TECH TUESDAY is a weekly content series covering all aspects of capital markets technology. TECH TUESDAY is produced in collaboration with Nasdaq.

We recently talked about how off-exchange trading hit new record levels in 2024, topping 50%.

In fact, in November 2024, the U.S. equities market saw the first month ever where more volume executed off-exchange than on. Off-exchange volume share also stayed above 50% in December 2024 and January 2025.

Some think the increase in off-exchange volume is because of the rise in “sub-dollar” stock trading, which tend to be microcap stocks traded mostly by retail investors, suggesting that this is not a problem mutual funds need to worry about.

However, today’s data shows that’s not true.

Off-exchange trading is high across the board

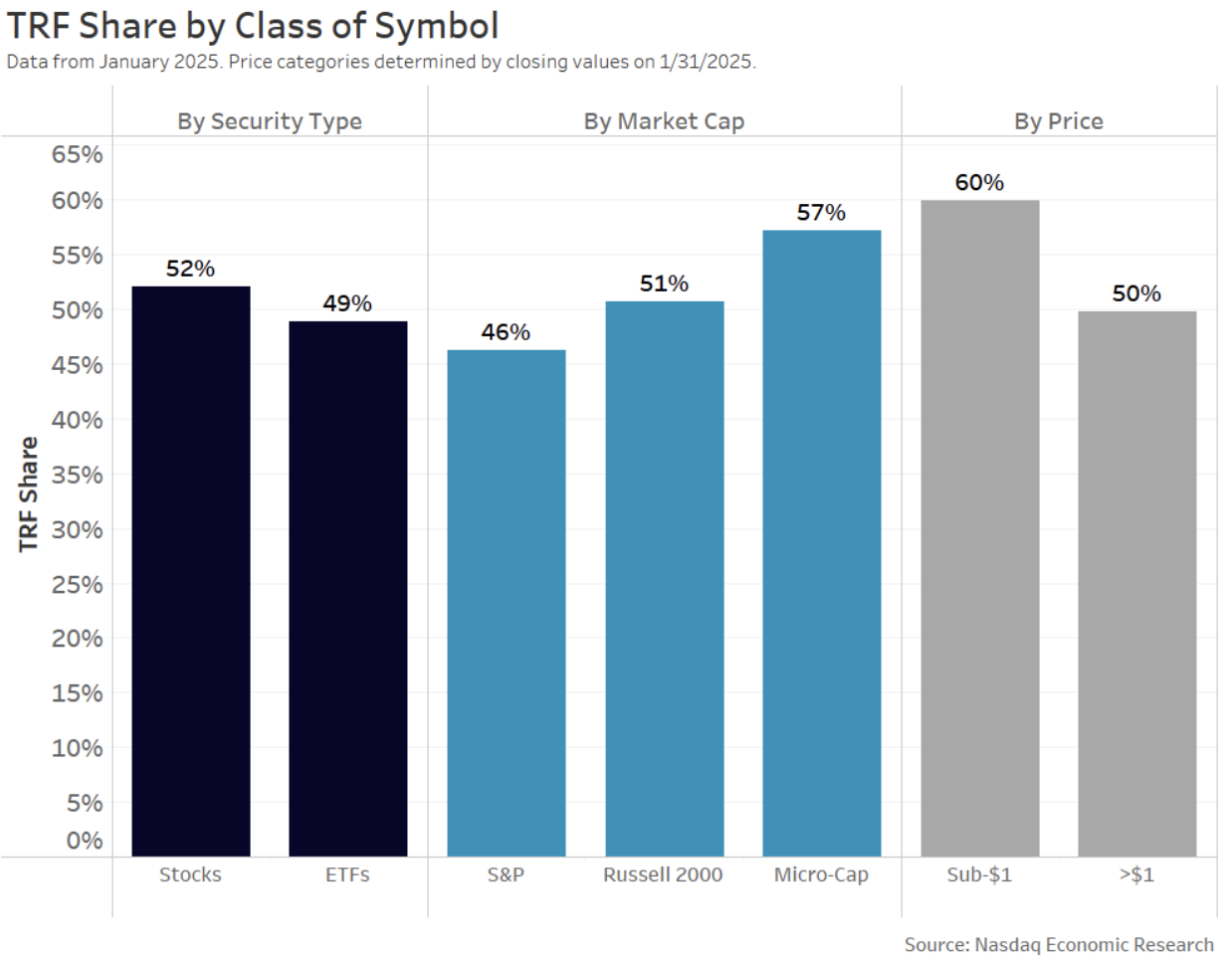

In fact, the rise of off-exchange trading is widespread, affecting lots of stocks that mutual funds are also trying to buy in large quantities. Off-exchange trading is over 45% for all market caps, including for stocks of all prices and exchange-traded funds.

No matter how you slice it, off-exchange share is up significantly since 2019.

