Floor brokers are already making or re-making their mark on the Big Board.

With the NYSE Trading floor partially re-opened on Tuesday, May 26, re-admitted floor brokers received an opportunity to resume their business operations (with reduced headcount and restrictions in place to enforce social distancing and other safety protocols).

And so far, so good.

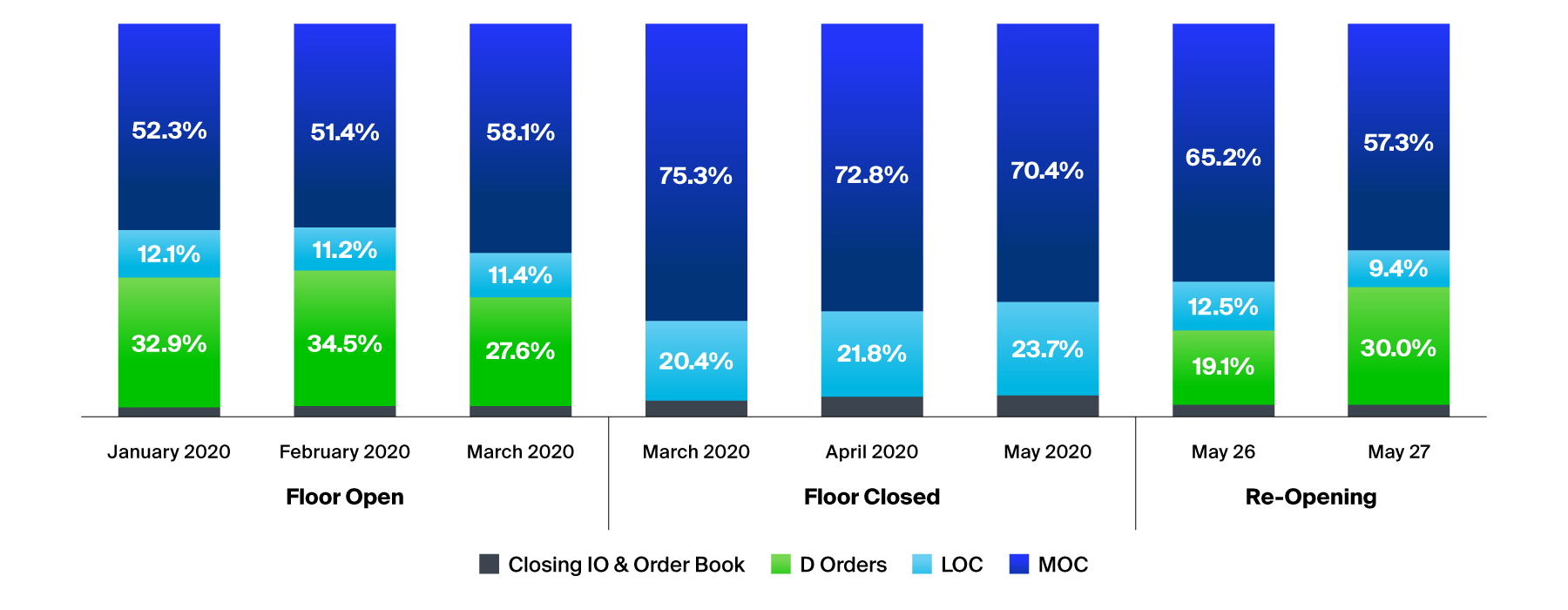

Floor Broker D Orders are Back in the Closing Auction

According to the NYSE, floor brokers have fueled the success of the NYSE Closing Auction, resulting in unrivaled liquidity and execution quality. Investors have swiftly resumed trading with Floor Brokers: D Orders, a flexible order type available only via the Floor, accounted for 30% of total Closing Auction volume on May 27.

