Clearwater Analytics to Acquire Enfusion for $1.5 Billion Expanding its Investment Management Platform with Front-to-Back Capabilities

Investor Conference Call Scheduled for Today at 8:30 a.m. ET

BOISE, Idaho and CHICAGO, Illinois – January 13, 2025 – Clearwater Analytics (NYSE: CWAN) (“Clearwater”) and Enfusion, Inc. (NYSE: ENFN) (“Enfusion”) today announced their entry into a definitive merger agreement for Clearwater to acquire Enfusion, a leader in software-as-a-service (SaaS) solutions for the investment management and hedge fund industry. The purchase price is $11.25 per share, delivered in an approximately equal mix of cash and stock. Additionally, Clearwater will pay $30 million to terminate Enfusion’s tax receivable agreement (TRA). This equates to a purchase price of approximately $1.5 billion.

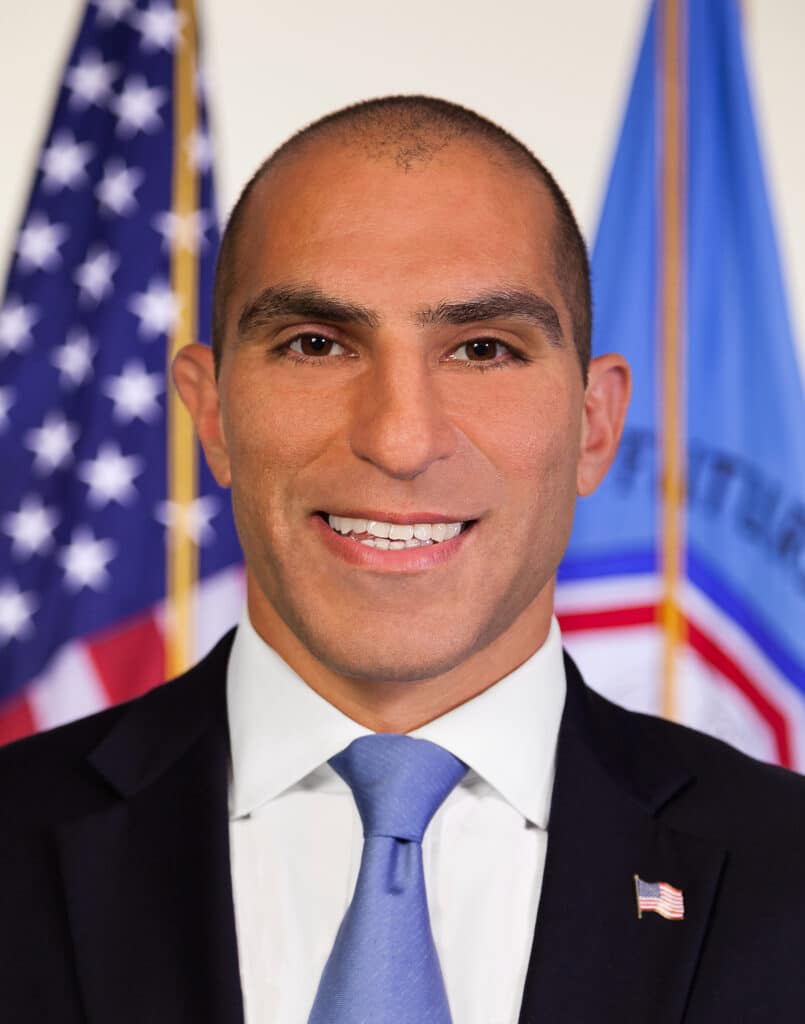

“Today’s announcement is about creating a future where our clients benefit from the synergy of two highly complementary, innovative software leaders, paving the way for a unified, cloud-native front-to-back platform that’s primed to serve institutional investors like never before. We expect to accelerate growth based on our increased right-to-win, higher back-to-base sales, greater presence across key geographies and increased Total Addressable Market (TAM). Coupled with our operating rigor and use of Generative AI, we have high confidence that we can drive meaningfully improved unit economics at Enfusion while also growing its emerging managed services business,” said Sandeep Sahai, CEO of Clearwater Analytics. “Most importantly, this acquisition enables seamless data management from the front office to the back office, unlocking powerful network effects that amplify client value.”

