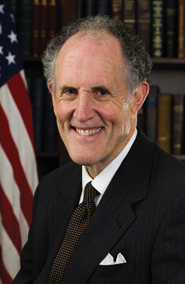

Sen. Ted Kaufman, D-Del., who first caught Wall Street’s attention with his call to bring back the uptick rule, has now zeroed in on high-frequency trading. He gave a speech on the floor of the Senate on March 2, in which he petitioned the Securities and Exchange Commission to take a hard look at the growing practice.

>> On the risks posed

High frequency trading poses two risks: systemic risk to the market and the risk of manipulation. It is high time that we weigh the risk of major high frequency trading errors against the supposed "efficiency" benefits of cutting down trading speeds by several milliseconds.

>> On a lack of transparency

Our regulators have been unable to shed much light on these opaque and dark markets, in part because of their limited understanding of the various types of high frequency trading strategies. Needless to say, I’m very worried about that.

>> On a lack of information

There is much work that still needs to be done in order to gain a better understanding of high frequency trading strategies and the risks of frontrunning and manipulation they may create. I am concerned that academics and other independent market analysts do not have access to the data they need to conduct empirical studies on the questions raised by the SEC in its concept release. Absent such data, the ongoing market structure review predictably will receive mainly self-serving comments from high frequency traders themselves and from other market participants who compete for high frequency volume and market share.

>> On the need for disclosure

The SEC [should] implement stricter reporting and disclosure requirements for high frequency traders under its "large trader" authority. We need the SEC to require tagging and disclosure of high frequency trades so that objective and independent analysts–at FINRA, in academia or elsewhere–are given the opportunity to study and discern what effects high frequency trading strategies have on long-term investors; they can also help determine which strategies should be considered manipulative.

>> On manipulation

Regulators must better define manipulative activity and provide clear guidance for traders to follow, just as Britain’s regulators have done in the area of spoofing. By providing "rules of the road," regulators can create a system better able to prevent and prosecute manipulative activity.

>> On naked access

The SEC’s proposal on naked access is a good first step, but exchanges must also be directed to impose universal pre-trade risk checks. If left solely in the hands of individual broker-dealers, a race to the bottom might ensue. We simply must have a level playing field when it comes to risk management that protects our equities markets from fat fingers or faulty algorithms.

>> On the surge in cancelled orders

The SEC should act to address the burgeoning number of order cancellations in the equities markets. While cancellations are not inherently bad–potentially enhancing liquidity by affording automated traders greater flexibility when posting quotes–their use in today’s marketplace is clearly excessive and virtually a prima facie case that battles between competing algorithms, which use cancelled orders as feints and indications of misdirection, have become all-too-commonplace, overloading the system and regulators alike.

>> On a cancellation fee

Perhaps excessive cancellation rates should carry a charge. If traders exceed a specified ratio of cancellations to orders, it’s only fair that they pay a fee. The ratio could be set high enough so that it would not affect long-term investors (even day traders), and should apply to all trading platforms, including dark pools and ATSs as well as exchanges.