The index industry is at the heart of one of the most exciting shifts in modern finance—democratizing investing, according to Kirsten Wegner, the newly appointed CEO of the Index Industry Association (IIA).

Wegner, who joined the IIA last week, told Traders Magazine that what truly attracted her to the organization was its mission: “By enabling greater access to markets and driving cost-efficiency through passive investing vehicles, the index industry is playing a pivotal role in shaping the future of investing.”

Based in Washington, D.C., Wegner is a financial industry expert, lawyer, and bipartisan consensus builder. She has more than 20 years of experience working with regulatory agencies, Congress, and leading collaborative education and advocacy initiatives with policymakers, the media, investors, and other key stakeholders.

Previously, Wegner spent eight years at the Modern Markets Initiative (MMI), with the last seven as CEO, where she led advocacy initiatives on public policy, educated key stakeholders, and built consensus on issues surrounding fintech, artificial intelligence, and market automation.

Before that, she was the Government Relations Director at the International Securities Exchange, where she established political and policy strategy for the first all-electronic options exchange. Earlier in her career, Wegner was a practicing lawyer focused on the financial services and technology industries and also spent three years in broadcast media.

Wegner believes that her leadership strength lies in consensus building. “I thrive on bringing diverse perspectives together to find common ground and create unified strategies,” she said.

“With the IIA’s constituency spanning 17 member firms across three continents, it’s a privilege to lead such a globally diverse organization,” she added.

As the new CEO, Wegner will work with the IIA’s 17 member firms and its Board of Directors to set high-level strategic direction, lead the IIA’s public policy and communications initiatives, serve as the index industry spokesperson, and represent the IIA in front of policymakers, regulators, investors, and other key industry stakeholders.

“Among my focuses is expanding educational outreach—including studies, data, and scientific analysis—to inform conversations about the positive impact of index firms on the investing ecosystem, and the net positive impact for everyday investors, in terms of cost savings, transparency, and market integrity,” she commented.

Broadening the IIA’s audience is her key priority for her first year—to reach not just asset managers, but also everyday investors saving for college, retirement, and other milestones, so they understand the positive impact of index firms in the role they provide as transparent and independent measurements on which index funds are based, she said.