Strategic Rationale

The acquisition of Enfusion accelerates Clearwater’s vision of building the first cloud-native front-to-back platform for the entire investment management industry:

Front-to-Back Platform Leadership: Enfusion’s front-office capabilities—including IBOR, portfolio and order management—will be integrated with Clearwater’s middle and back-office solutions and client reporting capabilities to enable a unified, cloud-native platform that seamlessly integrates with other technologies. This will allow clients to avoid the error-prone data handoff that happens between the front, middle and back office, which in turn creates major reconciliation issues resulting in inefficiencies, inaccuracies and increased risk.

Enhanced Right to Win in Asset Management: Approximately two-thirds of Clearwater’s core TAM comes from the asset management industry, but the company derives only one-third of its revenue from it. Enfusion has developed a next-generation platform for asset managers, starting its innovation in the front office. Clearwater, on a parallel journey, has built a disruptive platform focused on the middle and back office, specifically in data ingestion, aggregation, accounting, compliance, regulatory reporting, and comprehensive client reporting. By combining both sets of solutions and engineering expertise, Clearwater aims to significantly enhance its right to win with asset managers across various segments, geographies, and sizes.

Expanded Capabilities for Clients: With very high levels of client satisfaction, as reflected in Clearwater’s high NPS score, the company has consistently been asked to do more in adjacent segments of its workflow. With this combination, Clearwater’s clients in the insurance, asset management, and asset allocator sectors—including corporations, governments, pensions, endowments, foundations and REITs— will, in due course, benefit from seamlessly integrating Enfusion’s IBOR and its portfolio and order management software with the Clearwater platform. We expect this to accelerate Clearwater’s journey from 1 basis point to 4 basis points (bps) journey and improve net revenue retention.

Increased TAM and Hedge Fund Leadership: The acquisition positions Clearwater to expand into the hedge fund industry. Enfusion has an outstanding track record and wide acceptance as the leading end-to-end platform for hedge funds and more broadly, liquid alternatives. By adding dedicated engineering, product, and client operations teams, Clearwater aims to accelerate growth and drive greater innovation within the industry. This expansion is expected to increase the company’s TAM by $1.9 billion.

Global Growth Opportunities: The international markets make up approximately 50% of Clearwater’s TAM but the company derives less than 18% of its revenue from outside the U.S. Enfusion’s strong international presence, with 38% of its revenue generated in Europe and Asia, is expected to accelerate Clearwater’s global adoption strategy. Having a significantly higher presence across these geographies will strengthen Clearwater’s ability to expand internationally.

Significant Synergy Opportunity: The combination presents significant synergy opportunities across multiple fronts. Clearwater believes it will help accelerate Enfusion’s growth based on the increased right-to-win, back-to-base sales, greater presence across geographies, and increased TAM.

Secondly, Clearwater has built a highly robust execution infrastructure across New Delhi, Edinburgh and Boise that operates effectively and at scale. Over the past few years, Clearwater’s operating rigor and its ability to harness Generative AI has allowed the company to aggressively improve gross margin while improving customer satisfaction. Clearwater expects to bring those skills to Enfusion and has very high confidence of driving meaningfully improved unit economics, while also growing their emerging managed services business.

And thirdly, Clearwater expects considerable efficiencies in general and administrative expenses, yielding about $20 million in cost savings, which we believe will be delivered over the first two and a half years after close. In the Enfusion business specifically, Clearwater expects to deliver 400 bps in Adjusted EBITDA margin expansion in the first year after close and an additional 400 bps in the second year after close.

