How many firms are there in the Wilshire 5000?

Just 3,565.

There used to be 8,000 in this broadest index of what mkes up American stock markets, according to Georgetown University associate professor James J. Angel, a long-time analyst of finance.

At the current rate of decline, “there won’t be anything left for us to trade in a couple years,’’ he said Thursday at the 77th annual conference of the Security Traders Association of New York.

Indeed, he says, if the “broken pipeline” for spawning new companies for traders to trade in is not fixed, there won’t be 500 publicly listed stocks to put in the Standard & Poor’s 500 by the year 2060, by Angel’s calculations.

450

“This is the feeder system that is critical to every single one of you in this room,’’ said David Weild, chairman and chief executive of Weild & Co. as well as an advisor to Grant Thornton, the auditing firm. “If we don’t bring in a new supply of companies because the IPO entry system doesn’t work” then the country as a whole will lose its primary growth engine for jobs and there will be hardly any companies to trade in.

Weild figures that stock markets need 360 companies to go public every year, just to replace the ones that merge, die or go private.

But the number of companies going public has declined each of the last 15 years.

Since the bursting of the dotcom bubble, the average has been 126 new public companies a year. Since the financial crisis, 96.

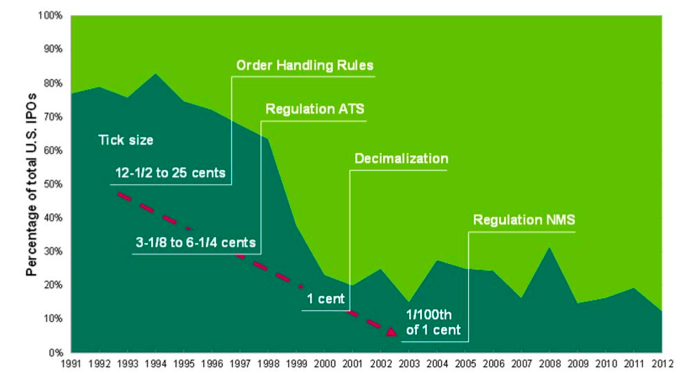

The sub-$50 million initial public offering fell off the cliff in 1998, after new order handling rules defined in 1997, Regulation Alternative Trading System (ATS) and low-tick-size electronic markets gained ground.

That was when the buying and selling of shares “went from quote trading markets to an electronic order book market ,’’ Weild content. That’s when the trader’s “maximum economic opportunity” essentially evaporated overnight, from a quote spread of 25 cents to the tick size of a thirty-second of a dollar, or 3.125 cents.

A study of 13 markets around the world, he said, shows that the countries that provide the most incentives to back new companies get the most IPOs. These include Canada, Australia and Singapore. Pulling up the rear: the United States.

Angel called for a couple fixes:

•Allowing issuers of stock to pick the tick size at which their shares would trade

•Allowing issuers to pay fees of a penny or two a share for marketing a given stock, askin to 12b1 fees for marketing mutual funds.

Testing different tick sizes for smaller companies “is worth trying,’’ said R. Cromwell Coulson, chief executive of OTC Markets Group, which handles trades in 10,000 small companies. “We’re trying to put together an ecosystem for small companies that works”

“We need nickels for sure on these types of stocks,” to support research, taking companies on the road and providing support, said Thomas F.X. O’Mara, co-head of equities at Cowen & Company, which specializes in developing smaller companies.

“The largest country in the world should produce the most IPOs,’’ Weild said. “The answer is not one-size-fits-all penny increments.’’