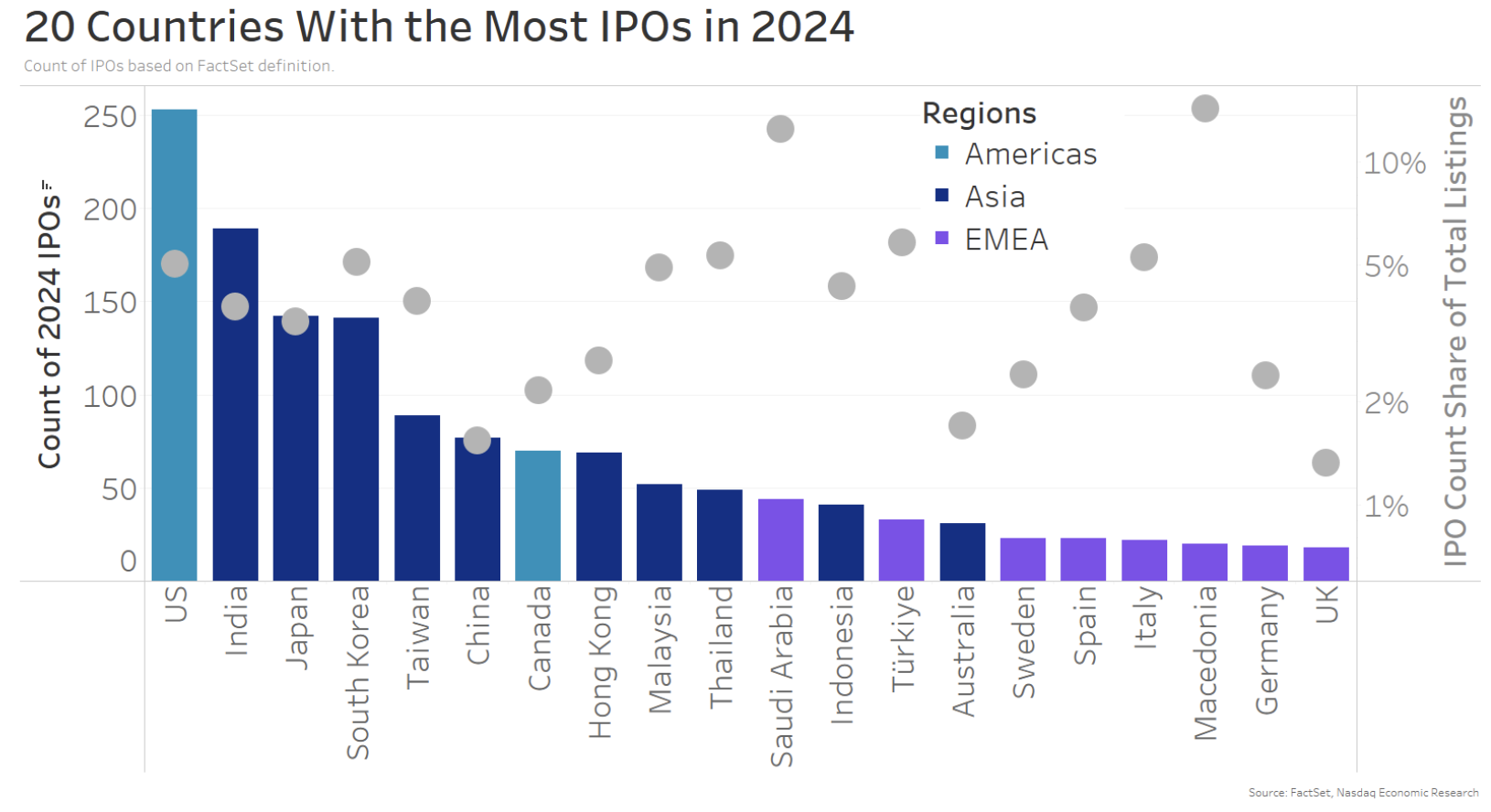

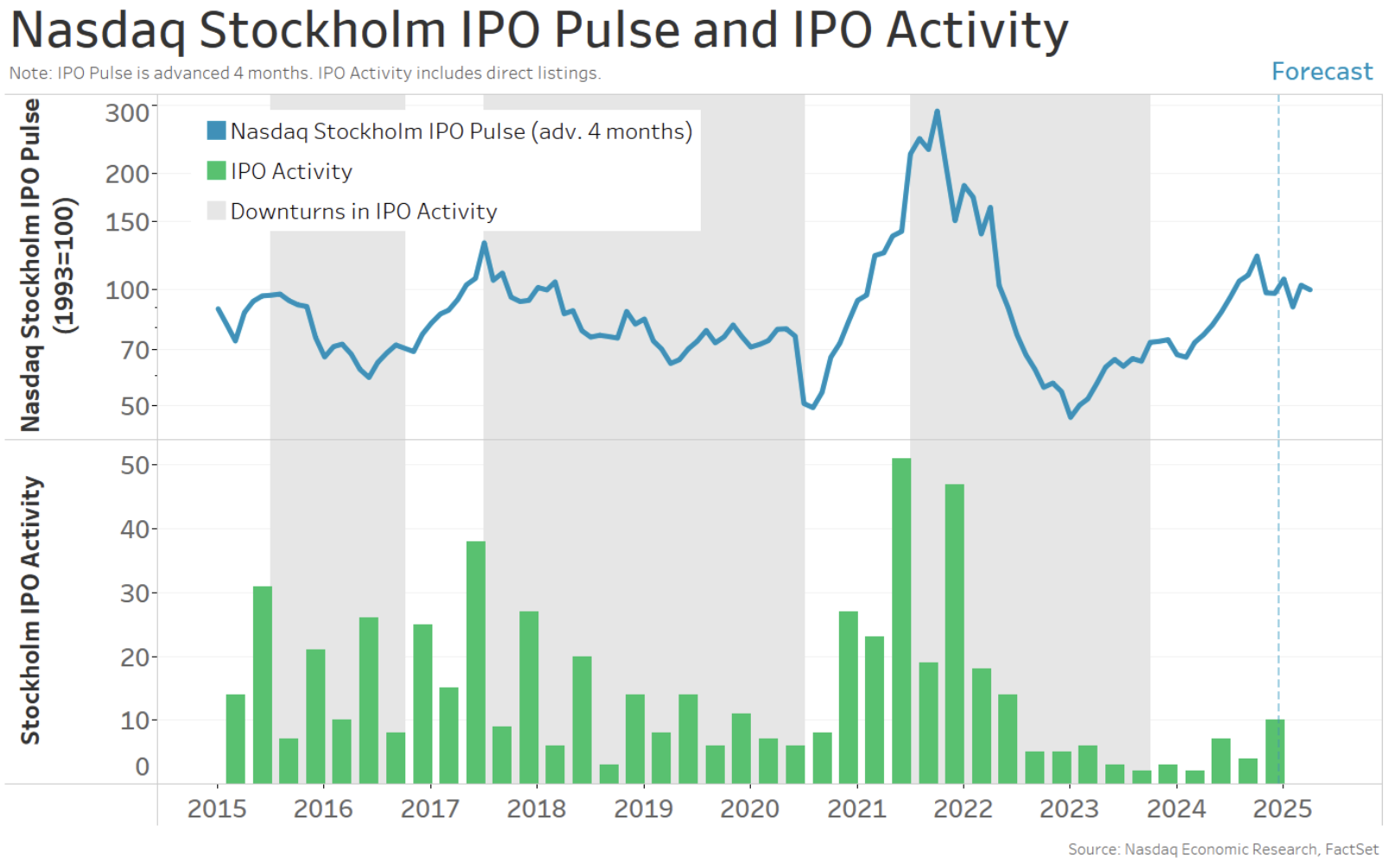

The index industry has evolved rapidly in recent years, Wegner said: “I think we’re seeing a shift in some areas—like in parts of Asia and Europe—moving from a savings mindset to an investing mindset. I’m excited for the positive role the index industry may play in this trend of democratizing investing to a broader demographic.”

