FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura company.

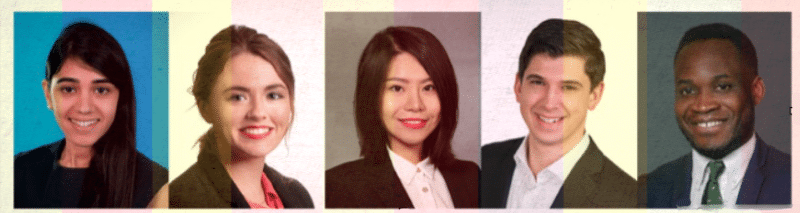

As Labor Day weekend signifies the unofficial end of summer, we wrap up our Flash Friday Gen Z series today with a quintet of promising young individuals from Chicago-based exchange group Cboe Global Markets.

Thanks to everyone who participated over the past six weeks — Instinet, T. Rowe Price, Nasdaq, NYSE, Instinet again, and Cboe. We’d like to keep it going, and these kids aren’t going back to school, but we think they need to focus on their work rather than humor Traders Magazine and our insipid and tedious questions.

Without further ado, please meet Cboe Zoomers:

Victor Werny, Manager, Listings

Briefly describe your educational background and work experience to date.

I graduated from Binghamton University’s School of Management in 2018 with a Bachelor of Science degree in Business Administration with Concentrations in Finance and Marketing. Since joining Cboe out of college as an Analyst, I have grown into the Senior Analyst and now Manager role. I currently manage the exchange’s U.S. Exchange Traded Product (ETP) Market Making programs, oversee all inquiries involving ETP data and analytics, as well as explore potential business opportunities within the ETP industry. Upon joining Cboe, I have obtained my Series 7 license.

How did you get interested in the world of finance / fintech?

I first got interested in the world of finance early on in college, when two fellow students and I were tasked with putting together an investment case as part of a business competition. In the process of constructing our pitch, we analyzed numerous data points and compiled them into various formulas and calculations in support of our recommendation. I truly enjoyed the fast-paced nature of the competition and seeing how the speed of information could greatly impact financial markets. While the aspects of data and markets piqued my interest, I also enjoyed the collaborative nature of working with a team to put together a complex presentation.

What is your role and responsibilities at your firm?

As a Manager on the listings team, I am tasked with a wide array of responsibilities. I spend a significant amount of my time analyzing Cboe’s ETP Market Making programs to ensure they are the most competitive in the industry, while not overcomplicating our requirements. Naturally, this also involves speaking with current and prospective market makers around the benefits of these programs and the requirements imposed.

Additionally, I work with the asset management community from a capital markets perspective to help them better understand how to examine market quality in their Cboe Listed ETPs. This entails compiling data points on a variety of metrics and presenting them to our clients. Furthermore, I speak with potential and current issuers about Cboe’s value proposition as a primary listings venue for ETPs, and how we compare to our industry peers.

What is the best aspect of your job?

I would say the best aspect of my job is the competition factor. I grew up collecting baseball cards and constantly making trades with my friends – with the end goal of obtaining the best cards possible. I believe the ETP listings business is very similar. Each and every day, our team is connecting with prospective and current asset managers on why they should list new products on or move existing products to Cboe. Competing for the most actively traded or extremely niche and lucrative products is always exciting, just like negotiating for all your friends’ Yankee cards!

Any notable mentors, past or present, that you’d like to recognize?

My parents have set a great example for me and my brother on the importance of hard work and putting your best effort into everything you do. Throughout my time at Cboe, I’ve also had three truly inspiring mentors – Laura Morrison and Rob Marrocco from our listings team, and Giang Bui, my former colleague. Each navigate their jobs with such a high degree of professionalism and passion for what they do and have taught me so much about the different aspects of the listings business, capital markets and market structure.

If you weren’t working in finance /fintech, what do you think you would be doing?