“This transaction marks an exciting new chapter for all of Enfusion’s key stakeholders. Since our inception, we have proven that the versatility, scale, and depth of our solutions captures the hearts and minds of both traditional and alternative investment managers. Together with Clearwater, our shared passion for building innovative technologies and enriching every aspect of the client journey will now accelerate and enhance our combined ability to support our clients’ evolving needs–whether they are expanding into new strategies, asset classes, or geographies. That commitment will ensure our clients remain on the cutting edge of investment management technology,” said Oleg Movchan, CEO of Enfusion.

Michael Spellacy, Chair of the Enfusion Board and a member of the Enfusion Special Committee, said, “Our agreement with Clearwater represents the culmination of a comprehensive process to determine the best path to maximizing value for all Enfusion shareholders. Our review of potential strategic alternatives for Enfusion was led by a Special Committee composed of independent directors and advised by independent legal and financial advisors. We are pleased to have reached an agreement that will both deliver significant and immediate value to Enfusion’s shareholders, and, together with Clearwater, provide our shareholders and employees with the opportunity to participate in meaningful potential upside.”

The merger agreement has been unanimously approved by a Special Committee of the Board of Directors of Enfusion, consisting of directors independent of Enfusion’s TRA holders, as well as by the Boards of Directors of both companies. Certain shareholders of Enfusion affiliated with FTV, ICONIQ and Mr. Movchan, collectively holding approximately 45% of Enfusion’s total voting power, have entered into voting and support agreements in favor of the transaction. The transaction is anticipated to close in Q2 of 2025, subject to approval by Enfusion shareholders, the receipt of required regulatory approvals, and customary closing conditions.

“Building on the momentum of our strong Q3 2024 results, we continue to see strong business momentum in Q4, and we are confident in our ability to meet and exceed the guidance provided for the fourth quarter and full year 2024. This outstanding ARR growth allows us to look ahead to 2025 with high confidence. These achievements reflect the durability of our business model and our disciplined approach to growth, which positions us to execute this transformative acquisition effectively. With Enfusion, we are taking a bold step forward, uniting two innovative platforms that will redefine investment management, deliver meaningful efficiencies, and expand our global reach,” said Jim Cox, CFO of Clearwater Analytics.

Enfusion management expects preliminary full year 2024 revenue of approximately $201-202 million, representing 15-16% year on year growth, and preliminary Annual Recurring Revenue (ARR) as of December 31, 2024, of approximately $210-211 million, representing 13-14% year on year growth.

Transaction Details

Under the terms of the merger agreement, Enfusion shareholders will receive consideration equal to $11.25 per share consisting of $5.85 per share in cash and $5.40 per share in Clearwater Class A Common Stock. This represents a 13% premium over the January 10, 2025, closing price of Enfusion Stock and a 32% premium over the undisturbed closing price of Enfusion Stock on September 19, 2024, the last trading day prior to media rumors about a potential sale of Enfusion.

The exchange ratio will be determined at close with reference to a 10% collar around a Clearwater Class A Common Stock price of $27.79. If the volume weighted average price of Clearwater Class A Common Stock for the 10-trading day period ending on the second to last trading day prior to the closing date (the “Final Parent Stock Price”) is below $25.01, then Enfusion shareholders will receive 0.2159 shares of Clearwater Class A Common Stock per share of Enfusion Stock. If the Final Parent Stock Price is above

$30.57, then Enfusion shareholders will receive 0.1766 shares of Clearwater Class A Common Stock per share of Enfusion Class A Common Stock. If the Final Parent Stock Price is greater than or equal to $25.01, but less than or equal to $30.57, then Enfusion shareholders will receive a number of shares of Clearwater Class A Common Stock determined by dividing $5.40 by the Final Parent Stock Price.

Enfusion shareholders will be able to elect to receive the mixed cash/stock consideration described above, or all-cash or all-stock consideration, subject to proration to the extent cash or stock is oversubscribed. Regardless of the mix elected, the value per share will be equalized ahead of closing, such that the value of each election choice will be substantially the same.

