Why have the equities markets – and equity trading venues in particular – been among the last to employ some of the most exciting, promising new technologies introduced in the last 25 years? With the rapid advancements in technologies like Artificial Intelligence, Machine Learning, cloud computing, etc., why has no one redefined the equity trading markets around any of these technologies?

AI is well suited to disrupt the status quo in equity trading venues because of its particular – and unique – market structure: readily measurable performance, well-defined investor objectives, a large number of transactions, highly commoditized nature of current platforms and its history of accepting technological disruption. These characteristics make now the time to bring advanced technologies like machine learning to equity trading venues. Its time for a smart venue.

Focusing Venues on Investors Objectives

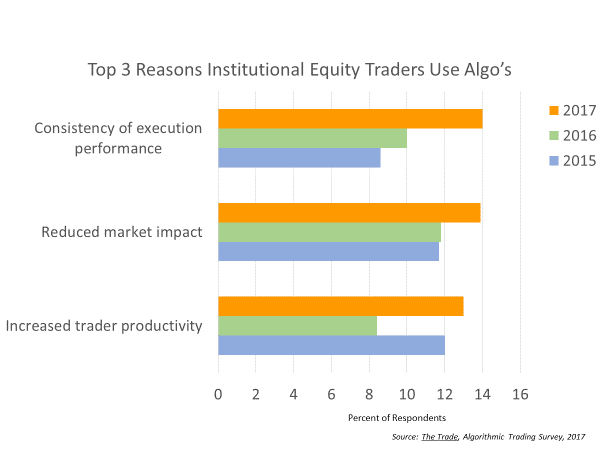

Its time to align the liquidity pools with institutional investors trading objectives. So, why arent these objectives already aligned? The Trade Magazine answered this question last year when they asked institutional equity traders their reasons for using algos, which is a direct reflection of what is most important to those traders. As shown in Exhibit 1, When executing trades with their brokers, the top three objectives traders cited were:

1. Consistency of execution performance

2. Reducing market impact

3. Increasing trader productivity

While the top three objectives have always been important for traders, each of these top three objectives have increased in importance in the last three years.

Reducing market impact has been at or near the top of these objectives in each of the last three surveys, while Consistency of execution performance has grown the fastest in importance and taken the top spot in the most recent survey. The venues, however, have not systematically focused on these objectives – modern AI now makes it possible.

Using AI to meet investors objectives

In light of the survey results in Exhibit 1, for buy side head traders the question now becomes, How do I reduce market impact, in a consistent fashion, and increase trader productivity at the same time? Could part of the answer lie in finding a venue that has the same objective and uses advanced technologies to achieve that objective? An efficient market engineered to minimize market impact?

One firm has set out to create such a marketplace. Imperative Execution was founded in 2016 by a team of former traders to design venues that are engineered to be aligned with investors objectives. Its mission directly addresses the top three objectives of institutional traders cited in Exhibit 1. Imperative Execution recently launched its first venue, IntelligentCross (IC), the first equity ATS powered by AI explicitly designed to meet the most important objective for institutional investors: reducing market impact.

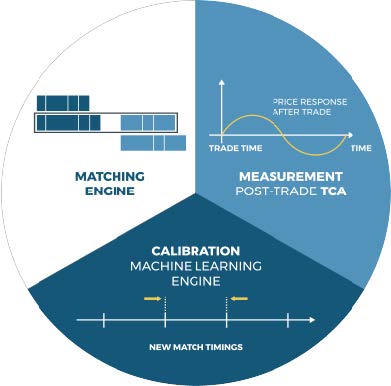

What makes IntelligentCross intelligent is its ability to measure its own performance in real-time and use an AI-assisted matching logic to minimize post-trade market response – a key Transaction Costs Analysis (TCA) objective for institutional investors.

What does it mean for a venue to use AI? Traditionally venues just matched orders using a pretty basic rule-set – triggered by order arrival and price changes. Matching towards a trading objective requires a smarter system – a closed loop process that measures-optimizes-calibrates matching based on data – a learning system. As shown in Exhibit 2, IntelligentCross is the first venue to employ this AI-assisted method to optimally schedule matches to minimize market impact. In other words, it learns from the market response to its own prints – an objective measure available to everyone. IntelligentCross runs a near-continuous matching process, matching every few milliseconds, with match frequency calibrated per stock. Its ML system aims to match as often as possible, while keeping the ripple effect after the print close to flat line. To the user – and the market at large – IC works like a traditional venue that any algo can use automatically, while optimizing towards what the trader is trying to achieve.

This is a great example of what AI at the venue level can offer to equities trading – working to improve performance, in the ever-changing market conditions, stock by stock, day by day, without requiring a change in the trading process.

The future of financial markets is now

With the rapid proliferation – and validation – of AI, machine learning, and so many other innovative technologies, it was only a matter of time before smart venues emerged. To understand what the future holds for the use of these advanced technologies in financial markets, its important to look at the history of technology in financial markets.

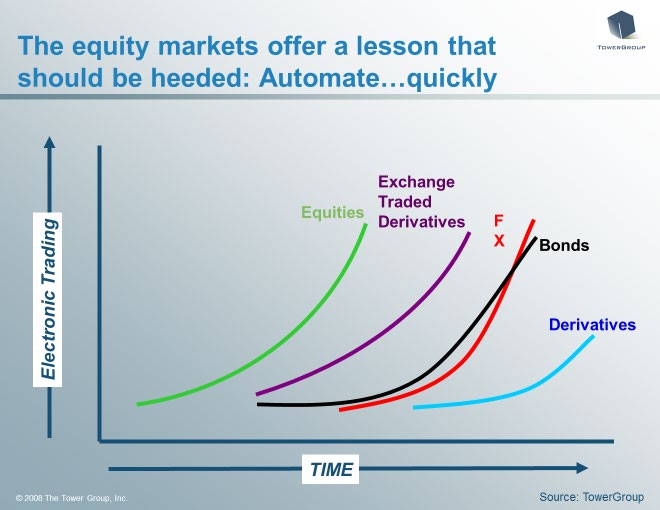

We need to go back into the archives to demonstrate just how far trading marketplaces have come…and just how far they have to go. As shown in Exhibit 3, I published a report in 2007 on the automation of markets which illustrated how the equity markets led the charge when it came to the electronification of markets. We can see that the equities markets led all other markets, both in when they began automating, as well as how quickly they adopted electronic trading.

Suffice it to say, despite the many incremental technological advances in the equity markets in the prior decade, theres been relatively little real technological innovation in the equity trading process…until now. Because machine learning techniques and methods are just now becoming mainstream in financial services, its time once again for the equity markets to benefit from these advancements,and lead the way on innovating all the financial markets in their adoption of advanced technologies, starting with smart venues.