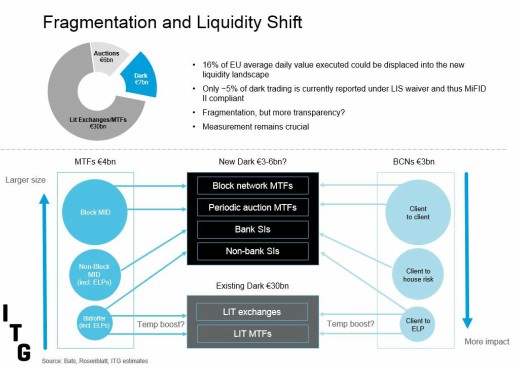

With the launch of MiFID II only weeks away, institutional investors are bracing for dramatic shifts in European equity market structure. The caps on the percentage of small-size trades conducted in dark pools and the elimination of broker-crossing networks (BCNs) could result in the displacement of as much as 16% of average daily value executed in Europe, or approximately $8 Billion in daily liquidity. (See Figure 1)

We are already seeing some market structure developments in anticipation of the MiFID II rules: block-focused crossing networks eligible for the Large-in-Scale (LIS) waiver (including ITGs POSIT Alert) have seen increased trading activity in recent months. To accommodate the 4% and 8% caps on small-size trades, a few exchanges and brokers have planned periodic auction books (including ITGs pending POSIT Auction). These periodic auctions offer lit matching opportunities and are aimed at capturing trades which fall below the LIS thresholds. The prohibition on BCNs has spurred several brokers to file applications to operate Systematic Internalisers (SIs), which are permitted to trade against their clients on a principal basis under the new rules.

Faced with this shifting landscape, buyside firms are struggling with the best way to optimize access to liquidity. New SIs and periodic auctions may offer the promise of additional liquidity, but each venue has its own set of limitations along with specific requirements for access. The shift to principal trading in SIs poses a further challenge for investors if they are seeking to accrue commission sharing agreement (CSA) credits on trades or if they want to use their research payment accounts (RPA) alongside the trades. The complexity does not stop once the trade is executed, either: direct executions in multiple new venues in Europe may require the need for multiple settlement tickets and higher settlement costs.

The increased fragmentation also creates challenges in making routing decisions, as traders seek to determine the optimal way to send flow out to conditional venues, traditional dark pools, lit venues and SIs. What is the proper routing order? How can you quickly re-optimize and re-route when you find liquidity in a particular pool?

To tackle these challenges, institutional investors will need to equip themselves with efficient, broker-neutral workflow tools and aggregators (such as ITGs Dark Allocator) that can access the broadest set of European execution venues on an agency-only basis, with aggregated settlement, intelligent routing capabilities and the flexibility to pay for trading on an execution-only basis or with additional CSA credits or RPA payments.

Duncan Higgins and Scott Kurland are both Managing Directors, Investment Technology Group