As we start a New Year and a new decade, there is a lot to look forward to. Here are our top 20 trends to watch in 2020.

Support for public markets

Returns on U.S. equities last year were strong, supported by low interest rates and high consumer confidence.

1. Support for equity valuations: Low interest rates could be the “new normal.” The slowdown in productivity and population growth also support extending the period of low interest rates. Which in turn supports current market valuations, maybe even if earnings growth slows.

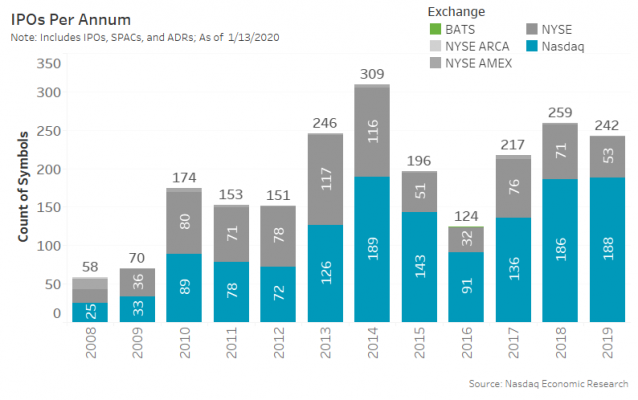

2. Continued strong IPO listings: With market valuations robust, the IPO market has also been strong as private investors look to liquidate many of their early stage investments bringing many of the “Unicorns” to market.

Chart 1: 2019 Was a Good Year for IPOs

Retail access to the market

Retail trading rules changed significantly in 2019. This year we will see how this impacts trading behavior.

3. Free commissions: In 2019, most retail brokers made it even easier for investors to buy and sell shares. Cheaper trading should create more trading, especially from semi-professional investors who care more about commissions because of their more frequent trading.

4. Fractional shares: Fractional shares reduces the capital required to make an investment. Some studies show that almost half of retail investors have no exposures to stocks. Ideally, both these changes broaden share ownership which should add to the retirement security of lower-income households.

5. Defining retail: If free trading means more semi-professional investor trades, the economics of retail flow could change. That may make it harder for wholesalers to offer price improvement. The next step may be to define retail better, so semi-professionals aren’t subsidized by mom & pop investors. During 2019, we proposed redefining “what is retail” to classify these semi-professional investors appropriately. Another solution, as some stock prices continue to rise, would be to limit the size of a retail trade to a more consistent dollar value. Right now any 9,999 share order is included in “retail” EQ metrics.

6. Accredited Investors and the growth of private markets: Speaking of retail definitions, late last year the SEC proposed a modification to the definition of “accredited investors.” That could help investors participate in private company growth (before they become Unicorns). But it won’t benefit lower-income households (who won’t qualify) and may end up keeping companies private even longer.

7. Reg BI and the Derivatives Rule: In contrast, both the new Reg BI and Derivatives Rule require the industry to be more responsible investing clients’ money. There is no perfect way to protect all investors while also encouraging them to buy riskier high-growth companies, but this tilts the balance in favor of lower-risk funds.

8. Consolidation vs. roboadvising: Perhaps driven by all of the above, the pending merger of TD and Schwab creates a more concentrated industry for mom & pop retail (who don’t have private wealth managers). Economically, free commissions represent the bundling of trading with other financial services. Does that give full-service retail brokers a benefit? Or will upstarts like Robinhood be able to compete with better economics on unbundled services?

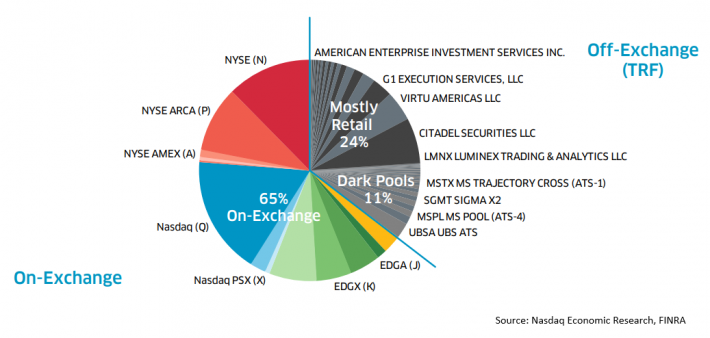

Chart 2: U.S. Equity Trading Landscape

Changing how institutions trade

The SEC has been actively changing how institutional investors trade too. Whether this changes their trading remains to be seen.

9. ATS-N reports are now filed. As expected the forms were extensive and comparing the results is cumbersome, but 2020 could see some changes as the buy-side reacts to what they’re seeing. There is potential for ATS’s to become more the same, now more is known about how each operate. Or we may see even more complexity as each try to differentiate their venues.

10. New 606 (routing) reporting are effectively “done,” but unlike ATS-N, the results are not public. Will someone develop a way to show the buy-side what is “normal” so they can benchmark their brokers or will different behavior “just stand out?” Even if it does, there is still no data to help investors quantify if different routing behaviors are costs or benefits.

11. Public prices (SIP). Last week the SEC issued a

directive to create a single SIP. Some want it to include more data (depth),

others want it to go even faster, some even want it to be free—objectives that

are seemingly at odds. Ironically, at the same time, Europe is trying to force

the industry to build an EBBO, having found that the commercial incentives in

MiFID failed to deliver one.

Could that prove the cost-benefit of the SIP is best as a top-of-book tool?

After all, retail investors don’t need depth as they get price improvement

off-exchange. They just need the NBBO as a benchmark. Regardless what we do,

some latency is unavoidable, as compiling the data takes longer than

distributing it. To reduce geographic latency, Nasdaq supports a distributed SIP.

