(FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura company.)

The financial industry has seen rapid innovation, particularly within capital markets, where new technologies and business models challenge traditional methods of trading, clearing, and settlement. In capital markets, regulatory sandboxes have become increasingly significant as they offer a controlled environment for testing innovative financial products, services, and technologies, without the immediate full burden of regulatory compliance. These sandboxes have proven to be valuable tools for both regulators and market participants, enabling innovation while mitigating risks and ensuring market integrity.

A regulatory sandbox is essentially a framework that allows firms, particularly those in the financial and capital markets sectors, to test new technologies and products under a relaxed regulatory environment. This temporary exemption from certain regulations provides a safe space for firms to innovate while still ensuring that regulators have oversight. The goal is to balance the encouragement of financial innovation with the protection of market participants and the prevention of systemic risk.

For example, the FCA’s regulatory sandbox, launched in 2016, has supported many fintech startups. One standout success story is Revolut, which tested its financial services in the sandbox before becoming one of Europe’s biggest neobanks, now valued at over $30 billion. The sandbox helped Revolut navigate compliance issues while refining its product offerings.

Meanwhile, AMF (Autorité des Marchés Financiers) Regulatory Sandbox in France allowed LiquidShare to test its distributed ledger technology (DLT) settlement system under regulatory supervision. making SME trading more efficient and cost-effective.

The U.S. regulatory landscape is more fragmented, with financial regulations spread across federal and state levels, making it harder to implement a national sandbox like in other jurisdictions.

Mike Piazza, partner at CM Law and a former Regional Trial Counsel for the SEC, said that the U.S. capital markets are highly regulated through law and regulation with multi-level oversight by various Federal agencies and State level regulators.

“Assuming the goal is to encourage innovation in the delivery of financial products and services, a regulatory sandbox authorized and initiated by, for example, the Department of the Treasury or the Department of Commerce would be a starting point,” he said.

With the broad mandate from the top of the regulatory pyramid, the prospect of a sandbox immune from other Federal or State regulation and enforcement may be possible, he said.

“However, this will require lots of coordination, communication, and “buy-in” by the regulators,” he commented.

Also, perceived or actual conflicts of interest would doom the effectiveness of a sandbox initiative so transparency and rigorous attention to potential conflicts or self-dealing are very important to such an effort.

Piazza further said that “limited scope sandboxes with clear objectives work better than those with broad, undefined objectives that are more akin to a solution seeking a problem approach”.

Regulatory sandboxes in the U.S. can foster innovation in capital markets by enabling collaboration between traditional financial institutions, fintech startups, and market infrastructure providers.

Their impact depends on the scope of each initiative, according to Piazza. For example, he said a sandbox that broadens the definition of accredited investors could grant more individuals access to private investments, beyond just crowdfunding. Insights from such programs could influence regulatory reforms, leading to greater market participation and long-term growth in U.S. capital markets.

Jay Biondo, Head of Surveillance, Trading Technologies, believes that a Sandbox with US regulators/customers would potentially be valuable because “it is very difficult to innovate in the regtech space when compliance officers are hesitant to adopt new systems that incorporate advanced technology out of a fear of how that system will be viewed by a regulator”.

“The inability to explain the technology when placed under regulatory scrutiny could lead to large monetary fines for a failure to supervise,” he commented.

For example, Biondo said, a compliance officer may be reluctant to adopt a trade surveillance system that uses generative AI due to the lack of explainability inherent to that technology.

The AI may offer superior detection capabilities, reduce false positives and be an overall extremely effective solution, he said.

“However, despite these innovations and improvements, a compliance officer would still potentially decline to adopt the new system because they wouldn’t be able to explain to a regulator how the system works, and they would ultimately select the legacy system with inferior technology instead,” he said.

Biondo added that a regulatory sandbox could help bridge this gap/foster collaboration by allowing customers to test innovative compliance systems that incorporate advanced technology in a risk-free environment, where the compliance officer “wouldn’t have to be afraid of being cited for a failure to supervise if they can’t fully explain how the system works”.

“The customer could also receive feedback directly from a regulator about whether or not the system would be viewed favorably when placed under regulatory scrutiny in the real world,” he said.

In addition, the regulators themselves would have an opportunity to learn more about the advanced technology that regtech providers are incorporating into their offerings, so that they can also feel more comfortable when they encounter firms that use those systems in the real world as well, he said.

While the U.S. doesn’t have a single, unified regulatory sandbox for capital markets, there are some key examples and initiatives that can be considered as part of the sandbox approach.

For instance, the U.S. Securities and Exchange Commission (SEC) created FINHub as a resource for innovators and entrepreneurs working with financial technology (fintech), including blockchain, digital assets, and trading technologies. While not a traditional sandbox, it serves as a platform for market participants to engage with regulators, get guidance, and ensure compliance while experimenting with new technologies.

Similarly, LabCFTC is the Commodity Futures Trading Commission’s (CFTC) initiative aimed at fostering innovation in the derivatives markets and related financial technologies. It serves as a regulatory hub for fintech, offering support to firms working on innovations like blockchain, machine learning, and high-frequency trading strategies.

Also, the Office of Financial Technology within the Office of the Comptroller of the Currency supports fintechs and banks looking to adopt new technologies. It helps firms navigate regulatory challenges and provides clarity for institutions experimenting with innovative financial products, including in capital markets.

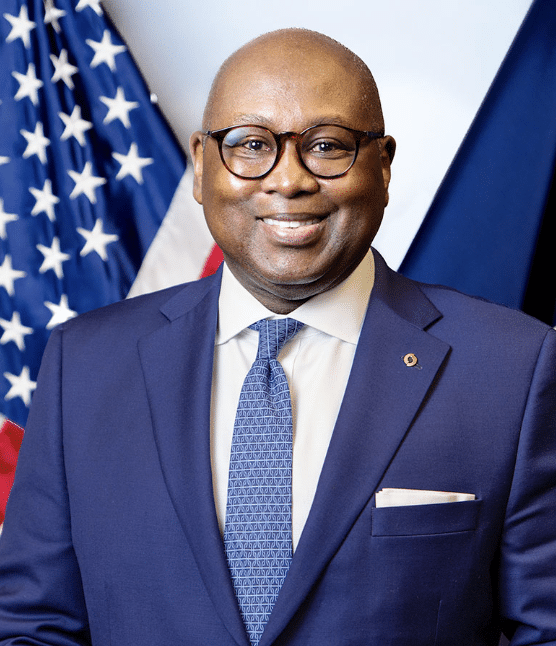

“Regulatory sandboxes are good for bankers, fintechs and regulators, and a valuable tool to foster innovation in the federal banking system,” Acting Comptroller of the Currency Rodney E. Hood, told Traders Magazine.

“Ensuring regulators have a seat at the table while innovation is ongoing, results in new products that have been tested, comply with regulations, are safe for consumers, and are ready to serve their intended purpose when launched,” he said.

The FCA’s work with regulatory sandboxes is a helpful model to inform a framework in the U.S, Hood said.

“I look forward to developing a regulatory construct to facilitate sandboxes so banks and fintechs can explore innovation, identify impediments, and resolve them without fear of penalties,” he added.