Chart 1: Off-exchange share has risen across all groups of stock since 2019

The rise is largely driven by bilateral trading – not dark pools

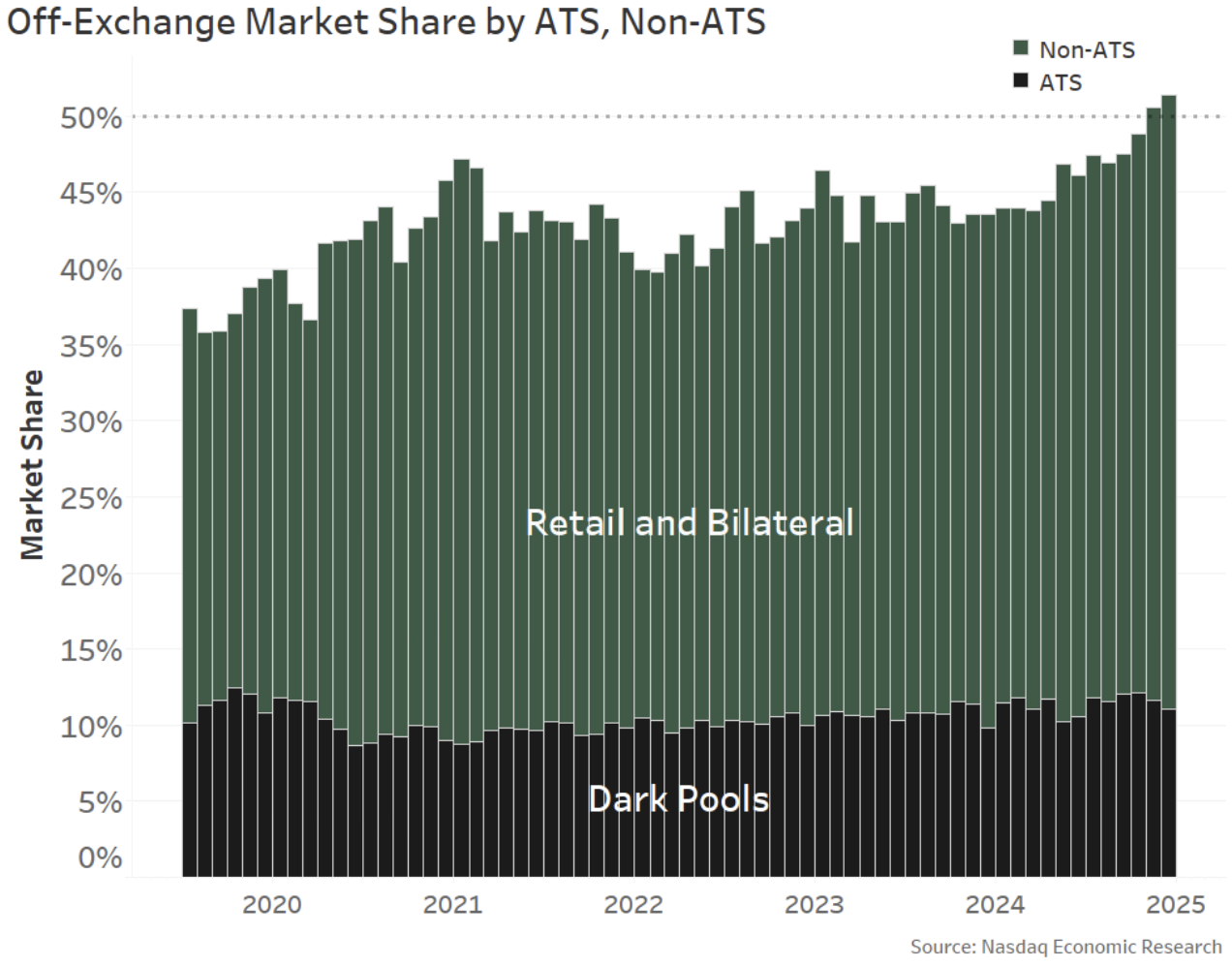

Interestingly, if we look separately at dark pools (ATSs) and other off-exchange (mostly bilateral) trading, we see that the dark pools market share has remained rangebound since at least 2019.

That means the growth is coming from firms filling spread crossing orders (often with price improvement) and negotiated trades.

To be fair, much of this trading is retail, which has grown significantly since Covid and free commissions. But retail doesn’t account for all of the non-ATS trades printed off-exchange.

Chart 2: Bilateral (non-ATS) has seen almost all the off-exchange share increase since (at least) mid-2019

Asset managers have less flow to interact with

Importantly, for mutual fund managers, these bilateral trades represent liquidity that they typically can’t interact with.

