FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura company.

In March 2013 issue of Traders Magazine, there was an article focused on a Tabb Group study that found that almost half of the U.S. asset managers and hedge funds prefer to have separate order management systems (OMS) and execution management systems (EMS). The lack of consensus was a core finding of that report.

Fast forward nine and a half years, and we try to explore if there’s a clear direction on whether buy-side trading desks should keep management and execution of their orders in two separate systems or unify them in a single one.

Tom Whelan, Managing Director, Global Head of Instinet Technology Solutions, said there seems to be a sort of “pendulum” with regard to the demand surrounding the comprehensiveness of trading platforms.

“At times there is a trend toward “unified and comprehensive” – but then inevitably it seems, the market swings back the other way toward selecting an array of more individualized but “best in class” platforms,” he said.

Whelan said that the market is now on the swing back toward best in class.

“A “one-stop shop” may sound convenient, but what we hear from large clients is that this convenience is often short-lived. We aren’t seeing a wider adoption of unified systems, instead we’re seeing a focus on tighter integrations between the OMS and EMS providers,” he said.

“Delivering platforms that generate higher performance over the trajectory of many years has often proven to be more compelling to Institutional Investors’ ROI, versus having the one-time benefit of signing a deal with one single integrated vendor that may not offer the same level of performance and client experience quality across multiple platforms. That can end up being a “false economy”,” he added.

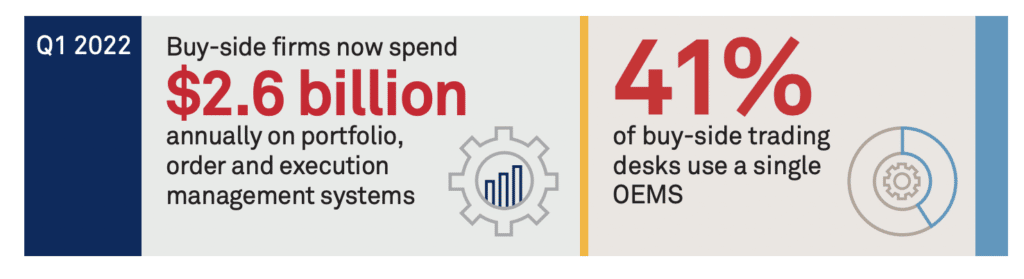

Nevertheless, according to a recent study by Coalition Greenwich, 41% of buy-side firms in Q4 2021 used a single OEMS, compared to only 30% the year before. “That growth came directly from those who had been using separate platforms, with 39% utilizing that approach currently, compared to 52% in 2020,” said Kevin McPartland, Head of Market Structure and Technology Research at Coalition Greenwich.

Moreover, according to the findings, 12% of respondents use a portfolio/order/execution management system (POEMS). “Combine that with OEMS users, and over half of equity-focused asset managers are working from a single screen,” commented McPartland.

The research also found several cases where users levered in-house OMS platforms that were then tightly integrated with a third-party EMS. “Not an OEMS by the strictest standards, but from the trader’s perspective, it feels much like a single system,” McPartland said.

Charles River, a State Street company, among others, now offers fully integrated OEMS. According to Kyle Pedrotty, PMI-ACP, Product Manager for Trade Automation at Charles River Development, maintaining separate EMSs alongside an OMS proves costly for asset managers and unproductive for their traders.

“Delays in staging and transferring orders between systems, with traders then engaged in swivel-chair between multiple trading screens, only to accept orders and route child order placements out to other venues results in lost time, lost opportunities, and missed markets,” he said.

In 2013, the respondents who wanted the unified system tended to be smaller firms that didn’t have a great deal of order flow. Contrary to the 2013 findings, the integrated approach nowadays is highly desired by many large asset managers, said Pedrotty, adding that Charles River is used by nearly 50% of the 100 largest asset managers globally (ranked by AUM).

He stressed that O/EMS integration is accelerating across the industry: “Our buy-side clients continue to demand innovations that help streamline their trade lifecycle.”

According to Enrico Cacciatore, Senior Quantitative Trader, Head of Market Structure & Trading Analytics, Chair – Voya Financial Veterans Council, the catalyst driving trends in OMS/EMS integration is around the “On-Prem” vs. “IaaS, PaaS, and SaaS” migration.

He said that software as a service (SaaS) cloud architecture, hosting a software distributed framework of applications and database for the client has enabled greater flexibility of design and faster release of systems updates.

