There’s been a lot of noise around the market structure reforms proposed by the SEC in December 2022, according to Ronan Ryan, Co-Founder and President, IEX Exchange.

Earlier this month, IEX Exchange surveyed over 200 institutional investors on the SEC’s proposed updates to Reg NMS.

“As the Investor’s Exchange, we thought it was important to hear from investors themselves instead of those servicing the market, so we surveyed a mix of institutional investors that represent pensions, hedge funds, mutual funds, and endowments,” Ryan told Traders Magazine.

In December 2022, the SEC shared four proposals to update U.S. equity market structure:

1. Regulation NMS: Minimum Pricing Increments, Access Fees, and Transparency of Better Priced Orders

2. Disclosure of Order Execution Information

According to Ryan, of these four proposals, the Regulation NMS proposal most directly represents an opportunity to update the rules of the current national market system to make the stock market more transparent and competitive for investors.

“We’ve heard a lot about retail investors’ take on the proposed reforms, but institutional investors like the ones who manage Americans retirement plans are often forgotten about in this conversation, and we felt their perspective is an important one that should be heard,” Ryan said.

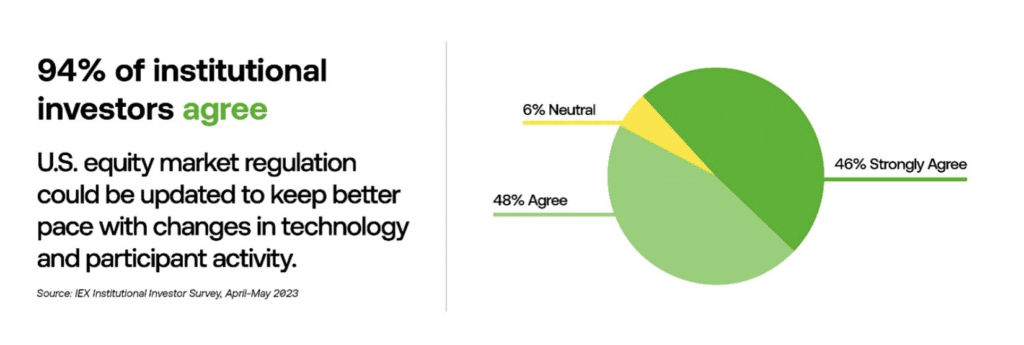

Overwhelmingly, the survey showed that institutional investors agree that U.S. equity market regulation could be updated to keep better pace with changes in technology and participant activity.

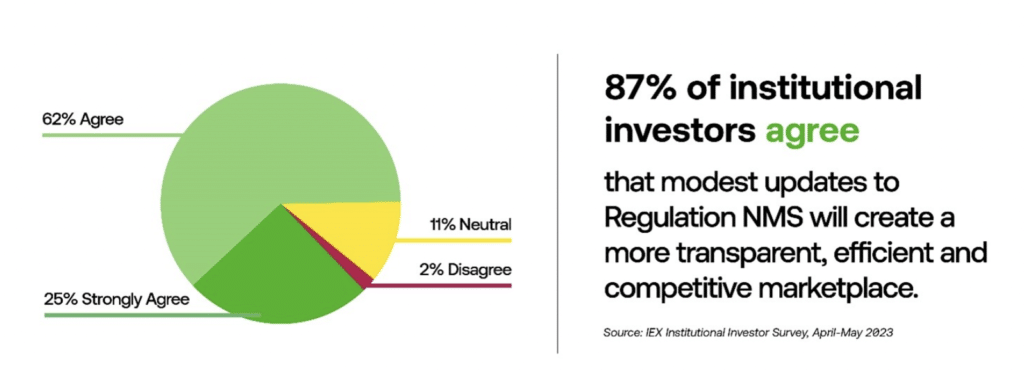

With 87% of respondents understanding that most updates to Regulation NMS will create a more transparent, efficient, and competitive marketplace.

“If you dig a little bit deeper on the various components of the Reg NMS proposal, like tick sizes, you see that the support for reform continues,” said Ryan.

Reg NMS was first introduced in 2005 and the markets have changed dramatically since that time, he said.

“It just makes sense that the rules be updated to reflect those changes,” he added.

According to the findings, 94% of institutional investors surveyed agree that U.S. equity market regulation could be updated to keep better pace with changes in technology and participant activity.

As part of this new Reg NMS proposal, the SEC has proposed narrowing this quoting increment for symbols they define as “tick/quote constrained.”

The SEC has proposed three new quoting increments in addition to the current penny wide increment: 10th of a penny (10 mils); 5th of a penny (20 mils); 1/2 penny (50 mils); and 1 penny (existing).

The survey revealed that 77% of institutional investors surveyed agree that the reduction of quote sizes from 1penny to 1/10 penny (10 mils) for select stocks would go too far.

According to IEX Exchange, the majority of exchange trading volume (over 85%) trades on exchanges that charge the maximum 30-mil fee – but technological efficiencies have changed the economics and exchanges now pay most of it back as a rebate to incentivize order flow.

Contained within the Reg NMS proposal is a recommendation from the SEC to reduce this access fee cap to a new maximum of 10 mils.

According to the findings, 75% of institutional investors agree that exchange rebates are not a deciding factor in their decision on where to route their orders, and that routing is left for their broker to decide.

In addition, 83% of institutional investors would be in favor of a simple access fee cap structure that would have a uniform 10 mil fee cap for all symbols (reduced from the current cap of 30 mils).

Further commenting on the findings, Ryan said: “I think we were prepared that those we surveyed would be supportive of the proposed changes, but the margins for approval—especially on access fee reduction (83%) and tick sizes of ½ penny (74%)—were much wider than we expected.”

“After seeing these results, it’s increasingly difficult to make the case that institutional investors don’t support the proposals. So, if firms are still actively against the reforms, you have to wonder what their motives are exactly,” he stressed.

Ryan said that IEX Exchange has a decade-long history of protecting investors by combining a transparent business model with innovative design.

“We’ve also been vocal about how market structure can help accomplish these goals—making markets fairer, more competitive, and more transparent,” he said.

“Much like the institutional respondents to our survey, we are generally supportive of the Reg NMS reforms proposed by the SEC, with some suggested adjustments as outlined in our comment letter,” he added.

Reducing price increments for tick-constrained symbols to half-penny increments, as well as reducing the exchange access fee cap will create more transparent, efficient, and competitive marketplace, Ryan said .

“The SEC has clearly signaled that its overriding goal in proposing the reform is to better serve the investing public, and we strongly agree that this must be the guiding purpose of the proposed reforms,” he concluded.