FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura Company.

Traders are moving to the suburbs — just like they did in 2000.

But there’s a big difference. In 2021, the migration of traders (and professionals in many other industries, for that matter) is driven by the experience of the ongoing pandemic, which suggests that (1) maybe living on top of each other (and breathing and coughing on each other) isn’t such a good idea, and (2) working remotely is much more accepted and even encouraged, so if you don’t have to make a long daily commute, why not get some space and a yard with trees.

This shift might take hold, or it might be looked back on as a passing fancy a year or two after COVID-19 is gone.

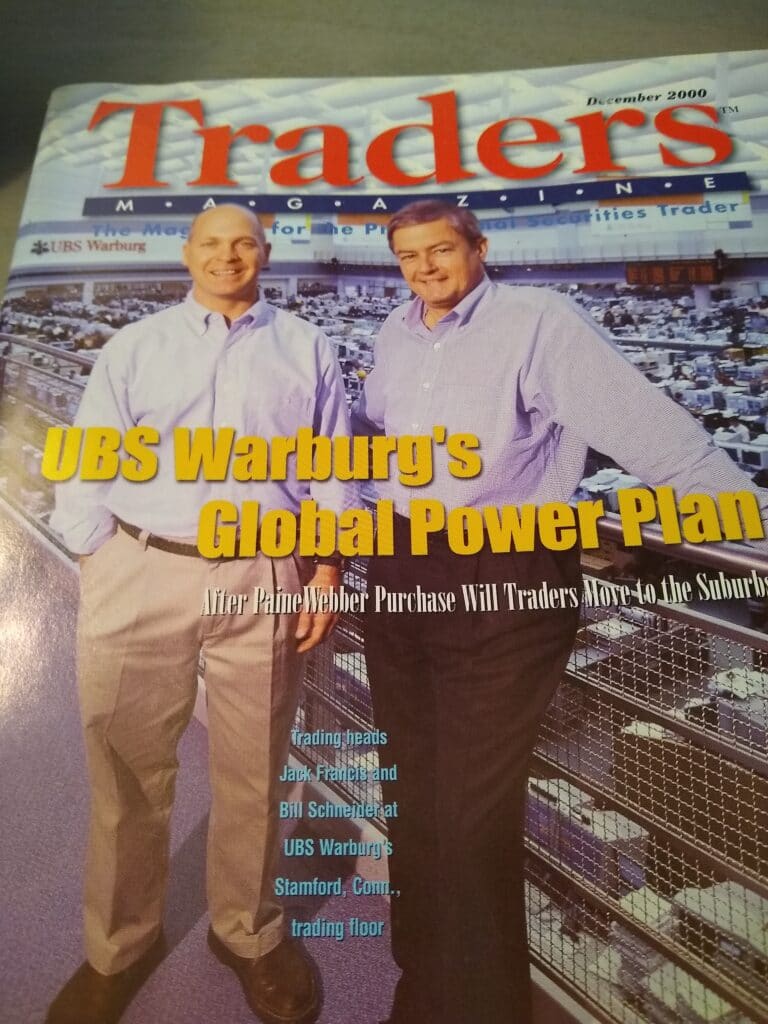

In 2000, the move to the suburbs (or at least one suburb), was all about being part of UBS Warburg’s giant trading floor, and beingpart of the Swiss bank’s giant ambitions to become a player in the U.S. securities trading business. This ‘move’ to the suburbs was often only for the day, as chronicled in the cover story of the December 2000 Traders Magazine: “UBS Warburg’s Global Power Plan: After PaineWebber Purchase Will Traders Move to the Suburbs?”

From the article: “Attempting to assemble a world-class trading operation in the suburbs is tough. That’s especially true for a foreign bank. Three years ago, when Swiss bank UBS Warburg built its North American headquarters in Stamford, Conn. — about 40 miles outside of New York City — it soon ran into recruiting problems. Young traders in the New York tri-state area preferred the action and opportunities in the Big Apple. And they were leery of the here-today, gone-tomorrow reputation of foreign banks.”

“That’s why UBS Warburg executives are now saying ‘Thank you, PaineWebber.’”

“UBS Warburg bought the U.S. retail brokerage firm in November for its lucrative wealth management business, but got a bonus: PaineWebber’s large Nasdaq and listed trading operation. If those traders can be convinced to reroute their commutes from New York City to Stamford — and for now most seem willing — the acquisition will accelerate the bank’s plan to become one of the top five U.S. trading houses.”

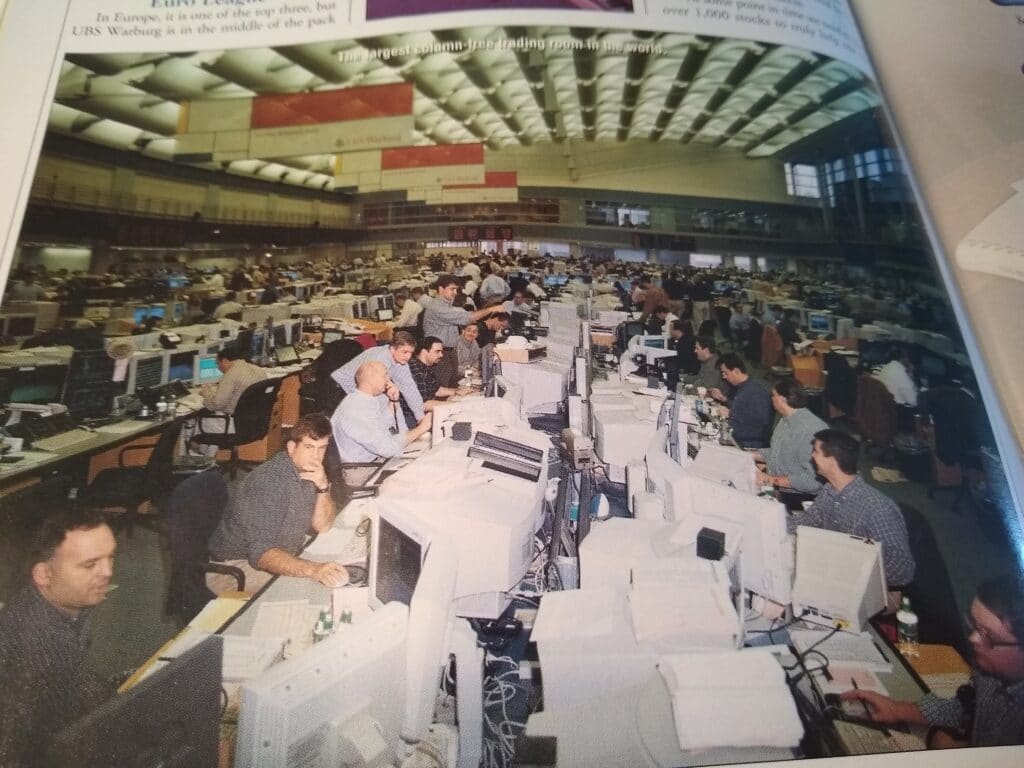

Back 20 years ago, UBS of course was known for its football field-sized trading floor. “The largest column-free trading room in the world,” the photo caption says.

Fast forward to today, and technological developments such as electronic trading, automation and algorithms, and cloud computing have made mammoth trading floors obsolete.

But the parallel in the migration pattern, amid very different times, is striking. In 2020, traders went to a suburb to trade on a giant trading floor. In 2020-21, traders are going to suburbs to take advantage of decentralized technology and remote work — or pretty much the opposite setup of a giant trading floor.