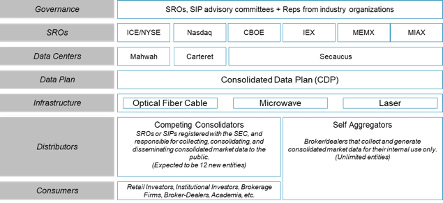

To update and modernize the provision of consolidated market data, SEC proposed a decentralized consolidation model that would replace the existing exclusive SIPs. This proposal could significantly reduce the geographic, aggregation, and transmission latency differentials that exist between SIP data and proprietary data. That has resulted in increasingly reduced the utility of SIP data and disadvantaged smaller market participants in particular.

To facilitate this decentralized consolidation model, it is proposed that:

- Each Self-Regulatory Organization (SRO) would be required to make available all its market data necessary for generating consolidated market data directly available to the newly defined entities including (1) Competing consolidators and (2) Self-aggregators

- The Competing Consolidators (CC) would be either SROs or SIPs registered with the SEC, and would be responsible for collecting, consolidating, and disseminating consolidated market data to the public

- Self-aggregators (SA) would be broker-dealers that elect to collect and generate consolidated market data for their internal use. An SA is not allowed to make consolidated market data, or its parts, available to others.

- All competing consolidators, (both SRO and non-SRO), would be subject to standards with respect to the promptness, accuracy, reliability, and fairness of their consolidated market data distribution.

- SROs would be required to make all data that is necessary for generating consolidated market data available to CCs and SAs directly from its data center, and in the same manner they makes proprietary market data products available to any market participant.

- • Changes in Governance

Under the proposed rule,

- The participants in the Equity Data Plans (EDPs) are to jointly develop a single new Consolidated Data Plan (CDP) that consolidates the three current EDPs

- The operating committee for the CDP will constitute of

- SRO members: Each exchange group and unaffiliated SRO can name a member, who will be authorized to cast one vote (two votes, if consolidated equity market share is > 15%)

- Non-SRO Members: An institutional investor, a broker-dealer with a retail investor customer base, a broker-dealer with an institutional investor customer base, a securities market data vendor, an issuer of NMS stock, and a retail investor

- The operating committee for the CDP will be tasked with (a) implementing policies to ensure usefulness of data (b) oversight on independent plan administrator, plan processors, etc. (c) developing terms and fees for data, ensuring fairness in pricing (d) reviewing plan processor performance (e.) ensuring fair revenue allocation

Potential challenges posed by the proposed rules

The proposed rules while are expected to have a positive impact on price transparency data and latency, they are also perceived to have a significant impact to Regulation NMS, by adding new complexity and unintended risks to the current market structure. A preliminary view of the impact of the rules to Regulation NMS can be found below:

| Reg NMS Sections | Regulation Area | Impact of proposed regulation |

| 600 | NMS security designation and definitions | New definitions for ‘‘administrative data,’’ ‘‘auction information,’’ ‘‘competing consolidator,’’ ‘‘consolidated market data,’’ ‘‘core data,’’ ‘‘depth of book data,’’ ‘‘exchange-specific program data,’’ ‘‘primary listing exchange,’’ ‘‘regulatory data,’’ ‘‘round lot,’’ and ‘‘self-aggregator’ |

| 601 | Dissemination of transaction reports and last sale data | None |

| 602 | Dissemination of quotations in NMS securities | For the proposed definition of ‘‘round lot,’’ the SROs would be required to collect and make available quotations in the smaller round lot sizes depending on the price of the NMS stock. |

| 603 | Distribution, consolidation, and display of information | National Best Bid and Offer (NBBO) would be based on the proposed new round lot size quotations. |

| 604 | Display of customer limit orders | The customer limit order display requirements of Rule 604 should apply to orders in the new proposed round lot sizes. |

| 605 | Disclosure of order execution quality | The proposed definition of round lot has an effect on the definition of NBBO and any execution qualitystatistics that rely on the NBBO as a benchmark would be affected |

| 606 | Disclosure of order routing information | The proposed definition of round lot could result in an increase in the number of indications of interest in higher priced stocks that would be required to be included in 606(b)(3) reports. |

| 607 | Customer account statements | None |

| 608 | Filing & amendment of NMS Plans | None |

| 609 | Registration of SIPs | None |

| 610 | Access to quotations | The market could become locked or crossed in odd-lot orders. Firms would have to keep track of both the NBBO (for 610c) for trading purposes, and the new PBBO (protected bid and offer) for 610(d) restrictions to apply |

| 611 | Order protection rule | Rule 611 would not be extended to smaller-size quotations reflected in the proposed definition of round lot, causing a gap in NBBO and PBBO. Impact on NBBO from the proposed round lot and protected quote definitions could affect other trading venues, where order types are based off of the NBBO |

| 612 | Minimum pricing increment | None |

| 613 | Consolidated audit trail | None |

Source: SEC Rules

The rules are expected to have the significant impact in the areas of concern for the SEC including (a) latency, where SIPs have a definite disadvantage3 over other data sources (b) content, where the gap is being reduced and (c) the cost of market data.