“As a result, OMS/EMS has more flexibility for bifurcation while still being under one hosted service,” he said.

Cacciatore added that traditionally using on premises services, scalability, flexibility, and frequency of software/hardware updates was more limited and thus an OEMS tended to provide a less flexibility design for services best needed for the OMS vs. the EMS.

The value of a cloud native architecture has allowed for asset managers to align their pre-trade, trade and post-trade requirements and capabilities with an OMS/EMS that best fits each firm, Cacciatore said.

“At Voya, we are gravitating towards a balanced approach using third-party managed services while leveraging internal proprietary capabilities,” he said.

Cacciatore further said that the third-party services should allow for flexibility to connectivity, access to data via API and optionality to FIX vendors, data providers and any other vendors that help improve Voya’s unique investment process.

“We have learned more toward having a more distributed, best-of-breed, and more plug-in-play architecture. The result is a unique OMS and EMS independent systems. However, it is critical that the independent OMS and EMS systems have strong ability to interact and communicate,” he said.

Cacciatore said that a single OEMS provides the highest probability of end-to-end straight through processing (STP) with limited translations or dropped data from such aspects as Algo Strategy names residing in EMS but not communicated to OMS via FIX. “Additionally, you are only communicating with a single vendor,” he said.

Meanwhile, Whelan argued that the benefits vary sometimes by the type of firm. “While “unified” sounds simpler, the platforms rely on different objectives, data streams, tools, and analytics,” he said.

“PMs look for different types of metrics, latencies, analytics capabilities and performance profiles than traders do, obviously. Some shops may have enough execution capability in their OMS but we still find that most clients demand more trading functionality than is traditionally available there,” he added.

Costs and Future of Integration

Coalition Greenwich data shows that buy-side firms now spend $2.6bn annually on portfolio/order management systems, with the majority of that revenue generated by mid-tier asset managers with assets under management (AUM) ranging from $500m to $25bn.

From a cost perspective, Whelan said there are both explicit costs and implicit costs to change platforms. In most cases, a firm needs to maintain the old and new platforms for some period of time, paying for both vendors in a redundant manner while they migrate their desk teams over, he said.

Implicit costs are by definition harder to measure but generally result in a higher degree of “pain” for the leadership and support teams, he said.

“It can be easy to forget during such times that this is an investment toward greater ROI and benefits (hopefully!) in the future platform,” he said.

“We’ve been told by our biggest clients, as well, that the most important thing to remember when evaluating the cost of change, is to weigh that short-term cost (or pain) against the opportunity costs of staying still,” Whelan said.

“While the process is often difficult we don’t think it should be quite so painful. What’s more, we think that the new platform provider has some responsibility to reduce the levels of friction for clients that are relatively predictable,” he added.

Pedrotty said the cost of switching to a single system depends on whether the EMS from your OMS provider is truly integrated. For example, in Charles River IMS, execution management is natively built in the same application as their OMS. In contrast, OMS platforms that have partnered with or acquired other EMS providers may only be joined through a FIX connection, he said.

Cacciatore added that if you are going from independent OMS and EMS structure to a single platform, the greatest changes and challenges tend to be related to workflow and systems integration re-engineering.

“The cost perspective is heavily dependent on if the EMS was a broker provided products with no explicit costs while the new OEMS embedded cost already part of OMS contract or an add-on cost. The biggest challenge really is technology/systems integration,” he said.

Cacciatore added that the future of the buy-side order and execution management system focuses on open-source, distributed architecture allowing for the buy-side to ingest the buy-side’s unique factors into the trading optimization process, whether automated routing functionality or transmitting downstream to brokers to allowing them to optimize trading strategies based on those explicit factors.

“We will continue to see growth in APIs to further improve access to unique datasets whether investment or trading related as well as increasing transparency on real-time access to transactional data and greater ability to leverage historical trading data to feedback into the investment process. The vision is a distributed, unbundled, interoperable, open-source and cloud-agnostic design for the future,” he commented.

Pedrotty added: “With large institutional asset managers, we expect tighter controls and regulations coupled with narrower margins demanding greater efficiencies in the front office. This will support continued demand from trading/dealing desks for consolidated platforms.”

Whelan concluded: “We think there’s plenty of excellent technology available in the trading ecosystem that can be integrated. You don’t need to be all things to all people by way of a single system if you lower the friction between the disparate systems and let them work in unison as an open platform.”