Clearwater is expected to pay a total of approximately $760 million in cash and issue between approximately 23 million and 28 million new shares to Enfusion shareholders.

In connection with the transaction, an additional $30 million will be paid to retire Enfusion’s TRA. This payment represents an approximately 78% reduction to the contractual early termination obligation otherwise due under the TRA in connection with a change of control, representing an approximately $105 million benefit to Enfusion’s shareholders.

Clearwater has obtained committed financing to support the transaction, which is expected to be funded, together with cash on hand, with a $800 million Term Loan B to fund the transaction and refinance certain existing debt. Clearwater has also secured commitments for a $200 million revolving line of credit. Gross leverage at closing is expected to be approximately 3.7 times adjusted pro forma EBITDA.

Advisors

J.P. Morgan Securities LLC is serving as financial advisor to Clearwater Analytics. Committed financing for the transaction has been provided by JPMorgan Chase Bank, N.A. Kirkland & Ellis LLP is serving as legal advisor to Clearwater Analytics. Goldman, Sachs & Co. LLC is serving as exclusive financial advisor to Enfusion’s Special Committee. Dechert LLP is serving as legal advisor to Enfusion’s Special Committee, while Goodwin Procter LLP is serving as legal advisor to Enfusion.

Conference Call and Webcast

Clearwater Analytics will host an investor conference call to discuss the transaction on January 13, 2025, at 8:30 a.m. ET. A live webcast of the call will be accessible via Clearwater’s Investor Relations website at investors.clearwateranalytics.com. A replay of the webcast will also be available on Clearwater’s Investor Relations website shortly after the call.

About Clearwater Analytics

Clearwater Analytics (NYSE: CWAN), a global, industry-leading SaaS solution, automates the entire investment lifecycle. With a single instance, multi-tenant architecture, Clearwater offers award-winning investment portfolio planning, performance reporting, data aggregation, reconciliation, accounting, compliance, risk, and order management. Each day, leading insurers, asset managers, corporations, and governments use Clearwater’s trusted data to drive efficient, scalable investing on more than $7.3 trillion in assets spanning traditional and alternative asset types. Additional information about Clearwater can be found at clearwateranalytics.com.

About Enfusion

Enfusion’s investment management software-as-a-service platform removes traditional information boundaries, uniting front-, middle- and back-office teams on one system. Through its software, analytics, and middle/back-office managed services, Enfusion creates enterprise-wide cultures of real-time, data-driven intelligence and collaboration boosting agility and powering growth. Enfusion partners with over 850 investment managers from 9 global offices spanning four continents. For more information, please visit www.enfusion.com.

Enfusion’s ARR

Enfusion calculates Annual Recurring Revenue (ARR) by annualizing platform subscriptions and managed services revenues recognized in the last month of the measurement period. Enfusion believes ARR provides important information about its future revenue potential, its ability to acquire new clients and its ability to maintain and expand its relationship with existing clients. ARR is included in a set of metrics Enfusion calculates monthly to review with management as well as periodically with its board of directors.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on the beliefs and assumptions of Clearwater’s and Enfusion’s management and on information currently available to them. Forward-looking statements include information concerning the following factors in reference to Clearwater and/or Enfusion: the timing of the consummation of the acquisition and the ability to satisfy closing conditions, possible or assumed future results of operations, possible or assumed performance, business strategies, technology developments, financing and investment plans, competitive position, industry, economic and regulatory environment, potential growth opportunities and the effects of competition. Forward-looking statements include statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “aim,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” “would” or similar expressions and the negatives of those terms, but are not the exclusive means of identifying such statements.