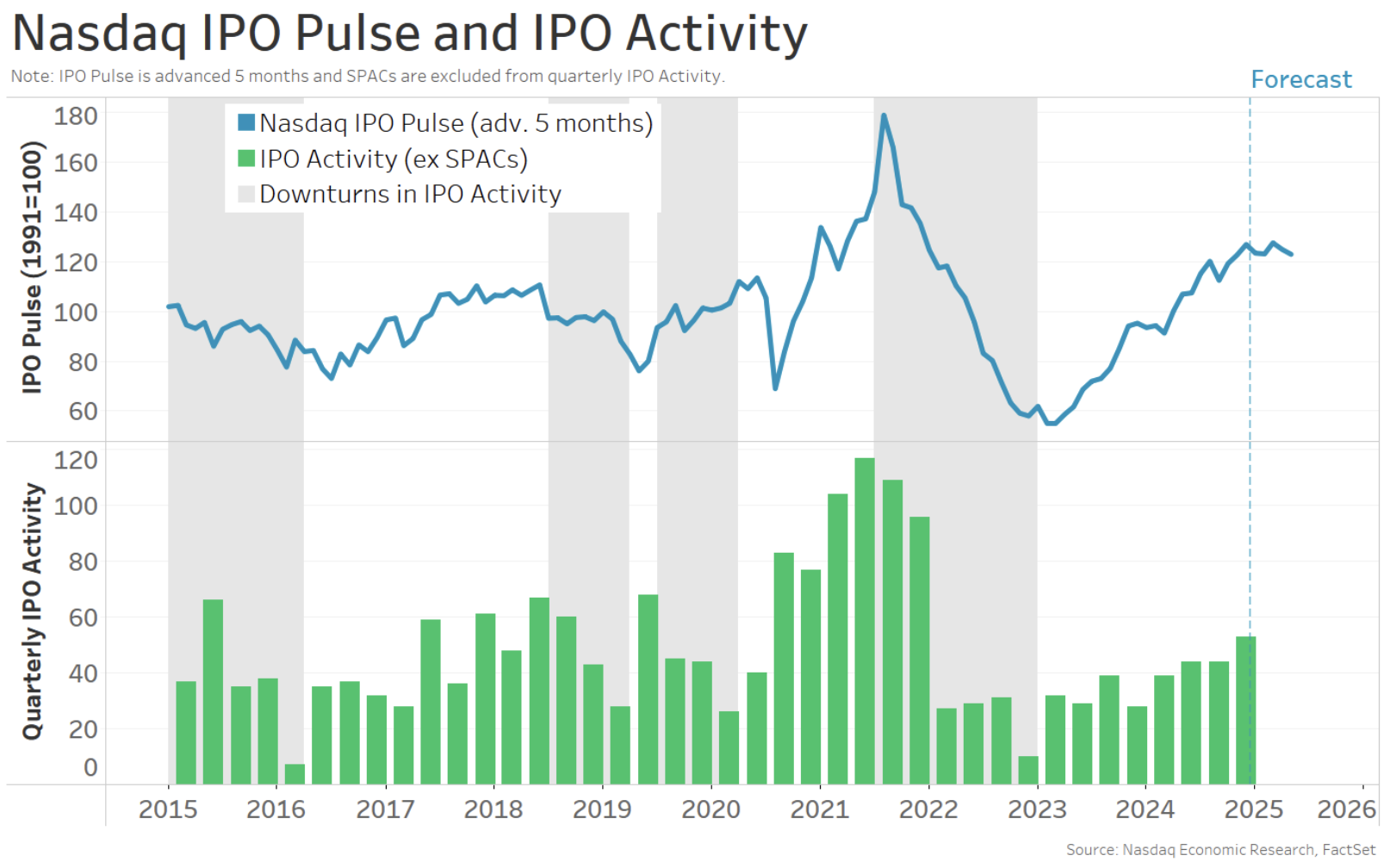

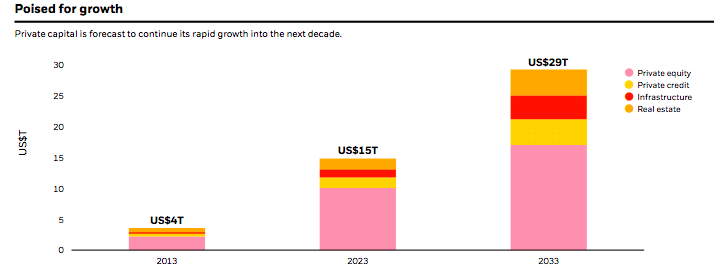

“As the passive investing trend continues to grow, we’ll see increased demand for related services that index providers offer—such as data solutions and custom index solutions forming the basis for benchmarks,” she added.

Building on the IIA’s achievement of a presence on three continents, she plans to deepen relationships with educators and policymakers on their issues in the U.S., Europe, and Asia.

“Challenges can be tackled by being open and having transparent data available for decision-makers,” she stressed.

Many of the independent index providers in the world are members of the IIA, including Bloomberg Indices, CBOE Global Indices, the Chicago Booth Center for Research in Security Prices (CRSP), China Bond Pricing Co., China Securities Index Co. Ltd., FTSE Russell, Hang Seng Indexes, ISS-STOXX, JPX Market Innovation and Research (Tokyo Stock Exchange), Korea Exchange, Morningstar, MSCI, NASDAQ OMX, Parameta Solutions, Shenzhen Securities Information Co., and S&P Dow Jones Indices.

IIA members administer over three million indices for their clients, covering many asset classes, including equities, fixed income, and commodities.

Part of the IIA’s mission is to consider ways to promote best practices for index providers, which makes it a natural supporter of appropriate and proportionate industry standards.

“I’m excited for the IIA to convene a broad group of stakeholders to explore policy questions, promote thoughtful discussion, and build consensus in the coming year. The financial ecosystem is interconnected, and I’m excited for the IIA to promote open and transparent conversations between stakeholders,” Wegner concluded.

A Letter From Julie Andress, 2025 STA Chair

By Julie Andress, KeyBanc Capital Markets

2025 STA Chair

It is with immense gratitude and a profound sense of responsibility that I begin my term as Board Chair of the Security Traders Association (STA). This moment reflects years of hard work, dedication, and commitment to the financial markets. I am deeply honored by the trust STA members have placed in me.

By way of introduction, my name is Julie Andress, a proud Cleveland native and graduate of John Carroll University. My career began in 2007 in New York at Bloomberg. In 2011, I returned home to Cleveland to join KeyBanc Capital Markets as a sales trader—a role I have embraced for the past 14 years. Over the years, I’ve had the privilege of serving STA at both local and national levels, and I am passionate about its mission to support professionals in the financial services industry.

