TD Bank Group (“TD” or the “Bank”) (TSX: TD) (NYSE: TD) today announced its intent to sell its entire equity investment in The Charles Schwab Corporation (“Schwab”) (NYSE: SCHW) through a registered offering and share repurchase by Schwab. TD will continue to have a business relationship with Schwab through the Insured Deposit Account (IDA) Agreement.

TD currently holds 184.7 million shares of Schwab’s common stock, representing 10.1% economic ownership. Schwab has agreed to repurchase US$1.5 billion of its shares from TD conditional on completion of the offering.

A preliminary prospectus supplement relating to the secondary offering of Schwab shares held by TD will be filed by Schwab with the U.S. Securities and Exchange Commission (the “SEC”). TD Securities and Goldman Sachs will be acting as joint bookrunning managers on the offering.

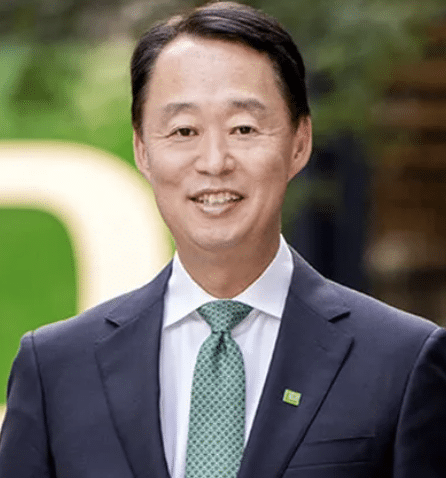

“As part of our strategic review, we have been evaluating capital allocation and have made the decision to exit our Schwab investment. We are very pleased with the strong return we are generating on the Schwab shares we acquired in 2020,” said Raymond Chun, Group President and Chief Executive Officer, TD Bank Group.

“We are confident in TD’s growth opportunities and long-term potential, and we plan to use C$8 billion of the proceeds to repurchase our stock. We will invest the balance of the proceeds in our businesses to further support our customers and clients, drive performance and accelerate organic growth.”

TD will continue to manage its capital prudently and strengthen its infrastructure. Additional details on the Bank’s normal course issuer bid have been provided in a separate news release issued this morning.