There is one thing still missing from the data debate-and thats data.

The author of arecent op-edin Canada made the comment that rise in data fees has …a significant bearing on …net investment returns.

Thats a big claim, sadly without any supporting calculations, which is symptomatic of much of the current data debate.

How big are mutual funds?

Before we get into cost math, we need to understand how big mutual funds are, and how much they trade.

ICIdata shows that equity mutual funds represent 52% of the $17 trillion in U.S. mutual fund assets, or$9.5 trillion. They also report that mutual fund turnover has fallen to just 32% (per side). That equates to trading of$5.9 trillion per year (buys and sells).

In contrast, the whole U.S. equity market trades $70 trillion per year. Thats$140 trillion(buys and sells).

Although it seems hard to believe, this puts mutual fund trading atless than 5% of market-wide activity. Thats in line with some estimates of retail trading.

What are the different costs to investors?

Lets first be clear: The results below dont suggest costs are bad for investors. Managing investments is not cost free; even those low priced index funds need a portfolio manager, custodian and accountants to calculate year-end distributions. For those investing with an advisor, it pays to ensure you save sensibly and have a secure retirement. And with a reported$27 trillioninvested in U.S. equities directly and via mutual funds (see below), simple math means small charges can add to large notional values.

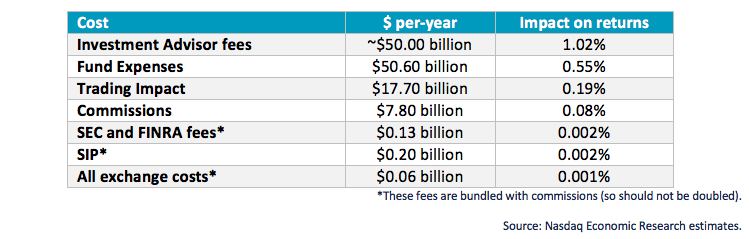

When thinking about costs, we look at five major types of costs: Investment Advisors, Mutual Fund Expenses (MER), Trading Impact, and Commissions and Regulatory (SEC and FINRA fees). To address the claim above, we also look at Exchange costs and costs for the Securities Information Processor, which we highlight are bundled into MER and Commissions.

Looking at all of these, it certainly puts exchange costs in context, and hopefully encourages a more data-driven debate. Even looking at grossed up costs (Chart 1), Exchange and SEC fees are a small part of the total equation. This is especially noteworthy considering the important role of exchanges in bringing companies to market, regulating the market and supervising trading, which provides the returns that help secure the retirement of U.S. workers.

When allocated based on turnover (below), the inherent cost or impact on investors returns is even smaller.

Chart 1: Estimated total revenues and investor costs across U.S. equities

Not all the data for this chart is freely available. Here is how we estimate it:

- Management Expensesare probably the largest cost to investors.ICIreports average expense ratios have fallen to 0.55% in 2018. Based on other ICI data that suggest U.S. equity mutual funds are $9.2 trillion, which adds more than$50 billion in costs to investors.Note that management expenses usuallyincludethings like SIP data costs, EMS and terminal costs, although soft-dollar agreements may pay these out of commissions. For completeness, industry-wide professionalSIP user coststotal around$0.2 billion per year.

- Investment Advisor fees: Otherdatashow S. households hold more stock in their own account ($17 trillion) than mutual fund holdings. However, these investors often also pay an investment advisor to assist them manage their assets. Data on industry revenues from U.S. equities ishardto find, but typical fees arereportedlyaround 1% per-annum on assets, so revenues could easily be the around the same as the cost of managing mutual funds:$50 billion.

- Market Impact costs: There isestablished literatureabout the fact that thattrading causes market impact, with aTransaction Cost Analysis (TCA) industrythat has developed to measure and manage it. Its simple economics really. Buying (or selling) large quantities of a stock adds to demand (or supply) which moves prices up (or down), sometimes permanently. Interestingly, its generally reported thatimpact costs have been fallingfor decades. RecentITG estimatesimply average shortfall costs in the U.S. of 30 basis points (bps) per trade. Wed highlight thats lower than any other country ITG measures, which speaks to how well the U.S. market works. But even then, on $5.9 trillion of trading, that adds up to almost$18 billion.U.S. Equity Commissionswere reported recently byGreenwich Associatesat$7.4 billion. Equity commissions are bundled, and include a number of other expenses including net exchange fees, broker technology costs, settlement costs and even research.

- SEC fees: SEC fees are reportedly around $2.3 billion and FINRA also charges brokers around $1 billion per year. Allocating these costs across the industry by value traded (see below) results in acost to mutual funds of around $0.13 billion, which is also a rounding error on investor returns.

It is also possible to estimate some of the components that are included in the $7.4 billion of bundled U.S. Equity commissions.

- The sameGreenwich Associatesstudy estimated around$4 billionof commissions was for research, or roughly around 50%.

- Extrapolatingour own study, all-in-exchange costs look to be around $1.5 billion. However based on trading levels below, the allocation to mutual funds would beless than $0.065 billion. The rest is incurred by other participants, from hedge funds to arbitrageurs and proprietary traders.

How much do those costs affect investor returns?

So, back to the original question: How much do these costs affect investor returns?

Remember thatICIdata showed U.S. mutual fund assets are around$9.2 trillion.Also remember that for industry-wide costs, allocations to investors will be less than 5% based on their contribution to value traded (see * in table below). Doing some simple math, Table 1 shows the estimated impact on returns from each of the investor costs weve discussed.

Table 1: Estimated impact of costs on investors returns

One thing seems clear. Exchange costs are not a significant drag on investor returns. Some would say they arent even a rounding error.

Authors note: Data and transparency on this side of the debate can be difficult to find as well. Weve estimated accurately, but stand ready to update our statistics with the disclosure of new data.