As we step into a new year, the financial markets face a period of significant transformation. A new administration, evolving geopolitical dynamics, rapid technological advancements, and regulatory changes have created an environment that is both challenging and ripe with opportunities. Adapting to change has always been essential to professional growth, and this year will be no different.

STA’s mission is to keep our members informed on industry trends while fostering a solutions-oriented mindset. As Chair, I am committed to ensuring STA continues to serve as a resource and advocate for our members. My primary focus this year will be broadening our reach across the industry in two ways.

The pandemic reshaped the geographical landscape of our profession, creating new hubs of financial activity in previously unexpected regions. Ensuring that every region has a voice at the table is imperative. This year, we launched our first chapter in Arizona—an exciting milestone for us as an organization and professionals in that region—and we will continue working to expand into other new or underserved areas. We will also collaborate with leaders in our affiliate regions to enhance inclusivity, particularly for members outside major financial centers.

Additionally, we will focus on significantly expanding our outreach to younger professionals. Their fresh perspectives and energy are vital to the future of our industry. New initiatives will be introduced to engage and integrate this next generation into our strategic vision, ensuring the continued success of our association.

Looking ahead, I am optimistic about the future of our industry. STA is a testament to the power of collaboration and the strength of collective expertise. Together, we will navigate the challenges and seize the opportunities ahead.

I would like to express my gratitude to those who have helped me reach this position. Past Board Chairs Jim Hyde, Chris Halverson, Katie McCallister, and Ryan Kwiatkowski have been invaluable mentors. I also want to thank the 2025 Board of Governors, Advisors and committee leadership for their commitment to serve and the STA Office—Dawn, Erin, and Jim—for their unwavering support. I know we will achieve great things together.

Finally, to all of you—thank you for entrusting me with this honor. I am excited about the journey ahead and committed to leading this association with dedication and integrity.

Here’s to a successful year for STA and its members. Thank you!