In this week’s Flash Friday, guest authors Takahiro Michiba and Risa Naka, Senior Associates at Nomura Research Institute (NRI), discuss cross-border implications of T+1 settlement in the U.S.

In less than a year, securities firms in the U.S. will be facing a significant change to their businesses. Effective May 28, 2024, the SEC has mandated that most securities transactions will need to be settled in a single day (T+1).

Investors will undoubtedly benefit from a shortened settlement period. For traders making domestic transactions, most will see reduced clearing fund requirements, improvements in how capital is deployed, greater liquidity and smoother, more efficient operations. On a broader level, capital markets themselves will be more efficient.

Outside of the U.S., investors will also feel the impact of this change. In Japan, for example, demand for U.S. stocks has increased among individual investors, driven by access to margin trading and initiatives, like the Nippon (Japan) Individual Savings Account, designed to boost individuals’ mid-to-long term asset accumulation. As such, younger investors are becoming more interested in opening brokerage accounts and fueling demand for U.S. securities.

Whether located in the U.S. or outside its borders, firms with international operations will encounter significant—potentially disruptive—challenges under new trading rules.

Cross-border transactions under the T+1 mandate are complicated by differences in time zones and foreign exchange. Compared to Europe, where London and New York City’s stock exchange hours overlap for part of the morning on the East Coast, markets in Japan, Korea and Australia face a bigger time difference than their European counterparts. To further complicate matters, some non-U.S. firms have yet to realize the exact forex implications that will affect their businesses as the U.S. shifts to a shorter settlement time.

Fortunately, U.S.-based and foreign broker-dealers, investors, securities firms, custodians (both global and sub) and buy-side firms still have time to reevaluate, upgrade and improve their processes and partnerships.

To do so, they’ll need to assess their technology, replacing manual controls with straight through processing (STP). They’ll also need to identify, review and potentially reassess their relationships with non-U.S.-based stakeholders, as operations and capabilities will be placed under greater pressure from the new settlement standard.

Assessing Cross-Border Challenges for Investors in the U.S.

Removing 24 hours from the settlement cycle will require firms across the globe to make operational and technical changes across the trade lifecycle. “When the industry moved to T+2 in 2017, many firms needed to add resources to support the transition,” said Robert Cavallo, director of DTCC Clearance and Settlement Product Management. “However, the move to T+1 is fundamentally different.”

For market participants in Asia, these revisions will result in changes to foreign currency funding and new operations models to meet the T+1 affirmation cutoff.

Under the old T+2 model, firms were able to fund foreign currencies with T+1, after they had confirmed the sale and execution of a trade. While it wasn’t exactly frictionless, this multi-step process allowed firms to meet settlement requirements and mitigate funding risks.

With the transition to T+1, firms will have to fund their trades with T+0, which has lower liquidity—and can be more costly and difficult than the older, slower model.

Utilizing a trading forecast, funds can be secured ahead of a trade, but that solution reduces firms’ flexibility for position taking, as well as decreasing capital efficiency. Not all firms are aware that they’ll soon be expected to take these steps to meet new settlement standards, which will in turn affect best practices for corporate treasury management for cross-border transactions.

That’s not the only challenge facing broker-dealers. In fact, the biggest issue is the T+1 affirmation cutoff.

For firms with manual processes, the affirmation cutoff will all but necessitate the implementation of new systems, replacing the old methods of settlement with STP technology. Furthermore, the T+1 standard effectively means new operational expectations for non-U.S.-based broker-dealers.

To illustrate this evolution, consider a hypothetical trade ordered by Japan, during normal market hours. This transaction has a Trade Allocation cut off of T+0 PM7 (JST T+1 AM9). Two hours later, the transaction reaches its Trade Affirmation cut off, at T+0 PM9 (JST T+1 AM11).

From here, the complexities of T+1 begin to emerge.

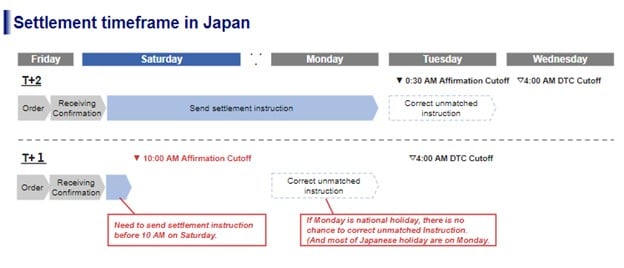

For a trade placed on Friday, the new T+1 standard could require that Japan-based broker-dealers secure an operations team and have its system up and working on Saturday mornings. The exact timing of the team’s working hours will depend on whether the U.S. is observing Daylight Saving Time (DST) or not, which would change operations deadlines by an hour. (During DST, the time difference is 13 hours; outside of DST, the time difference is 14 hours.)

Holidays only further complicate the situation. In Japan, most national holidays fall on Mondays. Therefore, when celebrating a Japanese holiday, settlement operations that occur on Monday cannot be handled under normal procedures.

Different firms are taking different approaches to the Affirmation Cutoff. “some are considering to come to the office early in the morning to complete the operation with a tight schedule, while others are building out teams, overhauling their technology or implementing a combination of solutions.

Firms are currently evaluating how best to operate under this new paradigm. Best-practice dictates that a combined approach, with accompanying safeguards and redundancies, means implementing technological and behavioral changes. It’s critical that firms seriously consider strategic and holistic investments in their workflows. Simplifying post-trade processing and laying the foundation for a touch-free environment will foster growth and success, across the lifecycle of a transaction.

The Right Partnerships are Key

The SEC’s adoption of T+1 settlement changes sounded the starting gun for a global race. From Tokyo to London, firms are implementing the latest in technology and evolving their business practices to meet new standards. Make no mistake: some will run this race better than others.

More than 1,800 firms are utilizing the Depository Trust & Clearing Corporation’s central trade manager (CTM), which is garnering attention globally as firms rush to upgrade their post-trade operations.

Firms using the CTM are able to configure their own matching rules and automate the trade confirmation process. “Clients using this workflow achieve a near 100% affirmation rate by 9PM on trade date, demonstrating that the adoption of the CTM…is a critical enabler to achieving T+1 settlement,” according to a report from Securities Finance Times.

There’s no doubt the stakes are high. T+1 means reduced coverage time for short positions, potentially increasing the failures of such positions. There are also regulatory considerations to take into account; fines for failures are a real threat to organizations under the upcoming settlement paradigm.

Finding the right partner, therefore, is key to finishing ahead of the competition. With its implementation deadline approaching quickly, the new era of T+1 will change the way Japan-based firms staff and run their operations, invest in technology, handle disruptions and affirmation failures, as well as how they implement solutions, like the CTM.

To be sure, U.S.-based corporations are finding that partnership with a local, ex-U.S.-based firm, one with institutional knowledge and on-the-ground expertise, is the difference between success and failure. Not only can local intelligence bring peace of mind to U.S.-based organizations, eliminating a source of stress as they upgrade and review their own systems and processes, it can also position them as a winner in their own market, helping them grow and succeed on their own terms.

FLASH FRIDAY is a weekly content series looking at the past, present and future of capital markets trading and technology. FLASH FRIDAY is sponsored by Instinet, a Nomura company.