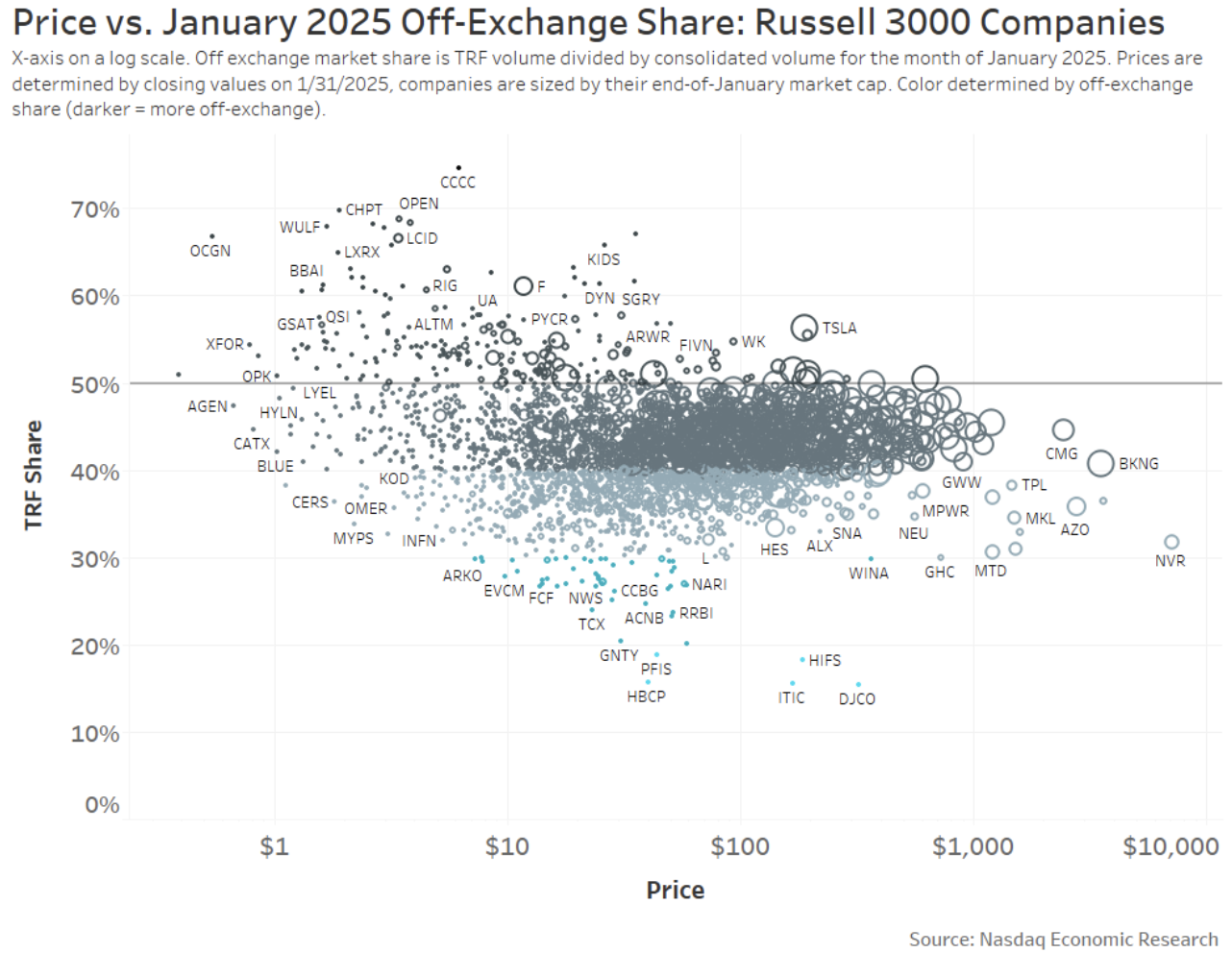

You might think it’s just a few “retail darlings” pulling the averages up. But in fact, looking at all stocks in the Russell 3000 Index, we see that very few now have off-exchange share below 30% (or, said another way, on exchange above 70%).

The majority of stocks see off-exchange trading between 40%-50%, and that’s true regardless of the stock price (horizontal axis) or market cap (circle size).

Chart 3: Accessible flow for asset managers

At the very least, that might mean buy-side orders using a “VWAP” or participation algorithm will actually be trading more aggressively in the market than they seem, which can increase the costs of trading.

It may also add to search and signaling costs, as routers navigate the fragmented hidden liquidity, and opportunity costs as fills are missed.

It might be time to reduce regulations that create unnecessary fragmentation

Lit prices, fair access and competitive NBBO are features that make stock markets different to other markets. U.S. households depend on a vibrant public equity market for their financial security.

It’s possible regulators have taken for granted the prices that lit markets provide. Thanks to economics that favor dark over lit markets, lit market share has been falling globally.

For institutional traders trying to navigate fragmented markets with large trades, fragmentation makes finding liquidity harder. Segmented markets mean there is less liquidity than a trader might think. Both can increase trade costs and reduce active mutual fund returns.

Research also suggests that companies with wider spreads will also have higher costs of capital, which will reduce their investment back into the U.S. and global economy.

Academic studies indicate that there is a tipping point above which market quality and spreads get worse, potentially between 10% to 46.7% dark. The U.S. market has now breached all those levels.