Forward-looking statements involve known and unknown risks, uncertainties, and other factors, many of which are beyond Clearwater’s and Enfusion’s control, that may cause their actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the ability to successfully close the acquisition, Clearwater’s ability to successfully integrate the operations and technology of Enfusion with those of Clearwater, retain and incentivize the employees of Enfusion following the close of the acquisition, retain Enfusion’s clients, repay debt to be incurred in connection with the Enfusion acquisition and meet financial covenants to be imposed in connection with such debt, risks that cost savings, synergies and growth from the acquisition may not be fully realized or may take longer to realize than expected, the finalization and audit of Enfusion’s 2024 fiscal year financial results which could potentially result in changes or adjustments to the preliminary financial results presented herein, as well as other risks and uncertainties discussed under “Risk Factors” in Clearwater’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the US Securities and Exchange Commission (the “SEC”) on February 29, 2024 and in Enfusion’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 12, 2024, as well as in other periodic reports filed by Clearwater and Enfusion with the SEC. These filings are available at www.sec.gov and on Clearwater’s website, investors.clearwateranalytics.com, and Enfusion’s website, ir.enfusion.com. Given these uncertainties, you should not place undue reliance on forward-looking statements. Also, forward-looking statements represent management’s beliefs and assumptions only as of the date of this press release and should not be relied upon as representing Clearwater’s or Enfusion’s expectations or beliefs as of any date subsequent to the time they are made. Each of Clearwater and Enfusion does not undertake to and specifically declines any obligation to update any forward-looking statements that may be made from time to time by or on behalf of Clearwater or Enfusion.

Enfusion’s financial results for and as of the year ended December 31, 2024, presented in this press release are preliminary, unaudited, and based on currently available information. Enfusion has provided estimated ranges because financial closing procedures for the quarter are not yet completed and final results may therefore vary from these estimates. These preliminary estimates have not been audited by Enfusion’s independent registered public accounting firm.

No Offer or Solicitation

This press release is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”).

Additional Information and Where to Find It

In connection with the acquisition, Clearwater will file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”) to register the shares of Clearwater’s common stock to be issued pursuant to the acquisition, which will include a prospectus of Clearwater and a proxy statement of Enfusion (the “proxy statement/prospectus”). Each of Clearwater and Enfusion may also file other documents with the SEC regarding the acquisition. This press release is not a substitute for the Registration Statement, proxy statement/prospectus or any other document which Clearwater or Enfusion may file with the SEC in connection with the acquisition. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION, THE RISKS RELATED THERETO, AND RELATED MATTERS. After the Registration Statement has been declared effective, the definitive proxy statement/prospectus (if and when available) will be mailed to Enfusion’s security holders. Investors and security holders will be able to obtain free copies of the Registration Statement and proxy statement/prospectus, as each may be amended or supplemented from time to time, and other relevant documents filed by Clearwater and Enfusion with the SEC (if and when available) through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by Clearwater, including the proxy statement/prospectus (when available) will be available free of charge from Clearwater’s website at investors.clearwateranalytics.com/overview. Copies of documents filed with the SEC by Enfusion, including the proxy statement/prospectus (when available) will be available free of charge from Enfusion’s website at ir.enfusion.com.

Participants in the Solicitation

Clearwater, Enfusion and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the Transaction. Information about Clearwater’s directors and executive officers is available in Clearwater’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 29, 2024, its definitive proxy statement for its 2024 annual meeting of stockholders, which was filed with the SEC on April 29, 2024, and in the proxy statement/prospectus (when available). Information about the directors and executive officers of Enfusion is available in its Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 12, 2024, its definitive proxy statement for its 2024 annual meeting of stockholders, which was filed with the SEC on April 26, 2024, and in the proxy statement/prospectus (when available). Other information regarding the participants in the solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Registration Statement, the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Transaction when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. Copies of the documents filed with the SEC by Clearwater and Enfusion will be available free of charge through the website maintained by the SEC at www.sec.gov. Additionally, copies of documents filed with the SEC by Clearwater, including the proxy statement/prospectus (when available) will be available free of charge from Clearwater’s website at investors.clearwateranalytics.com/overview and copies of documents filed with the SEC by Enfusion, including the proxy statement/prospectus (when available) will be available free of charge from Enfusion’s website at ir.enfusion.com.

