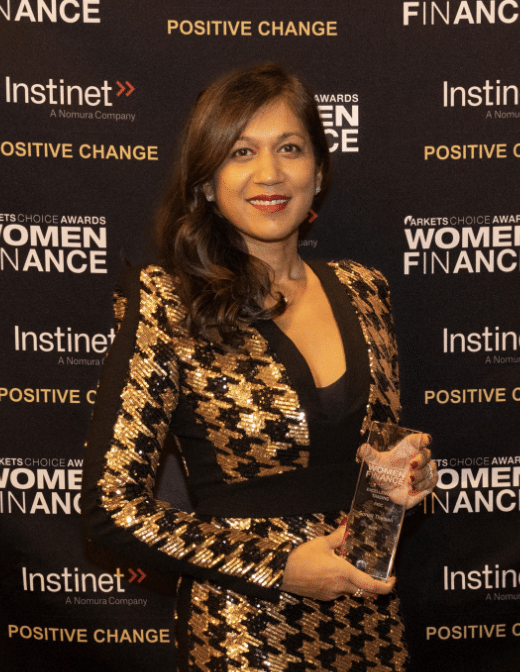

Sonali Theisen, Global Head of FICC E-Trading & Markets Strategic Investments at Bank of America, won Excellence in Trading – FICC at Markets Media Group’s 2023 Women in Finance (U.S.) Awards.

What FICC trading trends do you see?

Fixed Income markets of all profiles continue to incorporate analytics and technology into the investment process, for both scale and efficiency. Investors seek on-demand liquidity in a range of market conditions. Given the larger AUMs and outstanding market notionals in recent years, there is an ongoing focus to leverage data and technology to recycle risk efficiently. To that end, FICC ETFs and portfolio trading continue to grow in importance, and FICC automated market-making strategies are becoming more sophisticated. Algos have proliferated as the world becomes more data-driven. At Bank of America, we are building a quantitative overlay to virtually every business—whether or not it is “e-traded” on a venue. We expect this trend to continue, and we work hard each day across the franchise to be at the forefront of innovation.

What’s something you’re really proud of and why?

I’m so proud of the team that we have built at Bank of America. In our Fixed Income Electronic Trading and Markets Strategic Investments groups, we have backgrounds from across the globe and multiple asset classes, spanning the disciplines of trading, sales, quant research, technology, investment banking, legal, and journalism. These rich and diverse perspectives allow us to serve our Global Markets business and our clients in the most comprehensive and collaborative way. The team is entrepreneurial—I am amazed by depth of expertise and networks each member brings to the table, which drive many important contributions. On a broader scale, I see the great talent we are able to attract to our firm and I love supporting these efforts, particularly through our women’s network (WLC) and as a sponsor of one of our Black and African American networks (DEAL). I am grateful to our leadership for its deep commitment to bringing together top talent from all backgrounds. And I think our team is an excellent example that this is both the right approach and great for business results.

What’s your advice to the next generation of women in finance?

Though I’m not a particularly patient person, I’ve come to realize that most important journeys are marathons, not sprints. To best prepare for a fulfilling and successful career, I believe it’s important to outline an informed long-term vision for one’s market, while being open to challenge and revision in order to build consensus around the direction of travel. If this vision can serve as a guiding star to drive strategic initiatives with conviction, it becomes easier to withstand setbacks and recalibrate. It is important not to get discouraged or retreat when things get tough. In hindsight, I recognize that hard times have also been great catalysts for professional growth. Finally, it is infectious when someone approaches their work with enthusiasm and passion, which often spurs positive momentum within an organization and even the industry. “Energy is contagious, make yours worth catching!”