The Financial Industry Regulatory Authority has signaled to the Securities and Exchange Commission that it is prepared to amend its rule that prohibits payments for making markets in securities, to allow exchanges to make such payments under certain conditions.

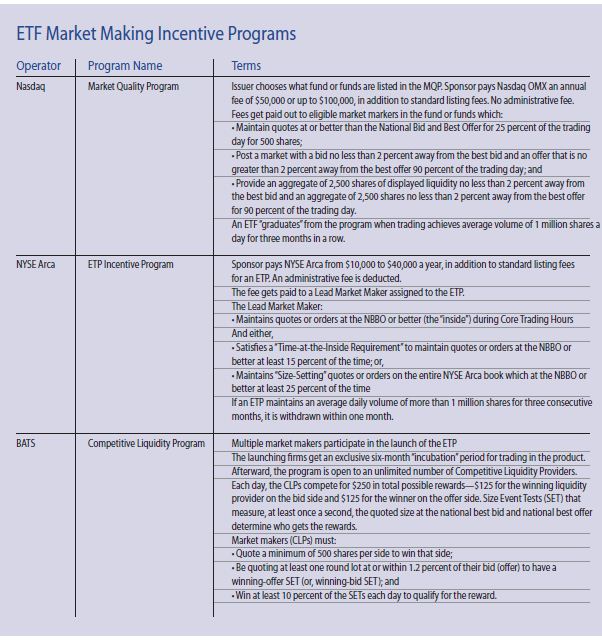

The filing of FINRA’s proposal to amend its Rule 5250 to allow market-making payments by exchanges comes less than a month after the SEC approved a Nasdaq Stock Market plan to create a program that would allow sponsors of exchange-traded funds to pay fees that would be used to encourage market-making in new and thinly traded products.

NYSE Euronext’s NYSE Arca exchange, which handles the greatest volume of trading in ETFs, currently awaits SEC approval on its own market-making incentive program.

Both of these programs follow the introduction of a Competitive Liquidity Program by BATS Global Markets, in December, that does not require an exemption from or modification of Rule 5250.

In its filing, FINRA proposes “to create an exception for payments to members that are expressly provided for under the rules of a national securities exchange.”

”Where a market maker payment is provided for under the rules of an exchange that are effective after being filed with, or filed with and approved by, the SEC pursuant to the requirements of the Act, it is FINRA’s view that comity should be afforded to such exchange rulemaking and the payment should not be prohibited under Rule 5250,’’ FINRA said in its filing, made April 18.

The broker regulator said Nasdaq’s payment program, called its Market Quality Program, is “objective, clear, and transparent” and adequately discloses to investors the existence of the program and how it works.

The implementation date of the proposed rule change is May 15, 2013.

Without the exemption, FINRA’s Rule 5250 explicitly prohibits any payment by issuers or issuers’ affiliates and promoters, directly or indirectly, to a member of an exchange “for publishing a quotation, acting as a market maker, or submitting an application in connection therewith.”

The rule is intended to make sure exchange members “act in an independent capacity when publishing a quotation or making a market in an issuer’s securities.”

The rule is designed to curb undisclosed arrangements between market makers and an issuer that “may make it difficult for investors to ascertain the true market for the securities, such that what might appear to be independent trading activity may well be illusory.”

Only the top ETFs, such as State Street Global Advisors’s SPDR S&P 500 (SPY) and SPDR Gold Shares (GLD) funds, Invesco’s PowerShares QQQ fund and top funds from major sponsors such as BlackRock and Vanguard Group get broadly traded. Roughly 1,200 out of the 1,400 ETFs extant in U.S. markets are thinly traded.

In fact, more than 50 percent of ETFs trade fewer then 25,000 shares a day, according to Damon Walvoord, head of ETF Capital Markets for Susquehanna Financial Group, which makes markets in the funds.

The incentive programs are designed to induce market making in ETFs that trade less than 1 million shares a day. The aim is to growth the list of ETFs that are widely traded from about 200 to 400 or more.

In Nasdaq’s tack, an ETF sponsor pays either $50,000 or up to $100,000 in addition to regular listing fees and chooses which funds will be in its Market Quality Program.

Each quarter, the exchange makes payments from those “MQP” fees to market makers that meet specified liquidity and market quality goals.

These include trading inside the national best bid or best offer for 25 percent of the trading day for 500 shares of a fund; posting a bid that is no less than 2 percent away from the national best bid and an offer that is no greater than 2% away from the national best offer 90 percent of the day; and displaying liquidity on each of the bid and offer sides of trading of 2,500 shares each way, through the day.

“We are going right at FINRA’s Rule 5250,’’ said David LaValle, vice president and head of ETP Listings at Nasdaq OMX. “We’re going right to the heart of the issue.’’

FINRA “has this fear that some evil issuer will get in cahoots with some awful manipulator and pay some manipulator to manipulate their stock,’’ said James J. Angel, capital markets professor at Georgetown University.

But the “issuer is not grabbing Tony Sopranos off the street and engaging in a grand conspiracy here.’’

Nasdaq OMX, as early as Wednesday, is also likely to take the wraps off of details on how it will remake its PSX exchange into an exchange-traded fund-focused securities exchange.

The attention to ETPs comes as volume in trading in these relatively new forms of shares has fallen, after a hot start. Volume fell to 941,000 shares a day in 2012, from 1.2 billion shares a day in 2011, according to Rosenblatt Securities.

ETP trading has surged from about 2 percent of consolidated volume a decade ago, to more than 15 percent in 2011, before falling last year.