If I were not working in the financial world, I would love the opportunity to be involved in politics. The political environment has always interested me and having the ability to be a part of change for generations to come would be extremely rewarding!

How optimistic are you in your generation’s ability to step up and lead (companies, industries, governments) when the time comes?

I am extremely optimistic in my generation’s ability to step up and lead when the time comes. It is amazing to see how many people I know who are already involved in start-up companies that are looking to make a positive impact and solve complex problems for current and future generations. I feel that my generation has lived through one of the most advanced eras of technology and many are already using the skills that they have accumulated over time to step up, lead and make data-driven decisions. I am truly excited to see what we accomplish as a generation in the years to come!

Pallavi Aggarwal, Senior Associate, Derivatives Strategy

Briefly describe your educational background and work experience to date.

I grew up in Queens, NY and went to Stuyvesant High School in Lower Manhattan. I graduated from Caltech in 2017 with a double major in Mathematics and Business. I worked as an investment data analyst at Dimensional Fund Advisors in Charlotte, NC for about two years before joining Cboe as an associate.

How did you get interested in the world of finance / fintech?

I took an investments course in college that sparked my initial interest in finance. I was struck by the extent to which capital flows between different entities in the financial ecosystem. Many of the statistical techniques I had learned in my math classes were also readily applicable to financial modeling problems. Around this time, I was doing summer internships in data analysis at NASA and other aerospace companies which I also enjoyed, so it seemed natural to pursue a career doing some combination of finance and data analysis after school. Even now, I feel lucky that I’ve been able to pursue work that has blended these interests so well.

What is your role and responsibilities at your firm?

I work in the Product Development group under Derivatives Strategy at Cboe. Our team conducts quantitative analysis using data – we help maintain and develop new derivatives products like futures and options. I typically use a range of technical tools to aggregate and clean data, perform any necessary manipulations or calculations, and potentially visualize or plot the output in early stages of the product development cycle.

I think our group is unique because we routinely interact with so many groups within Cboe like Software Engineering, Data, Legal, Marketing, and Operations as well as those outside the organization like the Options Clearing Corporation (OCC) simply because of the coordination and requirements needed to list new and existing products.

What is the best aspect of your job?

Launching a new product or finalizing development of one of its components is the best part of the job. Working on content for a new product’s website and seeing the page go up or doing research on a new product and eventually seeing its live quote or tick data on Bloomberg is extremely rewarding. A considerable amount of time and research usually goes into bringing a derivatives product to market, so a successful launch represents the culmination of all these efforts.

If you weren’t working in finance /fintech, what do you think you would be doing?

I would probably work on some aspect of improving the healthcare space for consumers. Many Americans understandably feel powerless dealing with the healthcare system, but once we realize every dollar flowing through it is funded by each of us, we can start to sit up and pay attention. I firmly believe that many problems consumers face from the system could be solved by better data analytics. For instance, if I were working in the healthcare space, I would develop tools that compare costs between hospitals for a given procedure using a particular insurance plan versus the cash price. I would also work on applications that help employers analyze insurance claim data so they can identify outliers and reduce their premiums.

Flash forward 20 years: what does the finance/fintech industry look like?

I believe many of the trends in the finance and fintech industry we’ve already seen during the pandemic will accelerate. Retail investors are emerging market participants looking for education and exposure in derivatives. Investments into cryptocurrencies will grow and there will be more widespread institutional adoption. More importantly, as banks increasingly invest in blockchain technology, transactions will be cheaper, more secure, and efficient. Finally, AI and machine learning is a game-changer for the industry – I’m excited to see how these systems parse through data to help investors make smarter trading and investment decisions.

George Ossei, Associate, Corporate Strategy and M&A

Briefly describe your educational background and work experience to date.

I graduated with a degree in economics and finance from Bryant University and followed immediately with a dual accounting and MBA degree from Northeastern, which I obtained in 2018. I worked as a consultant for Tredence, a data science and AI engineering company, for a year before joining the valuations and financial advisory group at RSM’s Chicago office. After two years at RSM, I joined Cboe as an associate on its global strategy and M&A team.

