Fredric Tomczyk, the new chief executive of Cboe Global Markets, said his three priorities to strengthen the group and enhance shareholder value are strategic focus, effective allocation of capital and developing talent and management succession.

Tomczyk said on the third quarter results call on 3 November that he has been very close to the strategy as the group has expanded and into a global derivatives and securities network as a Cboe board member for the last four years.

“While I wholeheartedly supported Cboe’s strategic direction, I see an opportunity to redefine this strategy to provide a clear focus on the core elements of our business that drive revenue and earnings growth,” he added.

He explained the current strategy is too broad and it needs to focus on a good organic strategy. In addition, a good strategy has to be built by the management team and reviewed and approved by the board so there is a common frame of reference based on secular and cyclical trends.

“I recognise that the EBITDA on margins have been falling in the last three or four years and I think we want to stabilise that trend and start to turn it round in the future ,” said Tomczyk.

He believes that the best use of capital is to invest in organic initiatives, which have had some good returns and will continue to be a focus. In addition, Cboe needs to pay a regular dividend and has been paying down floating rate debt as interest rates have been rising.

“You should expect less M&A going forward and a more focused M&A strategy,” Tomczyk added. “We are going to focus on making sure our strategy is tight, we are all on the same page and that the organic growth strategy is what we want it to be..”

Dave Howson, global president for Cboe Global Markets, said on the call that the group’s strategic growth priorities are derivatives; data and access solutions; and digital assets, and there have been important leadership changes to further support the global growth strategy.

In October Cboe said Catherine Clay was appointed to the new role of global head of derivatives. She oversees the business which includes futures and options markets in the U.S. and Europe, as well as a suite of globally traded proprietary products, including the S&P 500 Index (SPX) options and VIX franchises. Clay was formerly global head of data and access solutions and she was replaced by Adam Inzirillo, previously head of North American equities.

Howson said: “By aligning our organisational structure to the global nature of the business we anticipate harnessing the full strength of Cboe, increasing efficiency and collaboration across business lines and regions, while enabling us to better deliver world class products and services in a globally consistent manner to our clients.”

Cboe Digital

In June this year Cboe Clear Digital received approval from the Commodity Futures Trading Commission to launch margin futures contracts. Before the approval Cboe Digital could only offer fully collateralized trading and clearing of Bitcoin and Ether futures, which require customers to pay the full amount of a futures contract upfront. Margined futures are more capital efficient as customers only have to post a percentage of the contract value as collateral.

Howson said Cboe is working with customers and the CFTC on final preparations for the planned launch of margin futures in the first quarter of 2024, subject to regulatory approval.

“CBOE Digital will be the first US regulated crypto-native exchange and clearing house to offer spot and leveraged derivatives on a single platform,” he added.

Tomczyk said the world has changed since Cboe acquired ErisX, which has become Cboe Digital.

“We want to see how our digital business does as we launch margin futures,” added Tomczyk. “It’s clearly an asset class that does not have the trajectory it used to have but we believe our strategy was right in terms of putting that asset class into trusted markets.”

Howson continued that the firm is excited about the launch of margin futures and has had great engagement from customers and future clearing merchants (FCMs), with more crypto derivatives products in the pipeline.

“Cboe Digital is unique because it has spot and margin futures on the same technology platform, under the same regulatory framework and both spot and cash settled margin futures can be traded with the same connection so unique value is being added,” added Howson.

In addition, Howson argued that Cboe will benefit if the Securities and Exchange Commission approves spot bitcoin ETFs next year. Cboe is supporting eight ETF issuers and has surveillance agreements with five.

“When those ETFs come to market, not only do we get to list those products and have the trading, but the ecosystem that we have with a regulated exchange and clearing house will support authorised participants and market makers,” he added.

Options

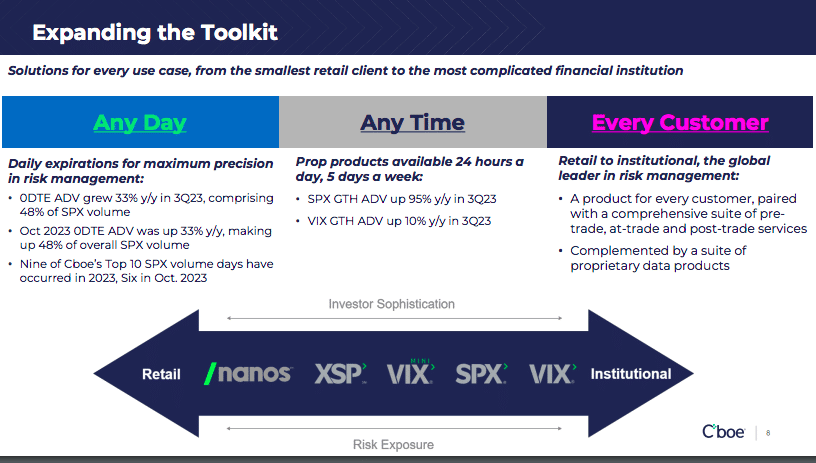

Within the S&P 500 Index (SPX) option suite, the fastest growing segment continued to be the zero day to expiry options, where average daily volume grew 33% year-on-year in the third quarter to comprise 48% of SPX volume.