Regardless, the SIP is a valuable tool. Its revenues solve

some of the markets free-rider problems while also providing a cheaper

but very reliable quote data for anyone trading in human speed (the SIP takes

less than one millisecond to compile, mostly due to geography. A time the SEC

already defines as de minimis).

12. Order Protection Rule (OPR). The debate about OPR is related to many other issues. If the SIP (#11) has unavoidable geographic latency, the protected quote will always be slower than actual quotes. However, if we unprotect quotes and allow the market to correct crossed markets, we might just legitimize latency arbitrage. At the other end of the speed spectrum, if proposed speed bumps (#18) are approved, not all quotes will contribute to market quality. But the most compelling reason to weaken OPR seems to be to reduce fragmentation, by requiring smaller and new venues gain significant market share before they can earn SIP revenues, something we support.

13. Thinly-Traded Securities. Fragmentation and complexity are two of the most commonly cited problems with the market (see #18). Unlisted Trading Privileges (UTP) allow all stocks to trade on any venue, which adds to both. Removing UTP, at least for thinly-traded stocks, might help those stocks trade better, something else we support.

14. Intelligent ticks and odd lots. During 2019, more evidence emerged showing tradability across stock price is problematic. In fact, the SIP (#11) is even considering adding odd lots quotes to the tape, although not protecting them (#12). Although stock splits would also address many of these concerns, intelligent ticks combined with the removal of round lots could make trading more consistent and simplify routing.

ETF evolution

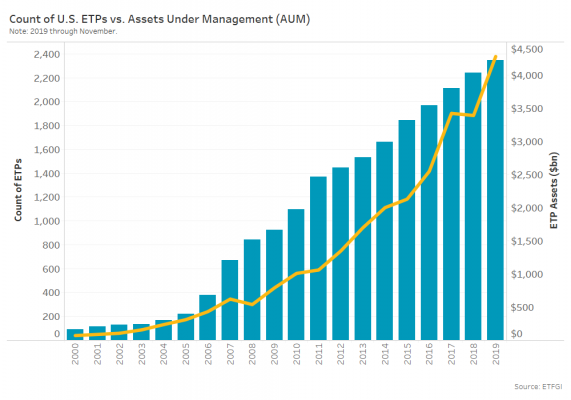

In 2019, the SEC significantly altered the ETF landscape with the new ETF Rule (simplifies bringing ETFs to market) and approval of non-transparent ETFs (helps traditional mutual funds convert to ETFs).

15. Even more ETF issuers. There are now over 2,200 ETFs. But streamlined ETF rules could see even more new entrants. History shows that successful ETFs have more than just a new ticker. New entrants need to consider current market competitors as well as how they plan to sell their new funds. Many ETFs have failed from lack of interest.

16. Even more thinly-traded ETFs. Non-transparent active ETFs are more likely to be popular with classic retail investors. That means they will also likely have low natural liquidity. Thinly-traded ETFs are not new, but ways to ensure spreads are tight and the economics of seeding and market making are shared fairly could arise again, especially if we see lots of new entrants and listings.

17. Index vs Active. Technically this topic has nothing to do with ETFs, especially given inflows into smart beta equity ETFs beat index flows in 2019 and the fact that non-transparent active ETFs are approved. But it’s related to why active ETFs might succeed. It was reported by Morningstar this year that index assets surpassed active mutual fund assets. That data was missing how pension funds are managed, but we expect the trend to continue. That doesn’t mean we will notice price discovery decline though, as there are still plenty of active traders in the market.

Chart 3: Count of U.S. ETPs vs. Assets Under Management

Does fragmentation add competition or cost?

One of the problems with a patchwork of different rules for trading is that ATSs and exchanges try to compete based on very different limits. That creates complexity and fragmentation that is only likely to increase.

18. Fragmentation and Complexity. This something most

participants seem to agree is bad, but it’s set to increase.

First with the launch of LTSE, MEMX and maybe MIAX. MEMX will be interesting to

watch because its owners make up the majority of current off-exchange (retail)

trading (Chart 2). Will their exchange bring some of that liquidity to public

markets where institutional investors can interact with it?

Secondly, proposals for asymmetric speed bumps will make counting depth more

complex. A while ago the SEC rejected the CHX (Chicago) proposal on the grounds

that it would not be an “actionable” quote, so would muddy the NBBO and best

execution requirements. Last year Cboe applied for its own speed bump offering

to at least make it an unprotected quote, similar to how Canada works. Then

just last month, IEX announced they were going to apply their quote fade

indicator (CQI) to their lit orders too. That would allow their lit orders to

free-ride off the activity on other maker-taker markets and fade IEX quotes

before sweep orders can hit the whole NBBO. It will be telling what the SEC

approves and whether those quotes count for the NBBO and SIP revenues. Careful

what you wish for though, as this will create actual “phantom liquidity.”

19. Rebates, PFOF and other incentives. Although

the courts will decide what happens to the Access Fee Pilot, a recent Yale op-ed

highlighted that there other incentives in the market that act in a similar

way. So banning rebates clearly won’t resolve routing conflicts or make markets

fair.

Instead data

show it will most likely make the NBBO wider and shallower. Dark and

grey markets will likely be the winners, investors and issuers may well be the

losers. Sadly, 606 enhancements won’t help investors quantify what it’s costing

them. Hopefully issuers don’t decide to stay private for even longer (#6).

It’s an election year

20. Volatility and volumes. Last but not least, 2020

is an election year in the U.S. That’s likely to add some volatility to

markets, as well as some uncertainty if polls are tight, as might impeachment,

Brexit, renewed trade wars and Middle East conflicts. That might lead to a

rebound from 2019’s relatively low volatility and volumes.

At a minimum, it should give us plenty to think about.