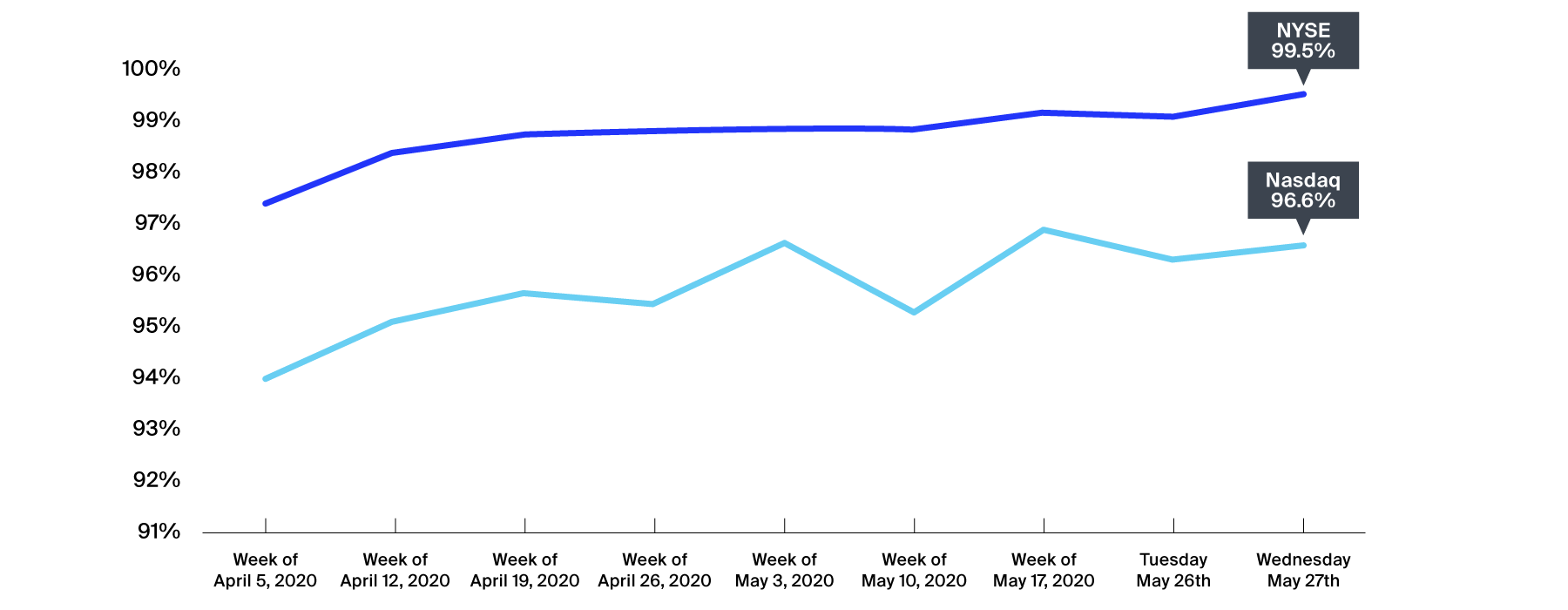

As auctions once again include this valuable source of liquidity, the NYSE has seen improvement in auction execution quality, bourse added. NYSE Closing Auctions regularly price stocks near their end-of-day volume-weighted average trading price, and the percentage of Closing Auctions doing so have gone up even further this week with the return of Floor Brokers.

Closing Auction: Share of Auctions Executing Within 1% of Previous 2-Minute Market VWAP

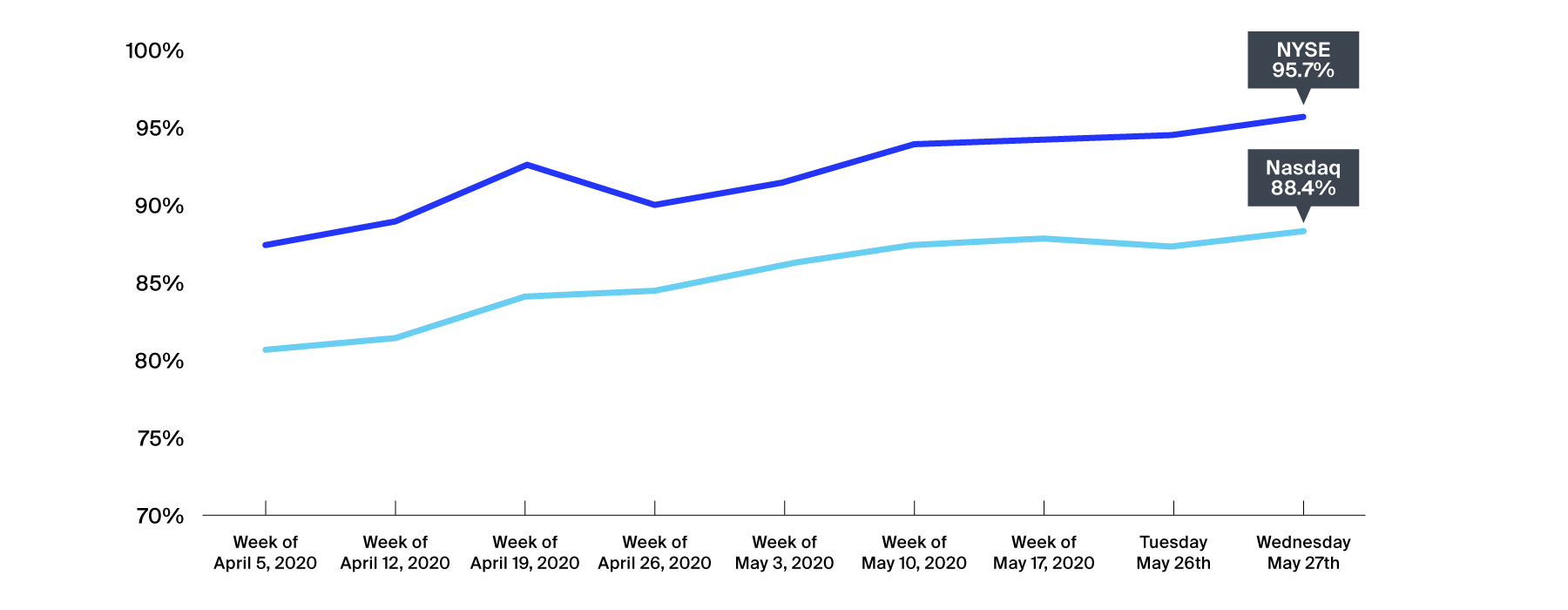

NYSE’s Opening Auction quality has also seen an uptick this week, with the return of the floor. Given the first minutes of trading after the open are usually the most volatile time of day, auction quality can be measured by how closely the open price tracks in line with subsequent trading. NYSE says it consistently excels at open pricing, and the floor’s return has only improved this metric.

nice to see @NYSE data already confirming the contribution to market quality floor brokers are making at the opening & closing auctions upon their recent return https://t.co/78Y399gZhd

— Joe Gawronski (@JoeRBLT) May 28, 2020

Opening Auction: Share of Auctions Executing Within 2% of Subsequent 5-Minute Market VWAP

To hear NYSE explain it, the trading floor is quickly resuming its critical function in the NYSE Market Model. “This will help improve market quality and liquidity, particularly during critical trading events such as the MSCI index rebalance,” the exchange said.