How did you get interested in the world of finance / fintech?

I started reading Paul Krugman early in my college career and kept up with CNBC’s nightly business report on weeknights. Both sparked my interest in the world of complex finance and trading. After I took my first finance class in my second year, I was sold on a career in finance.

What is your role and responsibilities at your firm?

As part of the global strategy and M&A team, I work on all aspects of the traditional M&A process in addition to corporate strategy initiatives. These are two functional areas that are highly complementary, and particularly important to Cboe’s growth strategy as it continues to push into new asset classes, markets and regions globally. The company completed six acquisitions in 2020 alone, expanding into Canada and Asia-Pacific, in addition to maintaining a strong presence in both the U.S. and Europe.

What is the best aspect of your job?

Work-life balance. It’s good to have a life outside of work to dedicate to other personal endeavors.

When you were a child, what did you want to be when you grew up?

Pilot. I may yet still pursue this as a hobby in the future.

Flash forward 20 years: what does the finance/fintech industry look like?

I believe fiat currency will go the way of the dinosaurs. Cryptocurrencies will dominate all aspects of financial transactions, so I believe it is prudent to get in on the action now.

Angie Wang, Manager, Data & Analytics

Briefly describe your educational background and work experience to date.

I have a dual undergraduate degree in Economics and Applied Math from the University of Washington and a master’s degree in Financial Engineering from Cornell. During the summer while I was finishing my graduate studies, I had the great opportunity to join Cboe’s internship program and later accepted a full-time quantitative analyst role after my graduation. Currently, I’m a manager in Data & Analytics, leading a quant team which is responsible for the advanced analytical projects of our organization.

How did you get interested in the world of finance / fintech?

I have always been deeply fascinated by mathematics and economics, particularly in how they could be applied in real life. Finance, quantitative finance to be more specific, is the sweet spot which allows me to play around with a tremendous amount of data (a.k.a. numbers), apply economic theories and be able to add values through identifying undiscovered patterns and finding answers to questions hidden in the numbers. I find that finance is a good balance and mix of those two.

What is your role and responsibilities at your firm?

Data & Analytics at Cboe is a cross-functional team that provides a centralized shared resource for the company’s advanced data and analytical needs across multiple business lines. We work very closely with functional business leaders around the globe to identify and provide solutions to their problems, develop thoughtful research, and derive insights from the market dynamics to help with business growth. We also work very closely with the technology team to identify, specify and build curated, derived and high-value data sets. Our team’s projects range from simple trend analyses, to market microstructure studies and predictive modeling.

What is the best aspect of your job?

I was just promoted to a manager earlier this year, and to me this is a totally different role than being an analyst. It’s not about just producing stellar results on my own, but inspiring and motivating my direct reports to put forth their best efforts, helping them grow and unlocking their full potentials to achieve their ultimate career goals. To me, seeing my associates grow and letting the entire team’s brilliance shine through is so rewarding and fulfilling!

Any notable mentors, past or present, that you’d like to recognize?

Yes! I have three incredible female mentors at Cboe I would love to recognize: Vivian Yiu, Eileen Smith, and Lisa Shemie. They taught me to be confident while being humble, kind and curious. They also answered my questions and helped me further understand the cultural differences between the U.S. and China (I was born and grew up in China) and pushed me out of my comfort zones. Those many moments still touch my heart deeply. I would also sincerely thank my current mentor, Cboe Europe’s Dave Howson, who has been extremely generous with his time, and willing to share his experience and expertise with me!

If you weren’t working in finance /fintech, what do you think you would be doing?

An interior designer or an architect.

How optimistic are you in your generation’s ability to step up and lead (companies, industries, governments) when the time comes?

