Outsourced trading (OT) might have reached a tipping point where it’s no longer a niche service, based on the recent Coalition Greenwich study of asset managers.

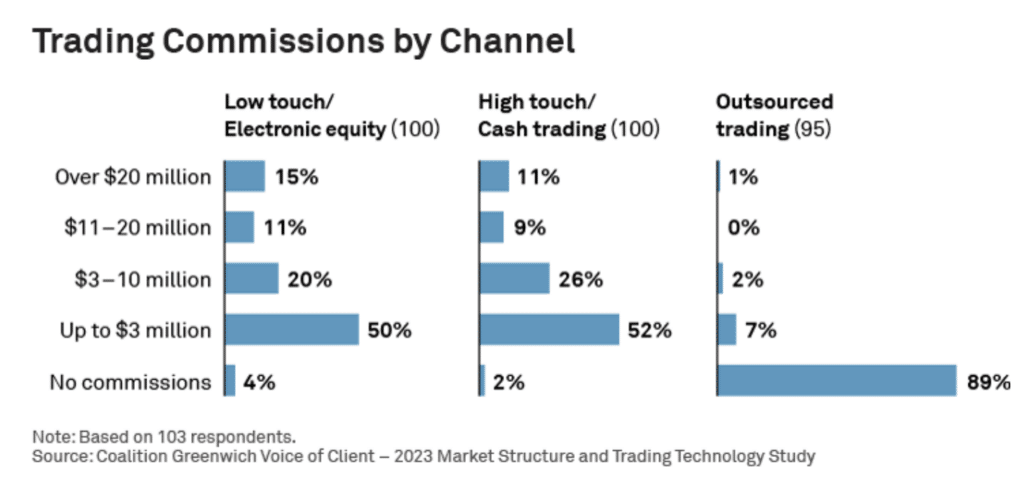

Based on responses from 103 buy-side equity traders globally in the fall of 2023, the study found that 7% of respondents paid commissions to OT providers ranging up to $3 million, while 3% paid more.

“This finding may raise eyebrows, as the buy side has traditionally been hesitant to admit to using such providers due to concerns about cannibalization and compatibility with best execution requirements,” Jesse Forster, Senior Analyst, Market Structure & Technology at Coalition Greenwich, said in a blog post.

While OT was initially designed for emerging hedge funds, he said, Coaltion Greenwich has spoken to several large and well-established managers who have also embraced the idea.

“They use it to gain access to liquidity, research and market intelligence that they might not have internally or through their traditional sell-side providers,” Forster said.

“We help them see what they don’t see on their own,” one outsourced representative told Coalition Greenwich.

According to Forster, this sentiment was echoed by a buy-side head trader, who praised the ability of outsourced providers to offer access to extra sell-side research that’s out of reach directly. Their desk views outsourced providers as an execution broker who gives them access to desired research.

Nevertheless, not everyone is convinced, Forster said, citing one independent outsourced head who was particularly offended, stating they would never try to disintermediate brokers by distributing research to non-paying buy-side clients: “We’d be foolish to compromise a sell-side relationship.”

Forster further said that the concept of trading discretion often comes up when talking about OT.

He mentioned one buy-side head that called it “the most perishable thing” and wondered how outsourced desks could preserve the flexibility of discretion the way only internal desks can.

“Other traders agreed, arguing only in-house traders, in continuous contact with their portfolio managers, can build real relationships and earn discretion around how they trade their orders,” Forster noted.

Perhaps surprisingly, he added that one outsourced trading executive agreed, saying they’d rather face off with an internal trader (rather than portfolio manager) who can shepherd investment information throughout the day to the investment team: “We become a lever and empower them, providing a path to information and liquidity.”

Forster argued that with over 40 firms claiming to offer OT services, the buy-side is now faced with a “daunting array of choices”.

“It’s an omnivore’s dilemma—many options may look appealing, but it’s hard to know which one will truly satisfy their needs,” he said.

Forster mentioned one provider that noted their niche has become institutionalized, but that doesn’t mean all platforms are created equal.

“Many newer entrants may struggle to gain traction—building relationships with the sell side takes time and effort,” he said.

“Several successful platforms pointed out that it’s not just about having the budget for technology; it’s about having the scale to hire top talent,” he added.

Forster stressed that there’s a “chicken-and-egg problem” here as well.

“Providers need scale to attract and retain quality traders, but they can’t offer competitive compensation without that scale,” he said.

“As one outsourced provider put it, “It’s easy to say you’re in the outsourced trading space, but it’s incredibly hard to scale and succeed,” he added.