FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura company.

Paraskevidekatriaphobia, also known as friggatriskaidekaphobia, is the fear of Friday 13th, which is considered an unlucky day in many cultures. The day may not bode well for US banks as their third quarter reporting season begins on Friday 13 October with JPMorgan Chase, Citigroup and Wells Fargo.

Nick Colas & Jessica Rabe, co-founders of DataTrek Research, said analysts have been cutting their earnings estimates for banks with the exceptions of JP Morgan Chase and Bank of America.

Jamie Dimon, chairman and chief executive of JP Morgan Chase, warned in an interview with The Times of India in September that the world is not prepared for 7% interest rates. He said: “We urge our clients to be prepared for that kind of stress. Warren Buffett says you find out who is swimming naked when the tide goes out. That will be the tide going out.”

McKinsey said in its Global Banking Annual Review 2023 that the past 18 months have been the best period for global banking overall since at least 2007. Rising interest rates boosted the sector’s profits last year by about $280bn and lifted return on equity to 12%, compared with an average 9% since 2010.

However, the consultancy warned that the traditional core of the banking sector, the balance sheet, is at a tipping point which it dubbed the “Great Banking Transition.”

The report highlighted four global trends that will shape the outlook for financial institutions:

– the change in the macroeconomic environment with higher interest rates and inflation, and a possible deceleration of Chinese economic growth.

– accelerating technological progress. McKinsey said: “The emergence of generative AI could be a game changer, lifting productivity by 3% to 5% and enabling a reduction in operating expenditures of between $200bn and $300bn, according to our estimates.”

– governments broadening and deepening regulatory scrutiny of non-traditional financial institutions and intermediaries.

– a shift in systemic risk as rising geopolitical tensions increase volatility and spur restrictions on trade and investment in the real economy.

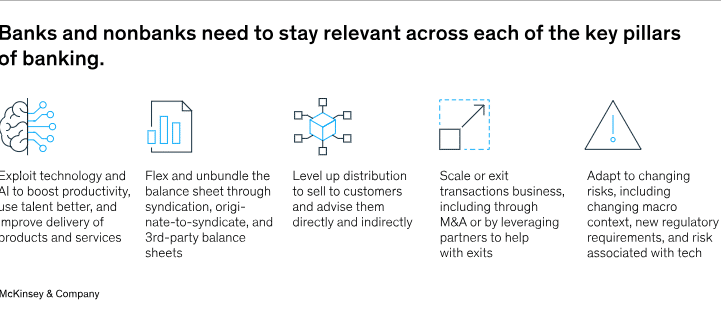

McKinsey said financial institutions need to reexamine their businesses and identify their relative competitive advantages in the balance sheet, transactions, and distribution to ensure that they are positioned to generate adequate returns.

“They will need to do so in a very different macroeconomic and geopolitical environment and at a time when AI and other technologies are potentially changing the environment and with a broader set of competitors,” added the report. “Scale and specialization will be determinant, as will value-creating diversification. Minimum economies of scale are also likely to shift, especially where technology and data are the drivers of scale.”