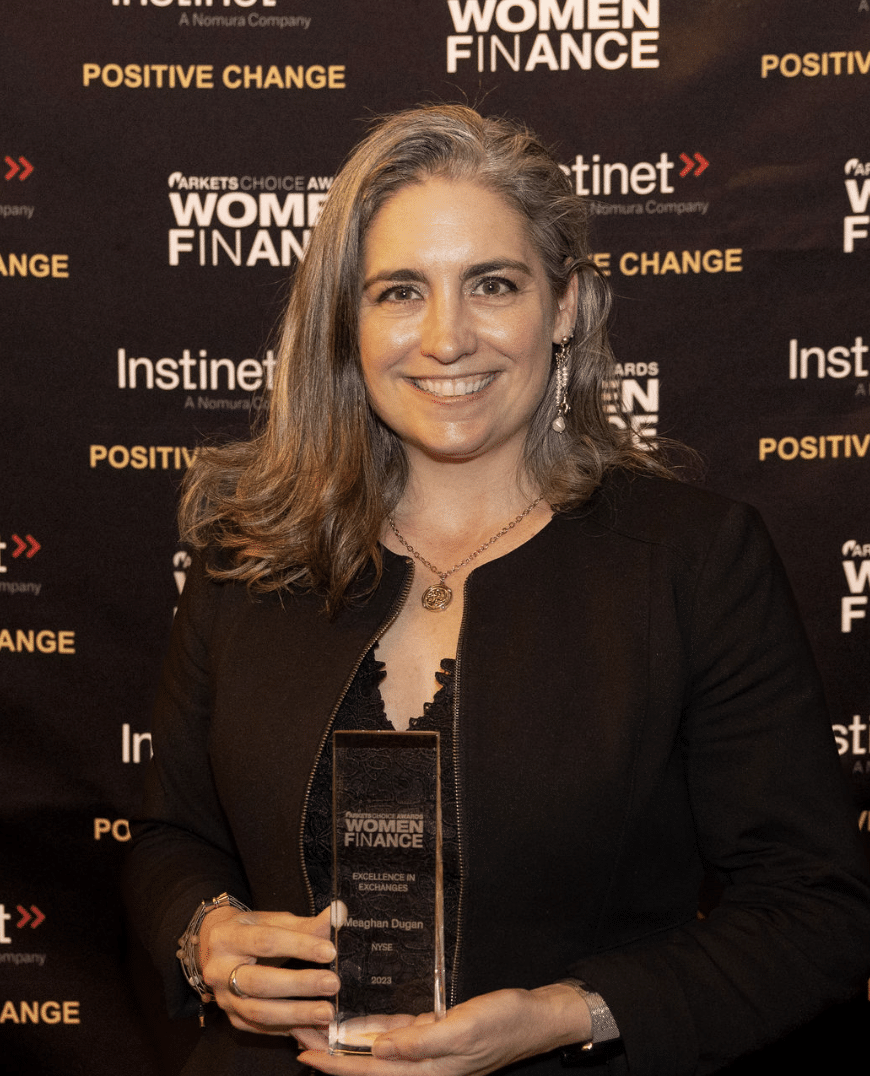

Meaghan Dugan, Head of Options at the New York Stock Exchange (NYSE), won Excellence in Exchanges at Markets Media Group’s 2023 Women in Finance (U.S.) Awards.

How would you describe your work/management ‘style’?

When I was growing into my career, I noticed that the most successful senior managers lead by example and from the heart. Since then, I have adopted these characteristics in my own way. For our work, I demand and set high standards each day, but it is also vitally important to be empathetic and caring. No one person has all the answers, so I take a collaborative approach to help drive innovation.

What is your greatest professional achievement?

When joining the NYSE, I knew my primary goal was to help bring our two options exchanges — NYSE American (Amex) and NYSE Arca — to our latest technology platform, NYSE Pillar. In early 2020, Covid brought new challenges but also an entirely new dynamic to working and collaborating across teams. In July 2022, we were able to seamlessly launch NYSE Arca onto Pillar. This was a huge accomplishment across all teams at the NYSE and the industry, as Arca remains the top exchange by volume! Then, just last month, we were able to successfully bring NYSE Amex onto Pillar. These two migrations have been my greatest professional achievements to date as they challenged many different skills, from collaboration and communication to innovation. We worked closely with our customers throughout both migrations with integrity and professionalism. Without the input of our members and our commitment to working together, we would never have been able to achieve this large goal. I am proud to have had such an incredible experience and am grateful for our deep client relationships.

What’s something you’re really proud of and why?

Early in my career, which began with no prior market experience, I encountered many challenges and roadblocks. The options trading floor where I worked in the late 90’s in San Francisco was packed with traders whose primary purpose was to provide liquidity to large institutional-sized orders. This was a fast-paced environment where it was far from easy to learn while still keeping up. I began as a clerk and then became a market maker, requiring me to understand the complex dynamics of options trading under extreme market conditions. Learning to be an options market maker and specialist were not the only challenges. Navigating major industry changes with new exchange entrants and new trading rules really began to reshape the industry into a more electronic, technically driven market. Looking back at this today, I am very proud of staying the course and learning to trade options while embracing the new technology that was beginning to reshape the industry.