| Areas of focus | How it is being addressed | Impact of change |

| Latency | With geographic latency estimated to account for about 96% of overall SIP latency, the proposed rules could have a considerable impact on reducing latency as it requires each SRO to make data available directly using the same access method, infrastructure, and delivery semantics as for their proprietary data, including fiber optic and wireless. | Significant reduction in latency |

| Content | The additional data proposed for consolidated feeds includes depth-of-book, auction information and other critical information. | Improved price transparency |

| Cost of Data | Pricing could include costs for accessing enriched exchanges data, consolidation of data and data transmission. The proposed model encourages competition in price, along with improved service quality. Firms might have to subscribe to at least two CompetingConsolidators to ensure redundancy including failover plans to quickly and easily switch in the event of a failure. At an industry level, this introduces additional costs, estimated to be $60 million4 annually, assuming 12 CCs. | Industry can expect competition in pricing of market data. Overall industry cost will increase due to creation of new CCentities |

| Governance | SIP operating committeeswill include both SRO andnon-SRO members to decide on pricing and enforcement of standards. | Increased representation from the industry |

| Conflict of Interest | The competing consolidator model to encourage innovation in market data services, as the CCs compete among themselves for market share | Reduced gap between two-tier market |

Impact to Technology

The proposed rules have an impact on technology infrastructure around areas of market data, order routing, trade execution, and compliance to name a few. We would be tracking this space and assessing the impact to various front office and back office functions.

- Market Data Connectivity: Broker-Dealers to evaluate, select and build connectivity to Competing Consolidators or become Self-Aggregators

- Market Data Processing: Broker-Dealers to evaluate, select and build connectivity to Competing Consolidators or become Self-Aggregators

- Order Routing & Execution: Assess and implement system changes in order routing, best execution, in a multiple NBBOs scenario, due to Competing Consolidators; unsynchronized view of the market due to latency differences

- Best Execution Policy: Define, implement and communicate the policy where NBBO could be separate from PBBO (new smaller round-lots) and compliance with Order Protection Rule

- Locked and Crossed Markets: Exchanges to determine rules to avoid displaying quotations that lock or cross any protected quotation, and prohibit exchange members from engaging in a pattern or practice of displaying quotations that lock or cross any protected quotation.

- Trade Reporting: Some of the existing industry implementations that have a dependency on SIP data to determine and implement the policy around market data usage such as for CAT Central Repository Data.

- Market Resilience: As multiple Competing Consolidators emerge, including existing exclusive SIPs, the existing SIPs could change the status from ‘‘critical SCI” (Systems Compliance and Integrity) systems to “Standard SCI” systems as they are no longer single points of failures, and reduce the costs of adherence to Regulation SCI.

Conclusion

We believe that the proposed rules are a good starting place for the industry to move towards a better designed Market Data Infrastructure. There are areas where more clarity is necessary including (a) how the rule aligns with the governance order5 for a consolidate data plan (b) the structure and controls around market data fees; as well as areas that would need further public debate like (c) NBBO/PBBO separation (d) application of Order Protection Rules (e) applicability of Regulation SCI, etc.

As the regulation continues to evolve, it would be important to track the impact it will have for market participants in the areas of best execution policies, regulatory compliance, cost of market data, and IT operations.

References

- Proposed Rule on Market Data Infrastructure https://www.govinfo.gov/content/pkg/FR-2020-03-24/pdf/2020-03760.pdf

- Reg NMS https://www.sec.gov/rules/final/34-51808.pdf

- Exchange Data Feed Latency Flow Map https://twitter.com/nanexllc/status/666765458868170752

- Costs of the Decentralized Consolidation Model Pertaining to Competing Consolidators, SEC Proposed Rule on Market Data Infrastructure

- Notice of Proposed Order Directing the Exchanges and the Financial Industry Regulatory Authority to Submit a New National Market System Plan Regarding Consolidated Equity Market Data https://www.sec.gov/rules/sro/nms/2020/34-87906.pdf

Rumman Iqbal, Consulting Partner, Wipro

Rumman Iqbal is a Consulting Partner at Wipro focused on Business & Technology Consulting in the Securities and Capital Markets practice. Rumman’s area of interest include Market Structure, Post-trade Services and Regulations.