Equities exchange IEX has tripled its displayed market share since June 2024 after introducing new pricing tiers, but said it has maintained market quality.

Bryan Harkins, president of IEX Group, told Markets Media: “We are particularly proud of our displayed market share as market quality has not been sacrificed for growth. On the contrary, our displayed growth has improved the performance of our dark venue.”

IEX Group announced the appointment of Harkins as its president in May 2024. Before joining IEX his roles included head of markets at Cboe Global Markets overseeing equities, derivatives and foreign exchange trading; president of BIDS Trading; and head of markets at BATS Global Markets.

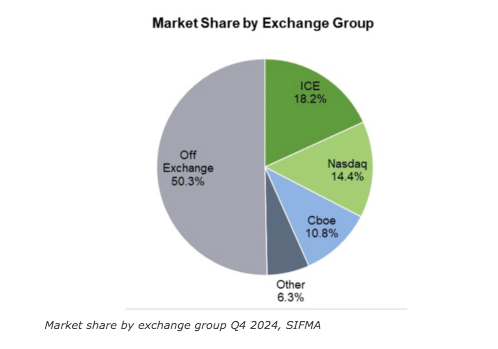

IEX embarked on a journey last year to find the sweet spot between performance and pricing and because of this, the exchange tweaked its pricing a few times throughout the year, according to Harkins. As a result, some liquidity providers gave IEX a shot and had a positive experience, which propelled growth in displayed trading. This growth comes as off-exchange trading of US equities grew to over 50% in the final quarter of 2024, according to data from industry association SIFMA.

Harkins admitted the displayed trading on exchanges has become increasingly challenging over the last five to 10 years.

“That makes our product especially useful in this environment where the Speed Bump and the Signal provide protection mechanisms for liquidity providers and allow them to post with greater consistency and confidence,” he added.

IEX was the first US equities exchange to power its order types with a machine learning-based mathematical formula, the Signal, also known as the crumbling quote indicator. The Signal predicts which way the market will move in order to protect customers from trading at a price that will imminently become stale.The Signal is enabled by the IEX Speed Bump, which gives IEX Exchange a time buffer in which to determine if a price is unstable before trades are executed.

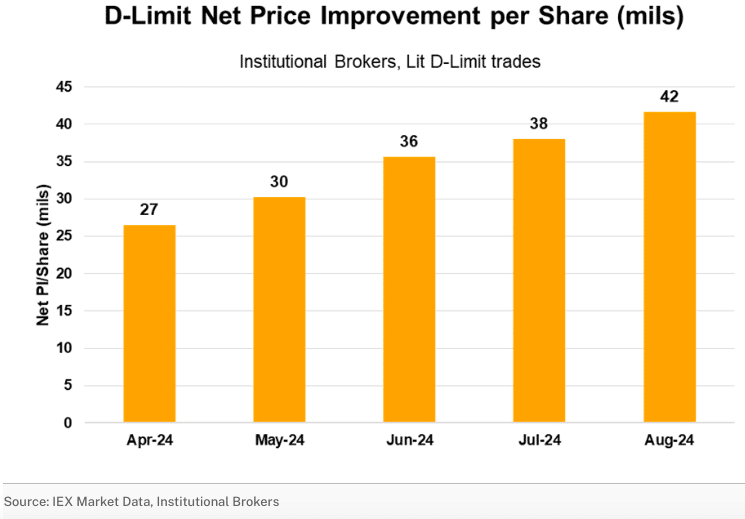

In addition, the SEC approved IEX’s Discretionary Limit, or D-Limit, order type in 2020. D-Limit protects liquidity providers from potential adverse selection resulting from latency arbitrage trading strategies, and was introduced to encourage members to submit more displayed limit orders to the exchange. D-Limit uses the power of the IEX Signal to move an order out of the way if the price is about to become imminently stale i.e. the order avoids being “run over” when the price is unstable.

IEX said in a blog in August 2024 that institutional brokers using the lit D-Limit order receive over 40 mils per share in pre-trade price improvement, which comes out to nearly 0.65 basis points across all D-Limit volume, an increase of over 50% from April 2024.

Harkins argued the displayed public market is essential in providing a healthy overall U.S. equity market.

“At IEX, we are pro-competition, and we understand the utility of off-exchange trading and alternative trading systems (ATSs), but it is very important to allow exchanges to be able to compete,“ he added.

SIFMA said the ATSs with the largest shares in the fourth quarter of last year were UBS ATS, Intelligent Cross and Goldman Sachs’s Sigma X2. IntelligentCross uses AI to optimize price discovery and matches orders near-continuously to achieve maximum price stability after trades.

“There is more innovation in how to design a market to improve outcomes and that is a great trend,” said Harkins. “We continue to be a leader in the space and welcome the competition.”

Options exchange

Harkins said: ”I think 2024 was the start of our next chapter at IEX, and we’re building from an amazing foundation.”

