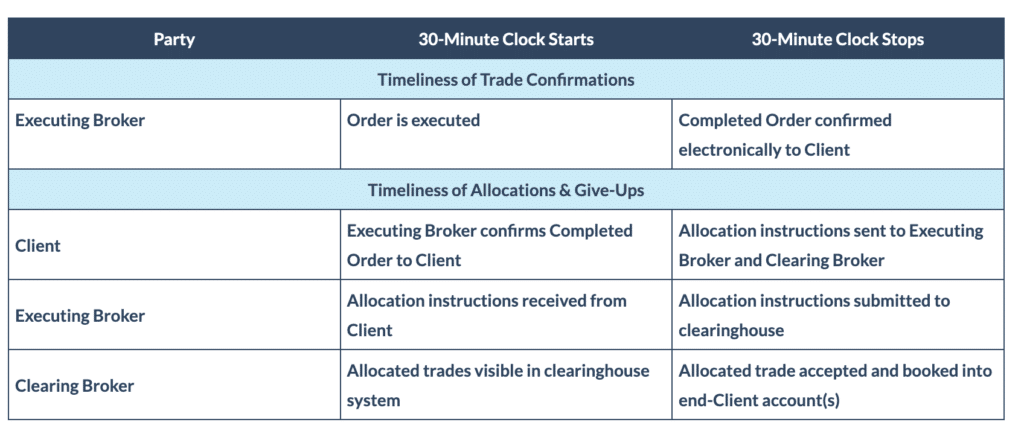

FIA and DMIST, the Derivatives Market Institute for Standards, have published the Final Standard for Improving Timeliness of Trade Give-Ups and Allocations, which defines start and stop points for the 30-minute clock from confirming orders to booking trades.

This is the first standard finalized by DMIST and an important milestone in its work to improve operational efficiency in futures trading and clearing.

The Final Standard on Improving Timeliness of Trade Give-Ups and Allocations is designed to improve the delivery and processing of allocation instructions by establishing 30-minute timeframes for completing steps in the allocation process.

It also defines metrics for measuring progress against the Final Standard.

Don Byron, Global Head of Industry Operations and Execution, FIA, said the vast majority of give-up transactions are processed in much less than 30 minutes.

“This Standard addresses the small percentage of trades that are not processed on Trade Day due to market inefficiencies and helps address processing problems that are magnified in periods of high market volatility and high volume,” he said.

According to Chris Edmonds, Chief Development Officer, Intercontinental Exchange, the 30/30/30 Standard is an example of how the industry identified an area that needed attention and worked together to create a solution.

“The 30-minute timeframes will help clarify a crucial period which falls between trades being executed and settled to make the post trade journey even more efficient and further reduce any potential for unnecessary risk to develop during periods of high-volume trading,” he said.

DMIST has also released a consultation paper on average pricing, which addresses the lack of consistency in average pricing functionality across central counterparties (CCPs).

This lack of consistency impacts the timeliness of give-ups and allocations and can require manual intervention.

Average Pricing is being used extensively because electronic trading technology allows firms to break large trades into many smaller-sized orders to minimize market impact.

Looking ahead, DMIST has begun working on standards for the reference data and other information that are attached to a trade as it moves through the trading and clearing workflow.

Clearing brokers often find that certain data and information have been deleted or truncated as the trade records move from firm to firm, and from system to system.

This can lead to delays in the processing of trades. A standard that clarifies which fields need to be populated as a trade moves from execution to settlement, and in what format, would reduce these delays and make the processing of trades more efficient.

Jeff Arnold, Chief Operations Officer, ABN AMRO Clearing USA, said the surge in volumes that began with the pandemic in 2020, along with a number of market-moving events over the past two years, illuminated the interdependencies of the global clearing market.

“The 30/30/30 proposal is a major step forward in supporting efficient markets while reducing clearing risks. The adoption of these timeframes will increase efficiencies throughout the lifecycle of an allocated trade,” he said.