“The diversity of use cases is where we expect to see strong and sustained volume in zero day to expiry options, regardless of what the market is doing, or where the VIX is trading,” added Howson. “These options have opened up a whole new risk premium for investors to capture, namely intraday risk.”

However, Howson stressed that although it’s important to note that while zero day to expiry options have become a bigger part of the pie, the pie itself is also growing. SPX volume surged 21% to a record add of 2.9 million contracts in the third quarter. Nine of Cboe’s top 10 SPX volume days have occurred this year, with six in October. He believes that bonds are being used less to diversify from equities and investors are increasingly turning to options for hedging.

There was also strong global demand for options, with average daily volume during global trading hours increasing 95% and 10% respectively, year-over-year.

“We have seen an increase in institutional engagement as more funds and strategies have been set up to trade this incredibly balanced ecosystem,” said Howson. “We see that sustainability persisting because it has continued over the last 18 months through different market cycles and volatility regimes.”

Cboe and S&P Dow Jones Indices have also announced plans to launch the Cboe S&P 500 Dispersion Index and four new credit volatility indices.

“Early market reception has been extremely favourable as each of these indices is designed to provide investors with key information to help them better manage their strategies and portfolios, potentially fueling further growth in our tradable products,” added Howson.

Cboe Europe Derivatives (CEDX) is also due to launch single stock options from 6 November 2023. Firms that have committed to supporting CEDX’s expansion into equity options include ABN Amro Clearing, Goldman Sachs, Morgan Stanley and Susquehanna International Securities. In addition, Interactive Brokers will become a direct trading participant on CEDX and a direct clearing participant for equity derivatives on Cboe Clear Europe, the group’s pan-European clearing house.

Howson said: “We plan to introduce liquidity provider and market maker programmes in the first quarter of next year, subject to regulatory approval. We see single stock options as a key milestone for our European derivatives initiative and our broader ambitions for creating the leading marketplace to manage risk around the globe.”

Financials

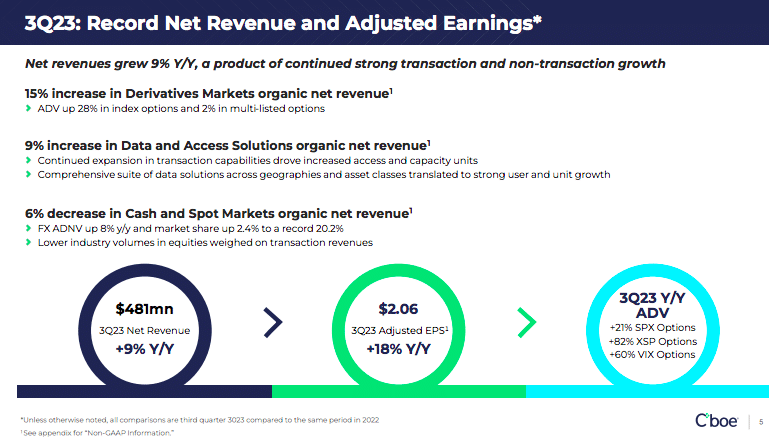

CBOE reported record net revenue for the third quarter of $480.5m, up 9% year-on-year.

The group reaffirmed guidance for the high end of organic total net revenue growth this year in the range of 7% to 9%, and the net revenue growth target of 7% to 10% for the data and access solutions business.

Jill Griebenow, chief financial officer and chief accounting officer, said on the results call that Cboe produced another quarter of strong earnings and record-setting net revenue and adjusted earnings results in the third quarter.

The derivatives business delivered a 15% year-over-year net revenue increase in the third quarter.

Tomczyk said the uncertain macro and geopolitical impact on markets globally led to investors and traders relying on Cboe’s suite of index options and volatility products to help manage risk and generate income.

“We believe our derivatives business remains incredibly resilient, supported by a growing customer base, and options products that are becoming increasingly recurring in nature as investors shift to shorter durations,” he added.

Data and access solutions’ net revenue increased 9% year-over-year, while cash and spot markets net revenue decreased by 6% which Cboe said was due to the challenging volume environment.