Seth Merrin, founder, chairman and chief executive of institutional dark pool Liquidnet, has joined Neuravest Research, which uses artificial intelligence to construct portfolios for institutional investors, as he believes the asset management industry is at an inflection point.

Merrin is taking on the role of executive chairman at Neuravest. Liquidnet, which he founded in 1999, was acquired by interdealer broker TP ICAP and Merrin stepped down on March 24, after the deal closed.

He told Markets Media: “There is no question in my mind this is the only way that assets are going to be managed in the next few years. We are the first to market with a very sophisticated offering and have first mover advantage.”

Neuravest is a successor company to Lucena Research, a data validation and predictive analytics company co-founded in 2014 by chief executive Erez Katz.

Katz told Markets Media that rebranding to Neuravest in February 2021 is part of the new direction of the company and made sense in the context of the new partnership with Merrin.

“We have built a platform that validates critical data for investment decisions that has run successfully for almost eight years,” added Katz. “However, we lacked scale and Seth brings a lot of experience and market understanding on how we move to the next level and transform ourselves to a global player.”

Predictive data

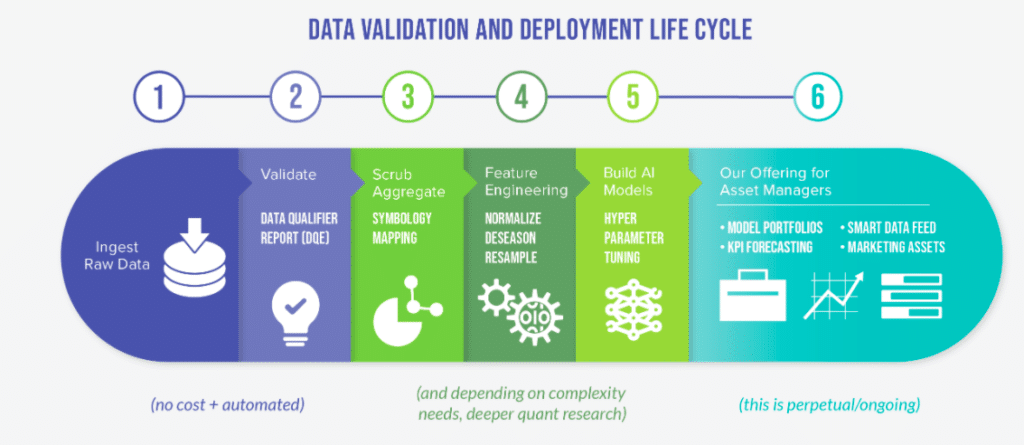

Neuravest partners with alternative data providers, currently 37, and its AI-driven proprietary technology can assess the predictive qualities of their dataset. If the data is suitable, it can be used to contract model portfolios.

Katz said: “We have the ability to ingest data from multiple sources very quickly and determine if it is predictive. The worst thing for asset managers is to use data that is not going to provide the value that is promised.”

For example, in June 2020 the firm partnered with Benzinga to evaluate whether an AI approach to news feed sentiment is predictive for active investment and to generate an aggregated score by ticker per day.

“In addition, we have incorporated a special algorithm to enable us to carry forward sentiment over time into the future, added Katz in a blog. “In other words, a news article can still hold value for days to come.”

Neuravest said on its website that the average annual return of return for a long only portfolio based on Benzinga’s financial news sentiment is 28.89%.

Asset managers can use the constructed model portfolios from Neuravest or combine a variety of datasets to build their own strategies – for example social media sentiment, consumer spending and corporate earnings.

“You combine them together to create best of breed multi-factor models that can predict the outcome of a stock or an asset that we have in our platform,” Katz added.

He continued that Neuravest looks for the best unique dataset in each vertical, such as environmental, social and governance, rather than duplicate sets of the same kind of data.

“There is increasing interest from our customers for ESG as well as related providers,” said Katz. “We are looking to find the best E, the best S and the best G so we provide best of breed.”

Neuravest mainly focuses on US and international equities but has recently added other asset classes including commodities and foreign exchange.

Transforming active management

Merrin added that he believes in active management but the only way forward for the industry to achieve returns is to use technology to manage assets – as humans cannot keep up with the amount of data being created and the growth of computational power.

“You either stay with a horse and buggy or you go with the car and that shift is taking place,” said Merrin. “Some people will not be sure whether the car is going to be better than the horse and buggy but in a few years you look back and it’s pretty clear.”

Only half of active funds outperformed their passive rivals during the sell-off and recovery of 2020 according to Morningstar. The funds data provider said in a report that just 25% of active funds did better than their tracker counterparts over 10 years. In addition, in US Large-Cap Growth Equity, no active funds beat their passive counterpart over a decade.

“Active management has underperformed for a very long time,” Merrin said. “Passive management has outperformed but it is a static model and the world is quite dynamic. If you have information and computational power you can have the best of both worlds.”

He described asset management as reaching an inflection point due to the massive proliferation of data being created and the maturation of artificial intelligence technology.

Merrin said: “In the same way as you wouldn’t use an accountant that writes on paper, this is the technology and type of data that every asset manager has to consume and for most firms this is not their core competency.”

Opportunity

Katz declined to give the number of clients or assets under management using Neuravest’s technology.

He said: “The pipeline has blown my expectations even though we just relaunched the company. I expect we are going to handsomely exceed our projections for the year.”

Over the next twelve months Katz expects Neuravest to expand globally. Katz continued that there have been forecasts that active assets under management will reach $10 trillion by 2025.

“This technology has been around for years for a few very large hedge funds but this the first time the mid-tier and upper-tier asset managers will have access,” he said.

Neuravest is putting its own capital to work within its thematic portfolios and providing customers and prospects full transparency into how the underlying portfolios perform with real capital in live market conditions and Merrin is also investing his own money in the portfolios.

Merrin said: “Do you remember the commercial when the guy said he liked the Remington razor so much that he bought the company? Well, I liked the company that much.”