IEX has filed with the US Securities and Exchange Commission to expand outside equities and launch an options exchange. The new venue’s rule book has been published on the SEC website, according to Harkins.

“We continue to work with options market participants on the design of our exchange and we are knee-deep in the development phase,” Harkins added.

If IEX receives regulatory approval, it will become the nineteenth US options exchange. In August 2024 Miami International Holdings launched the newest options exchange, MIAX Sapphire electronic exchange, which will be followed by a physical trading floor this year.

Harkins said: “We can’t just clone our equities exchange, but the core focus of improving outcomes for liquidity providers by protecting against adverse selection remains.”

What’s on the Horizon for Traders and Brokerages in 2025?

By Michael Martin, Vice President of Market Strategy, TradingBlock

In 2025, traders and the online brokerages they leverage can expect major shifts that will bring both challenges and opportunities. These changes could be driven by rapid advancements in technology, shifting investor expectations, evolving regulations, AI’s growing influence and a new administration in the White House.

Navigating the year ahead will require adaptability and an understanding of emerging trends. Whether you are a seasoned institutional investor or an individual trader looking to stay ahead of the curve, the following issues could loom on the horizon.

New White House, New Regulatory Landscape?

President Donald Trump has tapped crypto backer and former SEC commissioner Paul Atkins for the agency’s top job. With Atkins serving as chair, can we expect more clearly defined regulations that support the proliferation of digital currencies, as well as rules around how they are handled by online brokerages?

Just two days into Trump’s presidency, Acting SEC Chairman Mark T. Uyeda, announced the formation of a new crypto task force “dedicated to developing a comprehensive and clear regulatory framework for crypto assets.” Additionally, in a major pivot, the SEC recently rescinded Staff Accounting Bulletin (SAB) 121, which previously guided how financial institutions should account for crypto assets held on behalf of their customers.

With Trump back in the White House, can we also expect sweeping deregulatory efforts that may lead us into a bullish trend?

A Recipe for Volatility?

Despite Trump’s intention to boost the economy through deregulation, his tariffs could snarl supply chains, ignite trade wars and bring about market instability. Traders will likely pay closer attention to the sectors directly impacted by the latest announcements.

Sharp increases in the price of key resources can lead to stagflation – high inflation, high unemployment and slow economic growth. Combine this economic environment with the world’s ongoing wars and conflicts and you could have a potent recipe for market volatility.

Online brokerages should prepare themselves to meet the demands of traders who must quickly adapt their portfolios amid dynamic, unsavory market conditions. Options traders may increasingly use shorter-term options as they attempt to manage news cycle swings.

AI and Augmenting Human Decision Making?

Will AI proliferate and have a profound impact on securities-related research and decision-making? Firms that leverage AI while placing humans at the center of the decision-making process may have a greater chance of gaining market share.

While AI can process endless amounts of data, expedite research and surface valuable insights, the technology lacks the unique skills and insights of a professional who can interpret market sentiment, account for qualitative data, make nuanced decisions, adapt to dynamic market conditions and more.

Might active managers and stock pickers do well in 2025 by using AI to inform decisions rather than relying on AI to make decisions? Regulators will probably continue to review AI adoption and rollout to investors to ensure it doesn’t cross over into investment advice and to ensure investors understand the underlying basis of the research AI may serve up.

Additionally, brokerages will continue to adopt AI to augment traditional customer service roles and back-office services as they look to manage costs in a zero-commission world.

Growing Demand for Custom Routing Algorithms?

Liquidity fragmentation, which is when asset liquidity is scattered across multiple trading venues or platforms, will likely continue to hinder traders, asset managers and hedge funds looking to access available liquidity all at once.This fragmentation can lead to failed trades, delayed execution or inflated costs.

With 18 options exchanges alone, the need to solve this challenge has never been greater.As a result, we should expect to see a greater demand for custom routing algorithms, which promote liquidity management by dynamically scanning for and aggregating liquidity across venues. Done well, they allow traders to carry out orders efficiently across exchanges for smarter, faster and more cost-effective execution.

Balancing Tech with Customer Support?

With the Great Wealth Transfer underway, millennials are expected to inherit more than any other generation – a whopping $46 trillion over the next 25 years, according to Cerulli Associates. This means that the number of tech-savvy high-net-worth individuals and families could skyrocket.

As online brokerages work to build relationships with and meet the demands of these digital natives – who want customized, tech-enabled solutions accessible anytime from anywhere – they will have to strike a balance between leveraging low-friction technology and providing the person-to-person customer support that can make clients sticky. This includes leveraging a streamlined tech stack that can cater to a broad audience with evolving needs.

As we peer into the near future, it’s clear that traders and brokerages will face their fair share of hurdles.To succeed, they will need to embrace technology and be ready to quickly adapt to changing market trends.Those that stay ahead of the trends can emerge from this year even stronger.