For sure! I’m strongly optimistic in my generation’s ability to step up and lead, and I’m very hopeful that we will make great progress toward a more equal society. Our generation was born at the height of globalization and is naturally equipped with an open mind and empathy to embrace diversity. I believe we will continue to be proactive and be a keen advocate to challenge norms and promote inclusion.

Hunter Warner, Specialist, Compliance

Briefly describe your educational background and work experience to date.

I graduated from the University of Kansas with a B.A. in Global and International Studies. I spent a couple years in social work before joining Cboe as a Trade Desk Associate. Switching industries is never easy, but fortunately the Trade Desk gave me excellent opportunities to learn and excel. I was able to carry my operational skills over to the Compliance department where I continue to grow as a fintech professional.

How did you get interested in the world of finance / fintech?

When I graduated from college, I certainly did not envision I would be working in fintech. However, as I settled into my post-college life, I became more aware of my own finances and how financial services tie into local and global communities. Working at Cboe allowed me to not only explore this interest in finance but has also given me the opportunity to continue expanding my knowledge across business areas. I love that the stock market is always innovating and therefore my job is also constantly evolving.

What is your role and responsibilities at your firm?

As a Compliance Specialist, I work to ensure a positive culture of Compliance is alive and thriving at Cboe. I work closely with department leaders across the organization to ensure regulatory obligations are satisfied and compliance controls are effective. My role is primarily focused on ensuring compliance with the SEC; however, our team takes a holistic approach to compliance and I therefore get the opportunity to work on all aspects of the compliance function. Some of my responsibilities include submitting quarterly reports to the SEC, handling regulatory document requests, ensuring compliance obligations are met in the incident management process, and analyzing rule filings for potential impact to system compliance surveillance alerts.

What is the best aspect of your job?

I really enjoy the ever-changing nature of my role. There are always new industry or regulatory developments to learn or new projects to get involved with. However, the best aspect of my job is truly the great people that I work with. I am constantly surrounded by knowledgeable, passionate, and kind individuals who are happy to answer my numerous questions and are mutually invested in my success. There are so many interlocking processes that must come together for a large global fintech organization like Cboe to be successful and it is really important for all business areas to have an understanding and respect for each other. It is this deep value of collaboration that I find especially endearing about working at Cboe.

Any notable mentors, past or present, that you’d like to recognize?

My current supervisor, Jennifer Fuentes, has been tremendously impactful to my personal and professional growth. She encourages me to heighten my strengths and gives great constructive feedback for areas of improvement. She is a strong advocate for her team and allows me to take ownership of interesting and challenging projects. She is truly a compassionate people manager and has taught me what a holistic approach to leadership really looks like.

Lindsey Praechter is my mentor through the Cboe Women’s Initiative Mentorship Program. She is graciously guiding me to achieve my goals of networking internally and becoming a more confident contributor all while working from home. She is a patient listener and is an invaluable source of feedback and support from outside of my own team.

If you weren’t working in finance /fintech, what do you think you would be doing?

I would probably end up on some beach as a scuba instructor. The underwater realm is a truly remarkable place. If I wasn’t working to maintain fair markets, I would likely be working to maintain fair environments.

Flash forward 20 years: what does the finance/fintech industry look like?

I certainly believe a large part of the future fintech industry will be the increased participation of retail investors. As financial knowledge and resources have become more available, investing has also become more accessible to those looking to invest earlier in life and with smaller portfolios. The industry has already seen these changes and the race is on to adapt. Therefore, I believe in 20 years we will regularly see more investment products, market data, and educational resources geared towards all ages of retail investors. I hope that through these changes, more individuals will feel empowered with the tools and resources they need to make appropriate investments for their short and long-term financial goals.

How optimistic are you in your generation’s ability to step up and lead (companies, industries, governments) when the time comes?

I am very confident in my generation’s ability to step up and lead. As the generations before and after us, we are constantly learning, growing, and adapting. We also live in a time when mentorships and professional growth resources are abundant and constantly becoming more accessible. We have more knowledge available to us than ever before, and I certainly believe we have the hunger for more.