Bridging the Liquidity Divide: A Path to Smarter Options Trading

By Gino Stella, Sales and Trading Manager, TradingBlock

Liquidity is the lifeblood of financial markets, yet its fragmentation across 18 option exchanges presents a daunting challenge for traders, asset managers and hedge funds. Overcoming this fragmentation and integrating efficient liquidity management into everyday trading strategies has never been more critical. In 2024, options and futures contract volumes rose significantly relative to 2023, with total options volume up 10.6% to a record 12.2 billion contracts, according to the Options Clearing Corporation.

Today, the world of trading demands precision and flexibility. Enter customized algorithmic order routing, a powerful solution that allows traders to execute orders with unparalleled efficiency across exchanges. These tailored algorithms are a marked improvement over generic, off-the-shelf tools, empowering traders to design execution strategies for options trades that align precisely with their goals. The results? Optimized trade performance tailored to the trader’s intentions, reduced costs through desired destination targeting, and a greater ability to tackle fragmented liquidity head-on.

Fragmented Liquidity Matters in Options Trading

Imagine trying to purchase a particular stock option, only to find its liquidity scattered across multiple exchanges. This fragmentation increases the risk of failed trades, delayed execution, or inflated costs. For active traders, asset managers, and hedge funds employing sophisticated strategies, such inefficiencies can mean missed opportunities or underperformance relative to benchmarks.

Customizable routing algorithms address this by dynamically scanning for and aggregating liquidity across venues. Traders no longer need to manually route orders or limit their activity to a specific exchange; instead, a single, optimized order can target multiple exchanges simultaneously. This is liquidity efficiency in action – maximizing access to liquidity while reducing execution complexity.

Broker-neutral solutions allow traders to remain agile. Whether it’s integrating new exchanges swiftly, building redundancies to ensure reliability, or tailoring routes for specific conditions – a broker-neutral platform gives traders the tools they need to succeed. This level of customization sets a new standard in the options market, surpassing competitors where such tools are scarce and unattainable through a single executing broker relationship. Overall, customized algorithms can enhance the efficiency of trade execution by optimizing factors such as speed, cost, and likelihood of execution. They can dynamically adjust based on real-time market data.

A Game-Changer for Asset Managers and Hedge Funds

Active asset managers and hedge funds – especially those executing high-frequency strategies – are prime beneficiaries of this innovation. For these institutional players, liquidity fragmentation is not just a technical headache; it can undermine performance and profitability. A routing system that dynamically adjusts to liquidity changes, prioritizes execution speed, and reduces cost is a game-changer.

Take, for example, a fund manager executing large orders. Previously, directing those orders to one or two exchanges might have limited their access to liquidity or driven up market impact. With customized routing algorithms, the order can be dispersed intelligently across multiple exchanges to minimize slippage, optimize fill rates, and reduce fees – the costs associated with trading.

Even for “priority customer traders,” who are often very active and enjoy better pricing and rebates (incentives offered by the exchange for adding or taking liquidity) than professional traders, such systems enable smart decision-making by factoring in each exchange’s specific conditions. Traders can prioritize routes based on fees, rebates, or even venue reliability – enhancing execution quality while maximizing savings. Traders can engage multiple exchanges with just one order, effectively managing order counts.

The Future of Trading

The concept of liquidity efficiency is not new, but its systematic application in the options market is groundbreaking. As liquidity continues to fragment and markets evolve, the ability to adapt via customized routing strategies will separate the leaders from the laggards.

For traders, hedge funds, and asset managers, the message is clear: overcoming liquidity fragmentation through tailored solutions is no longer optional; it is essential. This approach unlocks new possibilities, enabling smarter, faster, and more cost-effective execution. As we usher in this new era of efficiency, one thing is certain: those who embrace liquidity optimization will lead the increasingly volatile markets of tomorrow.

TradingBlock is a member of FINRA, SIPC. For more information, visit tradingblock.com. Options involve substantial risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options prior to trading.