FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura company.

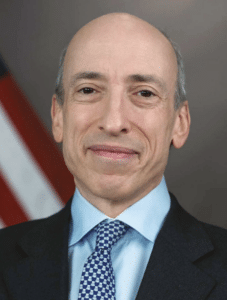

Last month, the U.S. Securities and Exchange Commission announced that Gary Gensler would step down from his Chair position on January 20, 2025.

The news came as no surprise, given that the SEC Chair role is a political appointment and January 20 just happens to be inauguration day, when Republican Donald Trump will take over from Democrat Joe Biden as US President.

Gensler started as SEC Chair on April 19, 2021, so his tenure will be three years, nine months and one day.

How does Gensler’s length of service compare historically?

The SEC has five Commissioners who are appointed by the President of the United States with the advice and consent of the Senate. Terms last five years; the Chairman and Commissioners may continue to serve up to approximately 18 months after terms expire if they are not replaced before then.

So an SEC Chair can serve as long as six and a half years — ish.

But they rarely go that long.

The shortest-tenured of the 33 SEC Chairs was G. Bradford Cook, who was sworn in on March 3, 1973 at the ripe old age of 35. Alas, Cook was caught up in a securities fraud scandal and he was forced to resign just 74 days later, on May 16, 1973.

The longest-serving SEC Chair was Arthur Levitt, who had the role from July 27, 1993 until February 9, 2001 – more than seven years. Levitt was known for his investor advocacy, but also took heat for not taking the opportunity to tighten certain corporate accounting rules when he had the chance.

The average tenure of the 32 SEC Chairs before Gary Gensler is a bit more than two and a half years. Gensler will have served about 50% longer than average when he steps down next month.

How will history view Gensler?

That remains to be seen, of course. For its part, the SEC said: “He led the agency through a robust rulemaking agenda to enhance efficiency, resiliency, and integrity in the U.S. capital markets. He also oversaw high-impact enforcement cases to hold wrongdoers accountable and return billions to harmed investors.”

Market participants and market operators would be less constructiv; many say Gensler has been a well-intentioned SEC Chair but his rulemaking has been excessive and even counterproductive at times.

But whatever side of the debate one falls on, it can’t be denied that Gensler maximized his time as Chair and served a vigorous term.